PayPay

Launched in 2018, PayPay has emerged as the leading mobile payment app in Japan, boasting a user base of over 62 million. The app's success can be attributed to its strategic marketing campaigns, user-friendly payment experience, diverse range of services, and seamless integration across online and offline platforms. Since its inception, PayPay has effectively steered local consumers away from traditional cash transactions towards the convenience of digital payments, making it an indispensable tool in the daily lives of Japanese individuals.

PayPay is integrated with Wallet Balance and Points. With widespread acceptance throughout Japan, it boasts a payment ratio exceeding 45%, surpassing other prominent digital wallets in the country.

Properties

The properties of PayPay are shown in the following table:

Payment type | Wallet | ||

Funding source | Wallet balance, Points | ||

Acquirer | AlipaySG, AlipayEU, AlipayUS, AlipayUK, AlipayJP | Refund | ✔️ |

| Merchant entity location | SG, AU, HK, EU, US, UK, JP | Partial refund | ✔️ |

Buyer country/region | Japan | Refund period | 365 days |

Processing currency | JPY | Chargeback/Dispute | ❌ |

Minimum payment amount | 1 JPY | Revoke from wallet | ✔️ |

Maximum payment amount | Balance[1]:

| Revoke from merchant | ✔️ |

| Time to return payment result | Real-time | Token refresh | ❌ |

Auth URL expiration time | 15 minutes | Token expiration time | 1 year |

[1] Balance: Using of PayPay gift voucher and PayPay points is included in the balance limit.

User experience

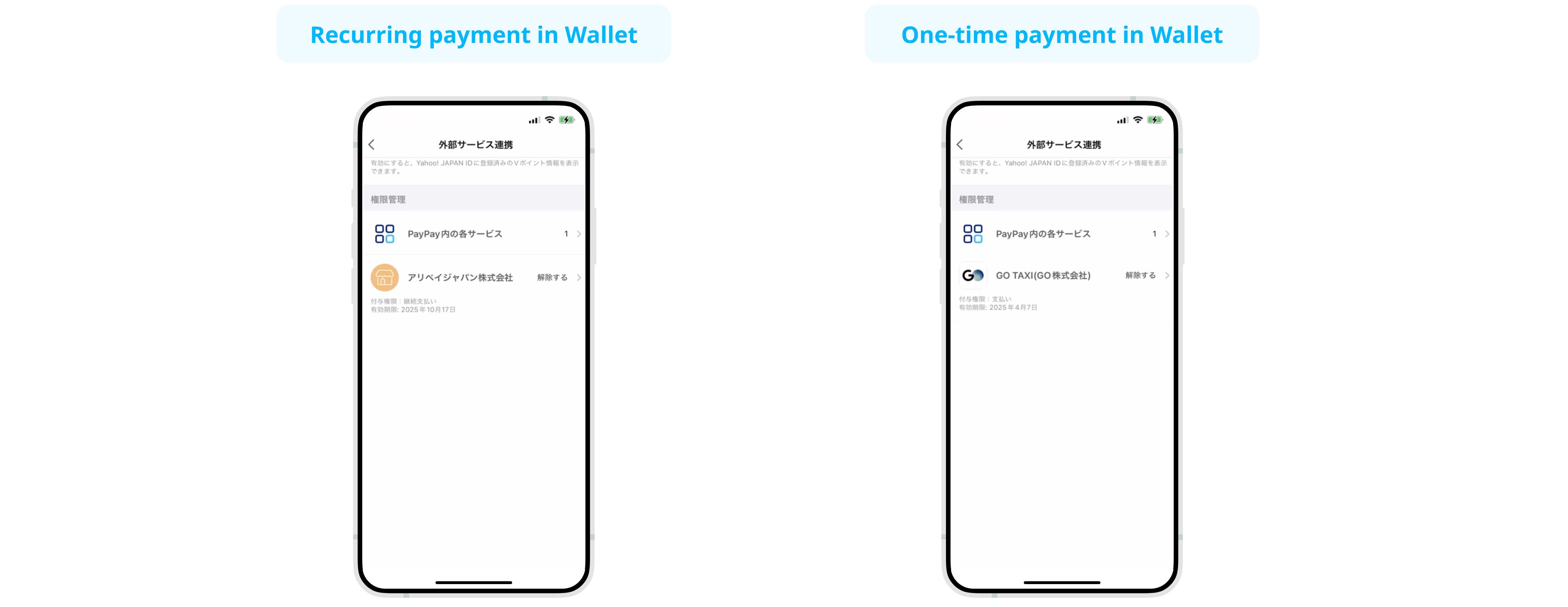

The following graphics show the PayPay authorization process, together with the authorization revocation process from the wallet side:

Authorization (mobile)

- The user chooses to sign up with PayPay.

