Discover

Discover card is a leading payment card provider in the United States, known for its competitive rates, attractive rewards program, and excellent customer service. Discover is available and widely accepted by merchants across the US market and enjoys broad acceptance worldwide through partnerships with various international payment networks.

Properties

The properties of the Discover payment method are shown in the following table:

Availability | Acquirer | 2C2P HK |

Acquiring region | HK | |

Buyer country/region | Global | |

Product features | Payment type | CARD |

Card brand | Discover | |

Payment flow | Redirect | |

Payment completion | Real-time | |

Currency | Processing currency | See the Processing and settlement currencies table |

Settlement currency | ||

Other | Settlement region | HK |

Settlement cycle | T+4 | |

3D | ✔️ | |

Authorization validity period | 7 days | |

Minimum transaction amount | The smallest unit of the acquirer currency | |

Max transaction amount | 499,999 USD or equal amounts | |

Checkout Payment | ✔️ | |

Auto Debit | ❌ | |

Multiple partial captures | ❌ | |

Partial capture | ✔️ | |

Overdraft capture | ❌ | |

Refunds | ✔️ | |

Partial refunds | ✔️ | |

Chargeback | ✔️ | |

Refund period | 365 days | |

Installment | ❌ |

Processing and settlement currencies for 2C2P HK

Processing currency | Settlement currency |

AED, CAD, CHF, CNY, DKK, EUR, GBP, HKD, IDR, JPY, KRW, KZT, LKR, MOP, MYR, NOK, NPR, NZD, OMR, PKR, SEK, SGD, THB, TWD, UAD, USD | HKD |

User experience

This section shows the user experience of Discover in different scenarios:

API-only integration

This section shows the difference in user experience between those PCI and non-PCI qualified under the API integration.

PCI qualified

This section shows the difference between the first-time and subsequent payments under the PCI qualified.

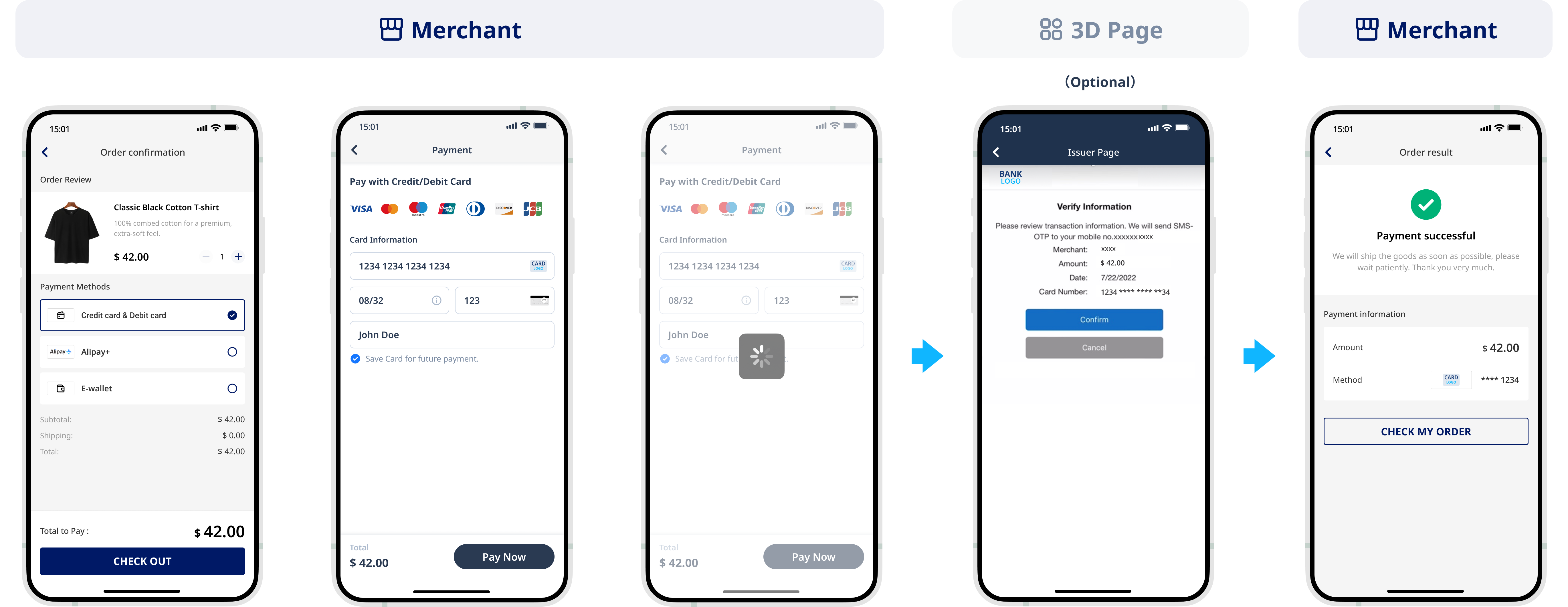

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the PCI qualified.

