Maestro

Maestro, a debit card service from Mastercard, is widely used internationally, particularly in Europe.

Properties

The properties of the Maestro payment method are shown in the following table:

Availability | Acquirer | 2C2P HK | 2C2P SG |

Acquiring region | HK | SG | |

Buyer country/region | Global | Global | |

Product features | Payment type | CARD | CARD |

Card brand | Maestro | Maestro | |

Payment flow | Redirect | Redirect | |

Payment completion | Real-time | Real-time | |

Currency | Processing currency | See the Processing and settlement currencies for 2C2P HK table | See the Processing and settlement currencies for 2C2P SG table |

Settlement currency | |||

Other | Settlement region | HK | SG |

Settlement cycle | T+4 | T+3 | |

3D | ✔️ | ✔️ | |

Authorization validity period | 7 days | 7 days To reduce costs, we recommend that you initiate a request to capture or cancel the authorization within 3 days. | |

Minimum transaction amount | The smallest unit of the acquirer currency | The smallest unit of the acquirer currency | |

Max transaction amount | 499,999 USD or equal amounts | 499,999 USD or equal amounts | |

Checkout Payment | ✔️ | ✔️ | |

Auto Debit | ❌ | ❌ | |

Multiple partial captures | ❌ | ❌ | |

Partial capture | ✔️ | ✔️ | |

Overdraft capture | ❌ | ❌ | |

Refund | ✔️ | ✔️ | |

Partial refund | ✔️ | ✔️ | |

Chargeback/Dispute | ✔️ | ✔️ | |

Refund period | 365 days | 365 days | |

Installment | ❌ | ❌ |

Processing and settlement currencies for 2C2P HK

Processing currency | Settlement currency |

HKD, USD, GBP, EUR, JPY, SGD, MOP | HKD |

AED, AFN, ALL, AMD, ANG, AOA, ARS, AUD, AWG, AZN, BAM, BBD, BDT, BGN, BHD, BIF, BMD, BND, BOB, BRL, BSD, BTN, BWP, BYN, BZD, CAD, CDF, CHF, CLF, CLP, CNY, COP, CRC, CUP, CVE, CZK, DJF, DKK, DOP, DZD, EEK, EGP, ERN, ETB, EUR, FJD, FKP, GBP, GEL, GHS, GIP, GMD, GNF, GTQ, GYD, HKD, HNL, HTG, HUF, IDR, ILS, INR, IQD, IRR, ISK, JMD, JOD, JPY, KES, KGS, KHR, KMF, KRW, KWD, KYD, KZT, LAK, LKR, LRD, LSL, LTL, LVL, LYD, MAD, MDL, MGA, MKD, MMK, MNT, MOP, MRO, MUR, MVR, MWK, MXN, MYR, MZN, NAD, NGNvNIO, NOK, NPR, NZD, OMR, PAB, PEN, PGK, PHP, PKR, PLN, PYG, QAR, RON, RSD, RWF, SAR, SBD, SCR, SDG, SEK, SGD, SHP, SLE, SOS, SRD, STD, SVC, SYP, SZL, THB, TJS, TMT, TND,TOP, TRY, TTD, TWD, TZS, UAH, UGX, USD, UYU, UZS, VEF, VND, VUV, WST, XAF, XCD, XOF, XPF, YER, ZAR, ZMW | HKD/USD |

Processing and settlement currencies for 2C2P SG

Processing currency | Settlement currency |

AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, VND | SGD |

AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, USD, VND | USD |

HKD | HKD |

AUD | AUD |

CAD | CAD |

EUR | EUR |

GBP | GBP |

HKD | HKD |

NZD | NZD |

SGD | SGD |

USD | USD |

User experience

This section shows the user experience of Maestro in different scenarios:

API-only integration

This section shows the difference in user experience between those PCI and non-PCI qualified under the API integration.

PCI qualified

This section shows the difference between the first-time and subsequent payments under the PCI qualified.