- The user is redirected to the PayPay page and selects a login method.

- The user enters the OTP.

- The user reviews the authorization information and confirms it.

- The user checks the authorization result.

- The user is redirected to the merchant result page.

Authorization (PC)

- The user chooses to sign up with PayPay.

- The user is redirected to the PayPay page and selects a login method.

- The user enters the OTP.

- The user reviews the authorization information and confirms it.

- The user checks the authorization result.

- The user is redirected to the merchant result page. (the user can click to redirect back or wait for PayPay to automatically redirect.)

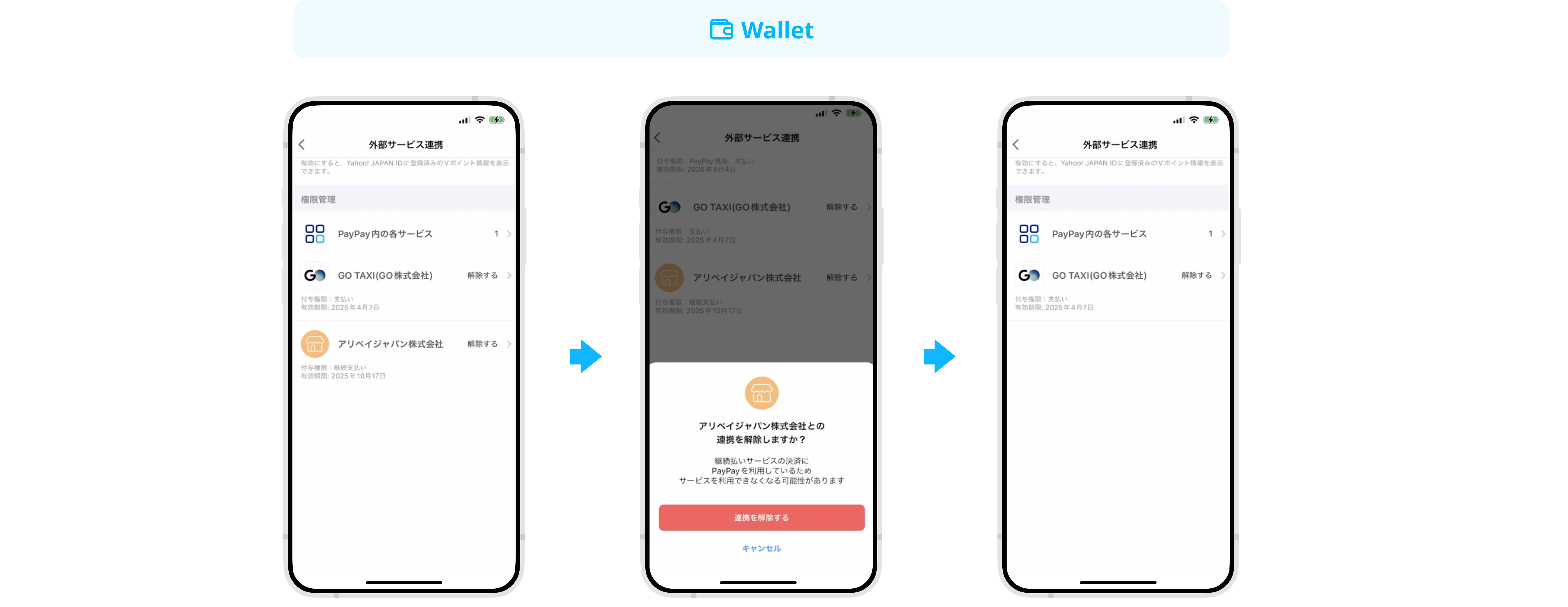

Authorization revocation (wallet)

- The user selects the merchant to revoke in the “External Cooperation Service” of the PayPay app.

