Chargeback

A chargeback occurs when a payer disputes a payment for reasons such as suspected fraud, non-receipt of goods, receipt of defective items, or being charged multiple times for a single transaction. In such cases, the payer contacts the Issuer to request a reversal of funds from the merchant.

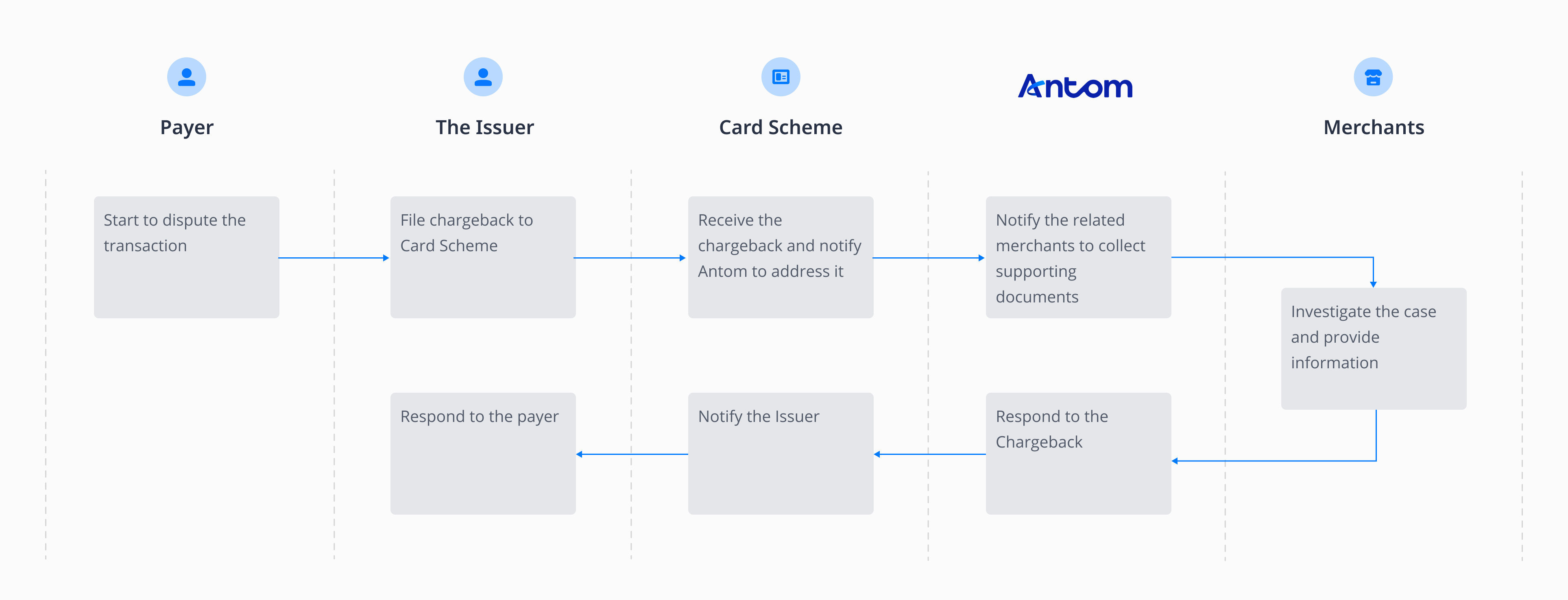

The chargeback process is displayed in the following graphic:

Figure 1: Flow chart of chargeback

Terms of chargeback

- You need to respond within the timeline according to different regions upon receipt of a chargeback notification.

- If you do not accept the chargeback, you need to respond with related chargeback defense documents within the specified timeframe. Failure to respond within the timeframe will be considered as acceptance of chargeback. The chargeback amount will be deducted from merchant settlement funds and indicated in the statement when the chargeback case is closed.

- You need to select an appropriate response code and may provide a supplementary description for chargeback defense.

- You need to collect, sort, and submit the information and/or documents according to the chargeback reason code by the Issuer.

- The information and/or documents provided by you need to be authentic, complete, and legible.

- You need to provide all information and/or documents in English. Non-English materials must be accompanied by a legalized English translation version.

Chargeback timeframe

Stage | Time frame | Explanation |

Chargeback initiation by the payer | 180 days | Card issuers or card schemes typically allow payers to initiate disputes up to 180 days following the original payment. However, in certain situations, the rules set by card issuers or card schemes may extend this period, allowing for disputes to be raised for up to 540 days. |

Receipt of a chargeback notification | T + 1 day | T: The day Antom receives the chargeback request. T+1: Merchants receive the chargeback notification sent by Antom. |

Merchant’s response to the chargeback | 2 - 20 days | As a merchant, you need to respond to the chargeback notification email within the specified timeline, which is usually 2-20 days depending on the region. |

Chargeback result closure (from defense date) | 75 - 180 days | After you submit the evidence, the chargeback result usually comes out after 75-180 days depending on the card scheme. |

Chargeback response procedure

When you receive a chargeback notification, take the following steps before issuing your response:

- Check the reason code associated with the chargeback. Select a relevant response code and, if necessary, provide a supplementary description to support your defense against the chargeback.

- Collect, sort, and submit the information and/or documents in English, which should be authentic, complete, and legible. Non-English materials must be accompanied by a legalized English translation version.

- (If applicable) Contact the payer to discuss the chargeback before you accept or challenge it. Contacting the payer will help you decide how to respond to the case and what sort of evidence you might need to defend it.

- Consider accepting liability. Defending a chargeback can be a lengthy and costly process, so you might not want to defend against every chargeback. Weight the pros and cons before you proceed.

- Make a decision. After considering the above steps, you have two choices regarding a chargeback:

- Accept: If you agree with the chargeback and the specific reason given, you can accept the chargeback. If you fail to respond within the required time frame, it will be interpreted as acceptance of the chargeback.

- Challenge: If you want to defend against the chargeback, you need to submit all assembled evidence within the required time frame.

Response codes of chargeback

Response codes | Description |

001 | Challenge the chargeback |

002 | Accept a partial chargeback |

003 | Accept a full chargeback |