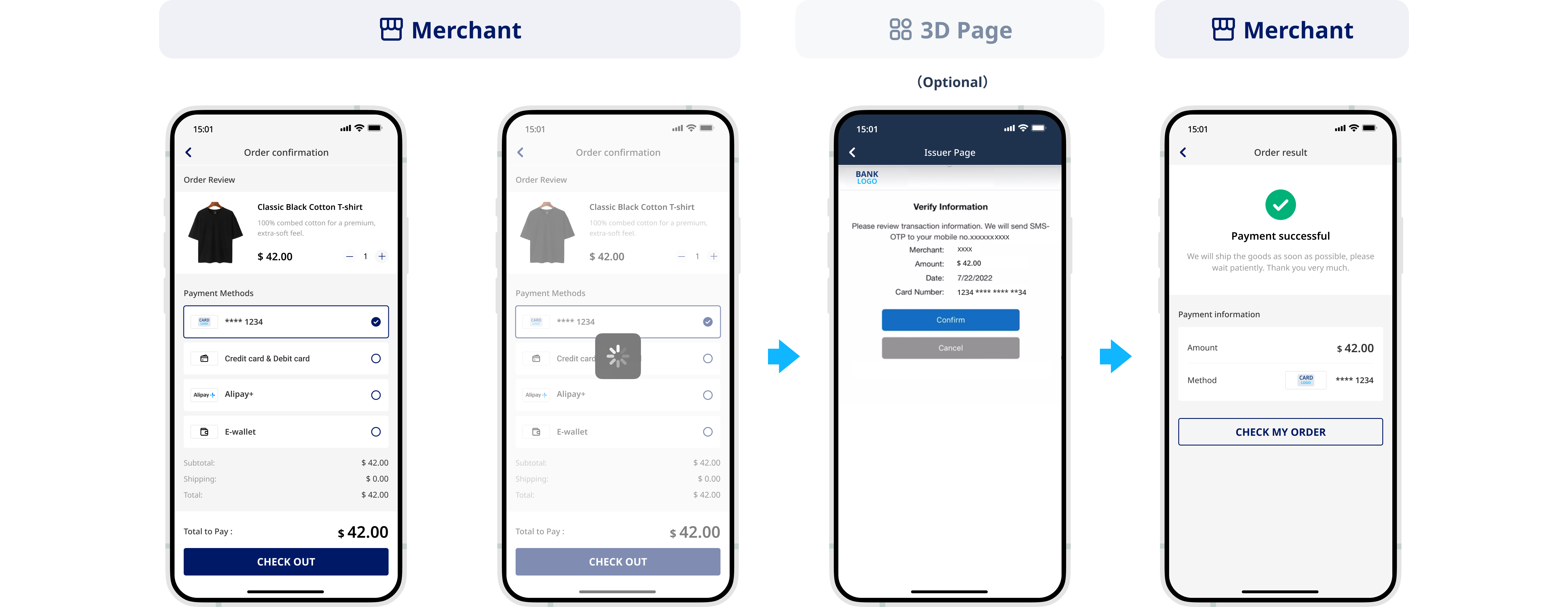

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the PCI qualified.

Non-PCI qualified

This section shows the difference between the first-time and subsequent payments under the non-PCI qualified.

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the non-PCI qualified.

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the non-PCI qualified.

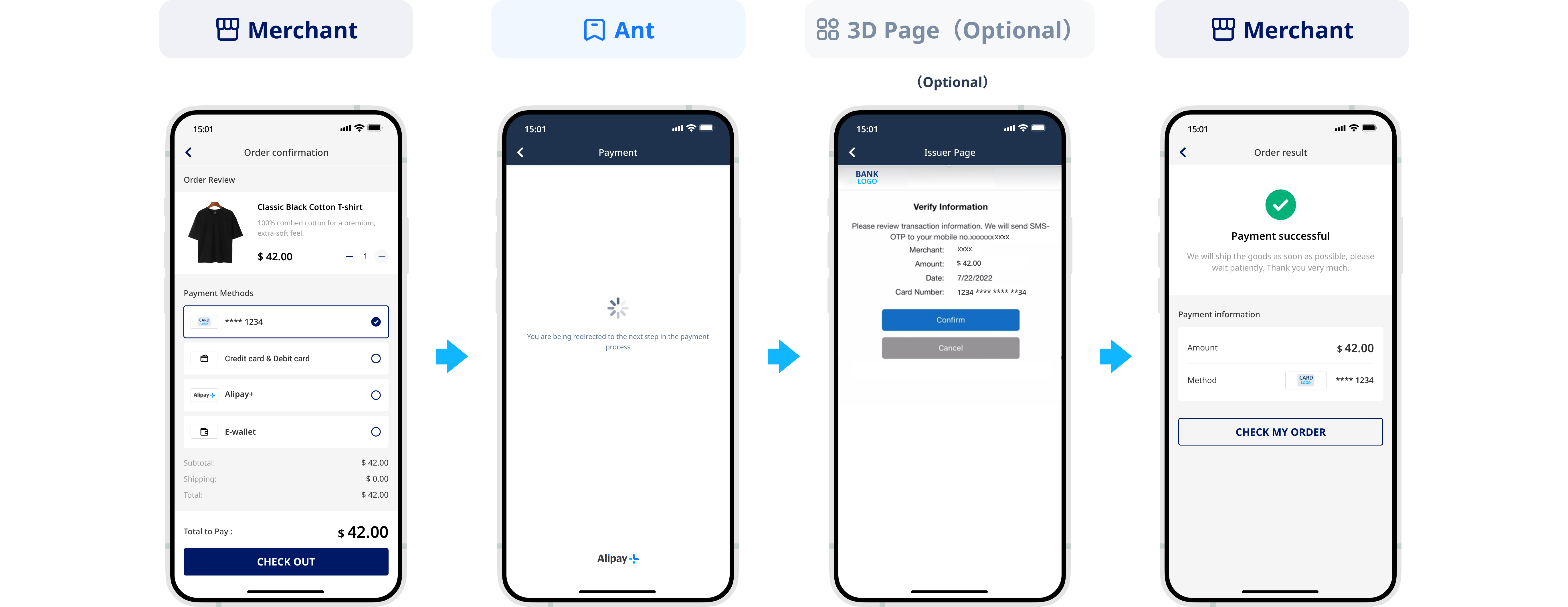

SDK integration

This section shows the difference between the first-time and subsequent payments under the SDK integration.

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the SDK integration.

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the SDK integration.