- The user confirms the authorization revocation.

- After successful revocation, the user returns directly to the "External Cooperation Service" page.

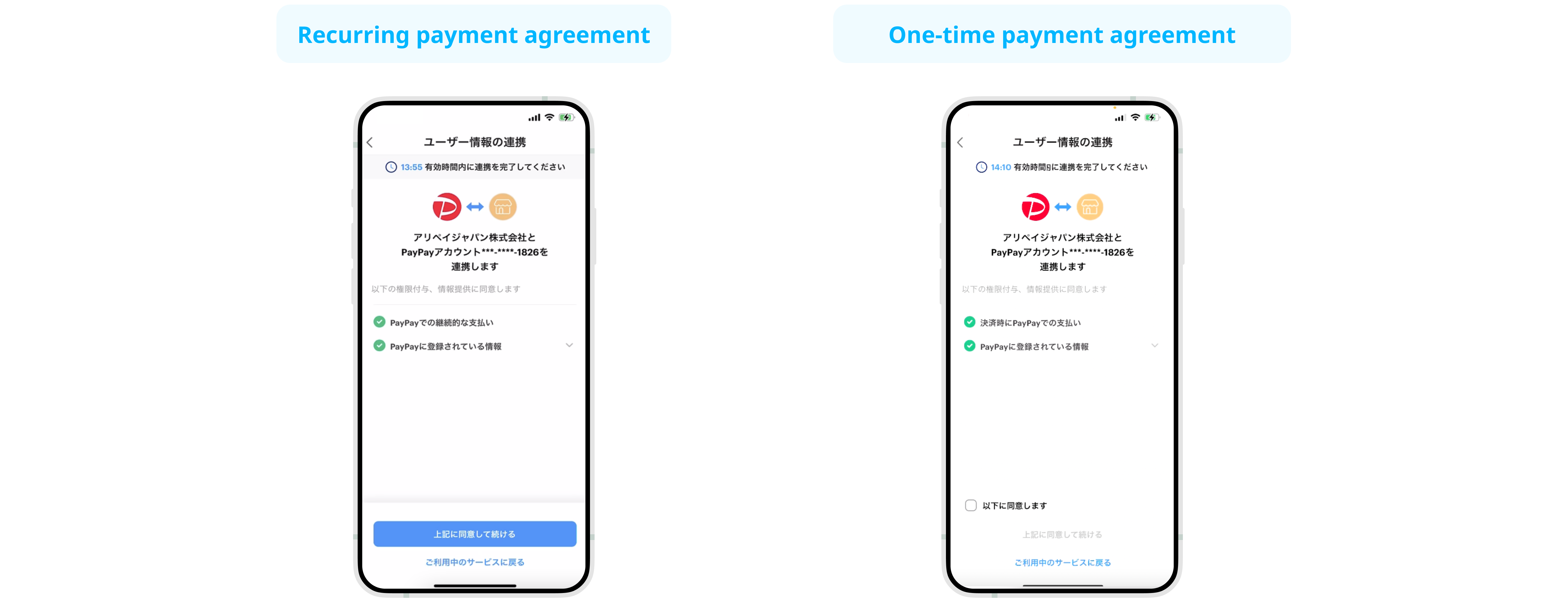

Authorization information page

The following figures show the difference in the authorization information page between recurring payment and one-time payment:

Integration considerations

The following section outlines integration considerations for various payment types, detailing customized integration solutions and payment method features.

Specify recurringPayment

When calling the consult API, the recurringPayment field indicates whether the auto debit is used for recurring payments. Valid values are:

true: indicates the auto debit is for recurring payments.false: indicates the auto debit is not for recurring payments.

Note: Specify this parameter when the value of customerBelongsTo is

PAYPAY. PayPay will continuously monitors the transaction. If the specified value does not align with the merchant's actual business, it may trigger a subsequent investigation by PayPay, potentially leading to the suspension of the transaction.

About normalUrl

PayPay only supports the return of normalUrl. If this URL is opened on a mobile device, the buyer can click the 開く button in the upper right corner of the PayPay page to redirect to the app for authorization. After the initial selection, PayPay will remember the buyer's choice for default automatic redirection.

Note: PayPay Auto Debit supports one-time payments, contact Antom Technical Support for more information.