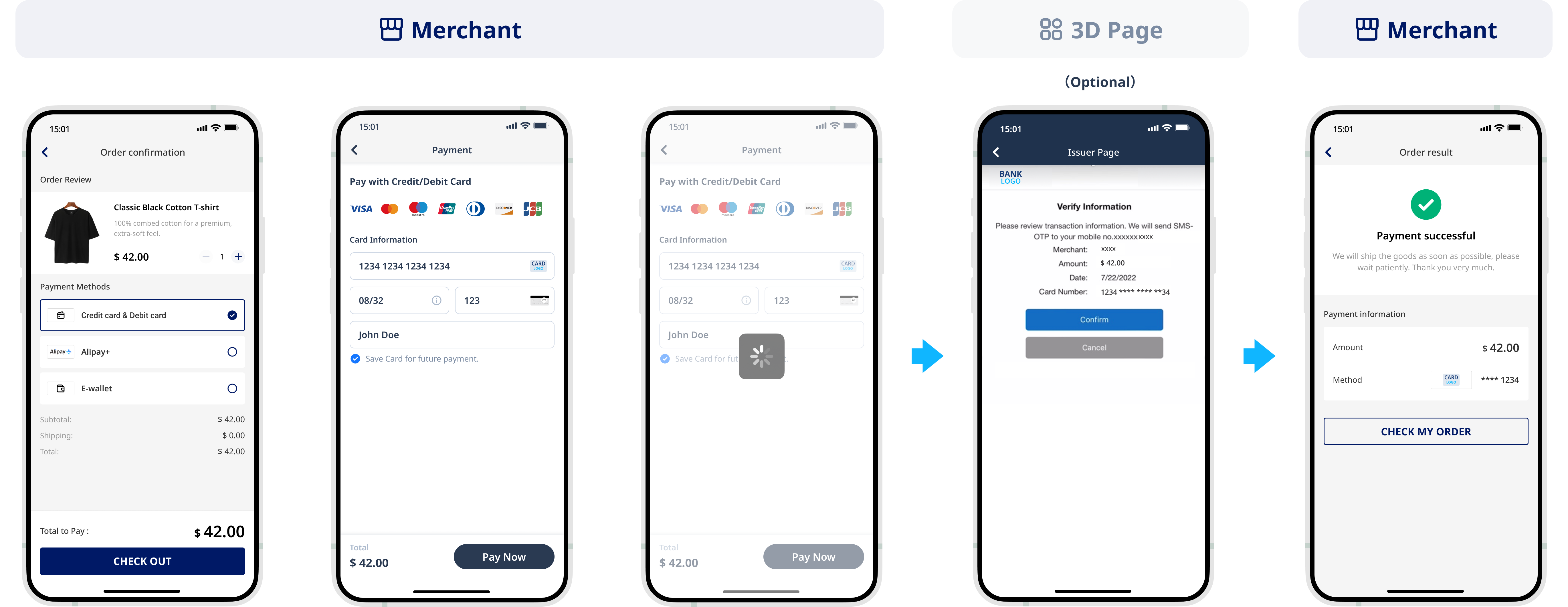

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the PCI qualified.

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the PCI qualified.

Non-PCI qualified

This section shows the difference between the first-time and subsequent payments under the non-PCI qualified.

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the non-PCI qualified.

