BillEase

BillEase, launched in 2017 by the fintech company First Digital Finance Corporation, is one of the largest Buy Now Pay Later providers in the Philippines.

Buyers can apply for credit lines by providing personal information. Credit lines enable them to buy products in installments or by using Buy Now Pay Later. Buyers can complete repayments through various means such as InstaPay, PESONet, e-wallets, bank transfers, and at over 22,000 retail stores including 7-Eleven, Cebuana, and MLhuillier.

Properties

The following table lists the product properties supported by BillEase:

Payment type | Alipay+ payment method | ||

Acquirer | AlipaySG, AlipayEU, AlipayUS, AlipayUK | Merchant entity location | SG, AU, HK, US, EU, UK |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | Philippines | Partial refund | ✔️ |

| Time to return payment result | Real-time | Chargeback/Dispute | ❌ |

Processing currency | PHP | Refund period | 365 days |

| Minimum payment amount | Buy Now Pay Later: 50 PHP | Maximum payment amount | Buy Now Pay Later: 50,000 PHP Installment payment: 100,000 PHP |

User experience

Note: The following payment flows on different terminals are reference only, and represent this payment method's flow on different terminal types. For supported merchants' terminal types, consult Antom Technical Support.

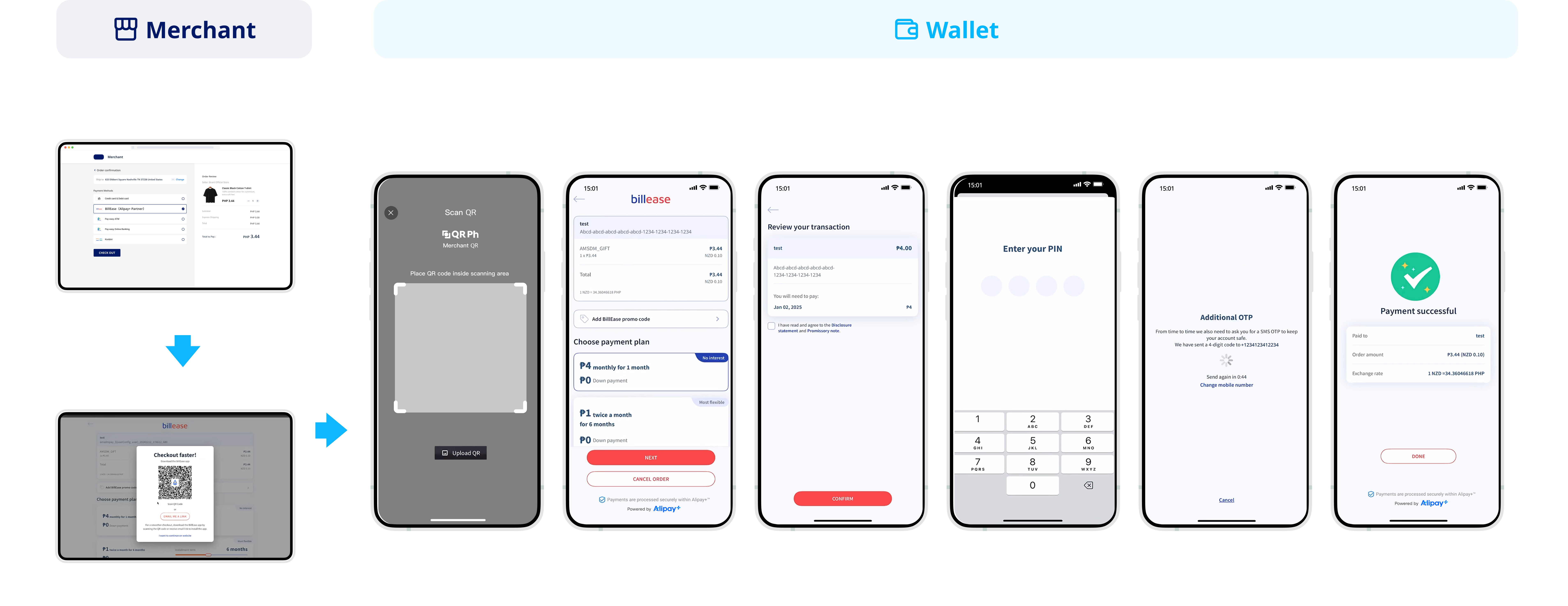

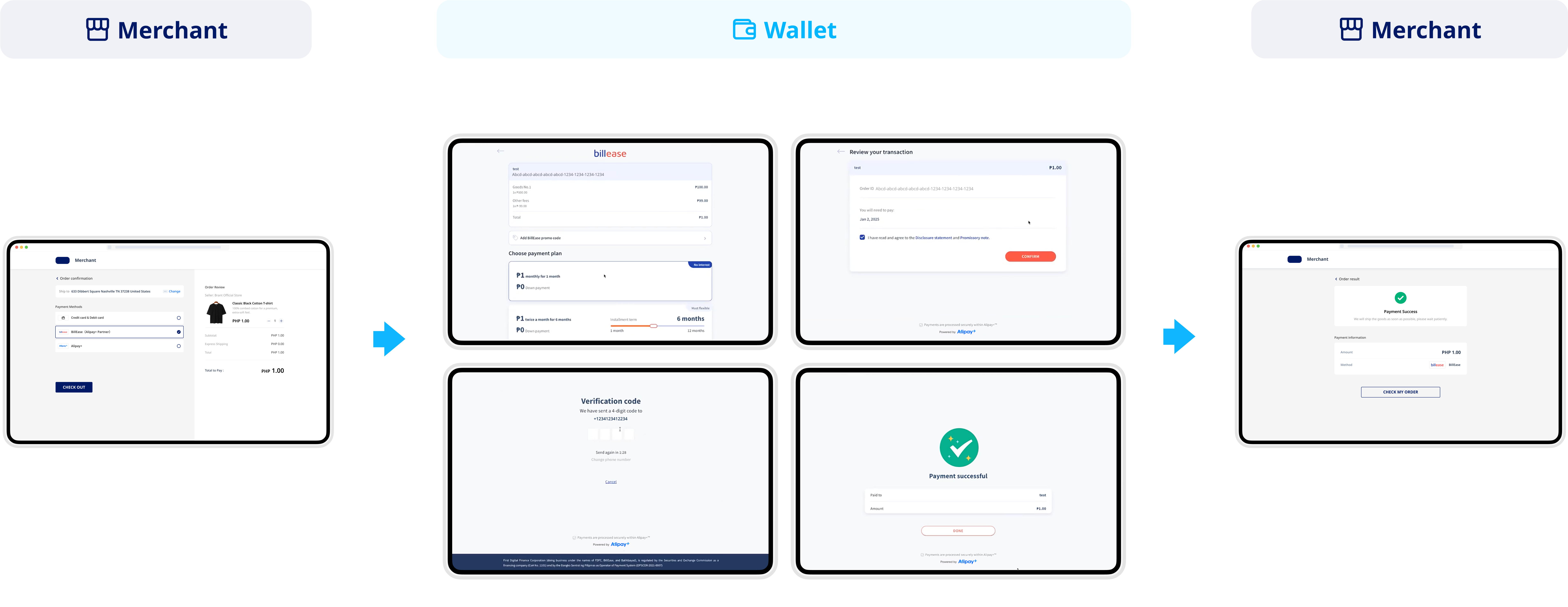

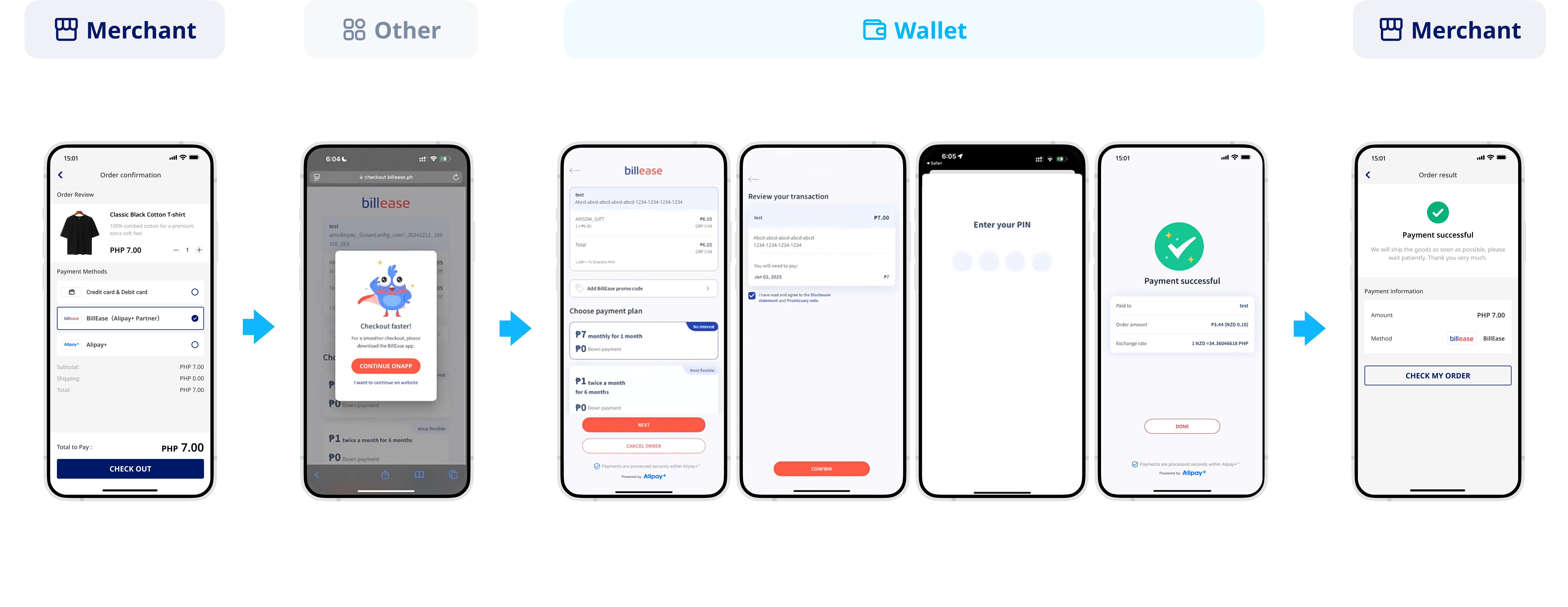

The following figure shows the journey of paying with BillEase:

- The buyer selects BillEase to pay.

- The buyer is directed to the BillEase payment page, where the payment code is displayed.

- The buyer scans the QR code with the BillEase app.

- The buyer chooses the payment plan.

- The buyer confirms the order information.

- The buyer enters the PIN to complete the payment.

- The buyer completes the OTP verification.

- The buyer confirms the payment result.

Note: The BillEase page in Step 2 does not automatically refresh or redirect to the merchant results page when the payment is completed.