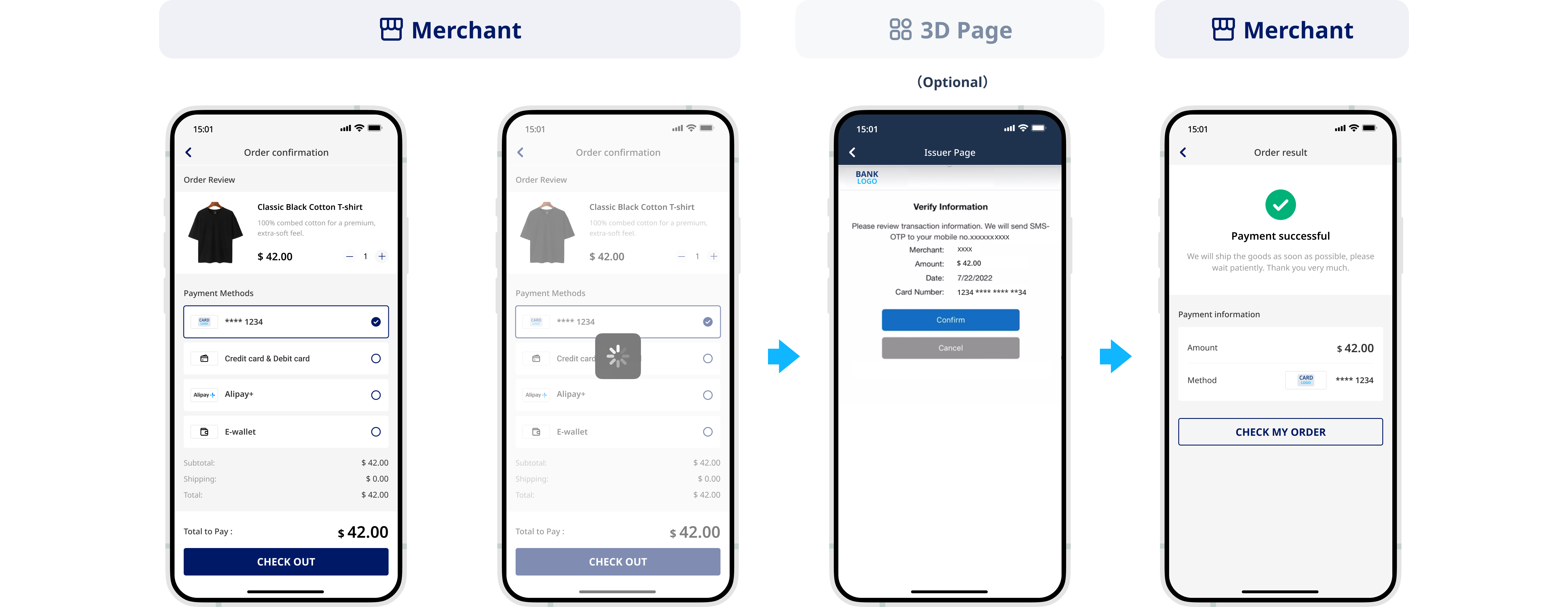

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the non-PCI qualified.

SDK integration

This section shows the difference between the first-time and subsequent payments under the SDK integration.

First-time payment

This section shows the difference between Web and app when users make the first-time payment under the SDK integration.

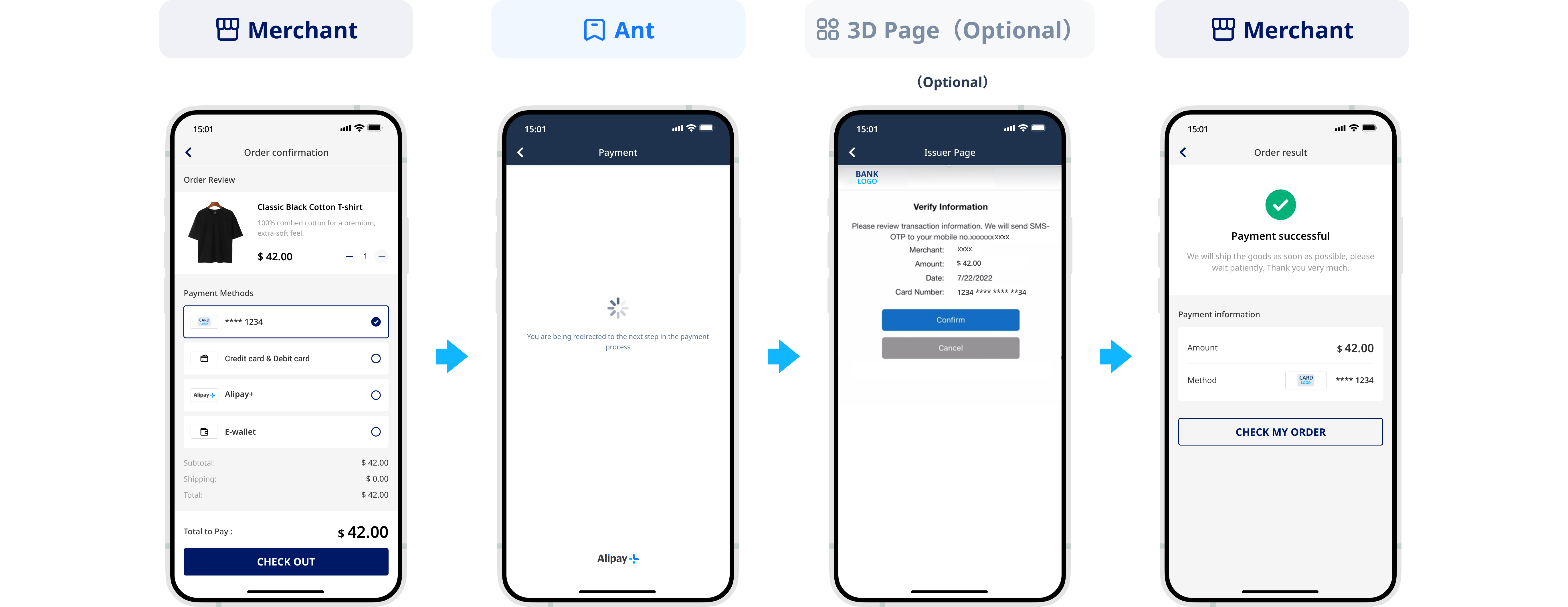

Subsequent payments

This section shows the difference between Web and app when users make the subsequent payments under the SDK integration.