How the dispute works

Disputes are divided into three stages: retrieval request, refund escalation, and chargeback, which may vary based on the different payment methods supported.

- Retrieval request: A dispute may start with a retrieval request, wherein the payer requests transaction details from the merchant.

- Refund escalation: If a payer disputes a payment and requests a refund, the Issuer can initiate an escalation.

- Chargeback: A chargeback occurs when a payer disputes a payment and contacts the Issuer to reverse the charge. The payer can file a chargeback for various reasons. including suspected fraud, overcharging, or failure to receive a product or service. A chargeback will lead to a payment reversal.

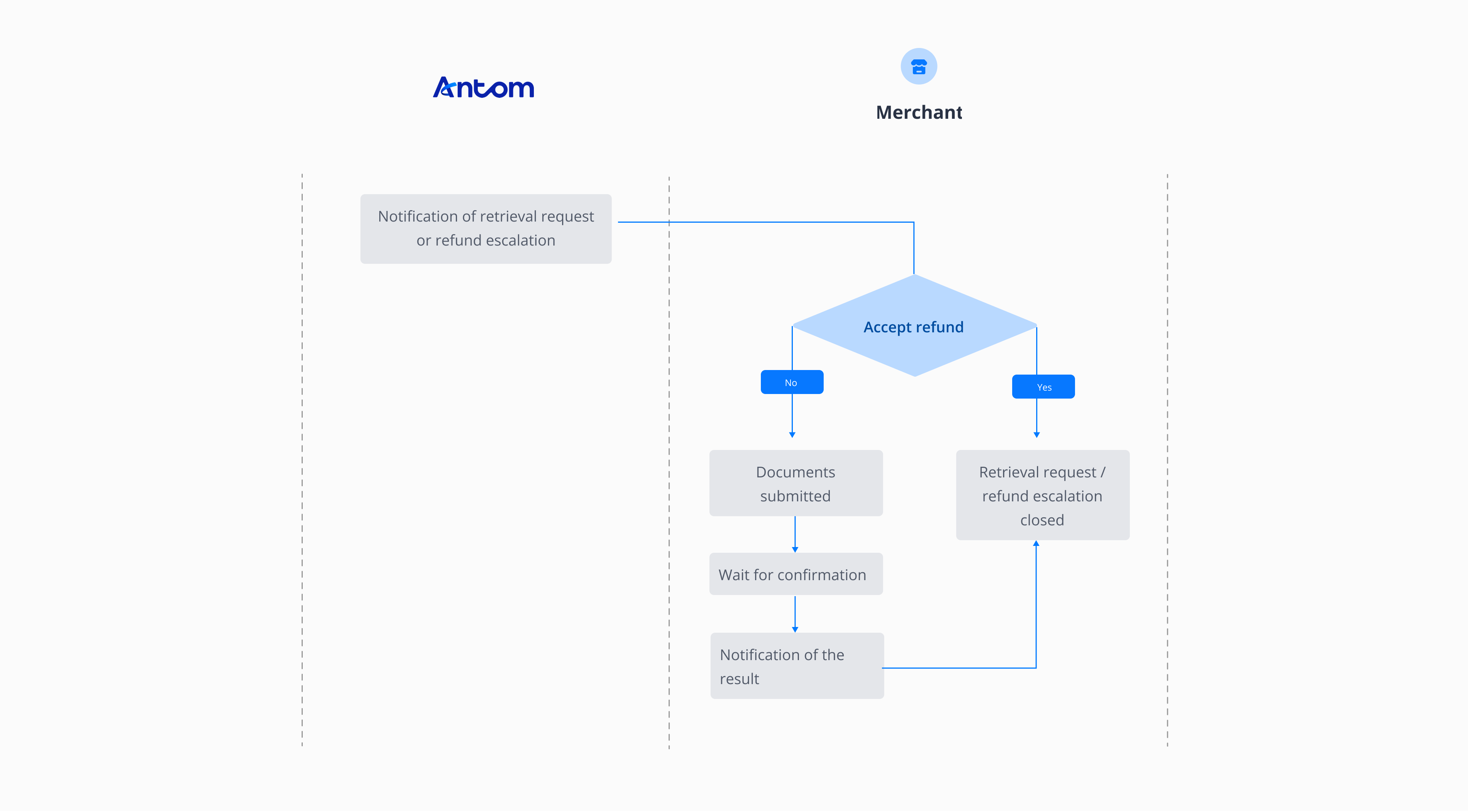

Retrieval request/refund escalation workflow

The retrieval request or refund escalation flows are shown in the following graphic:

Figure 1: Flow chart of a retrieval request or refund escalation

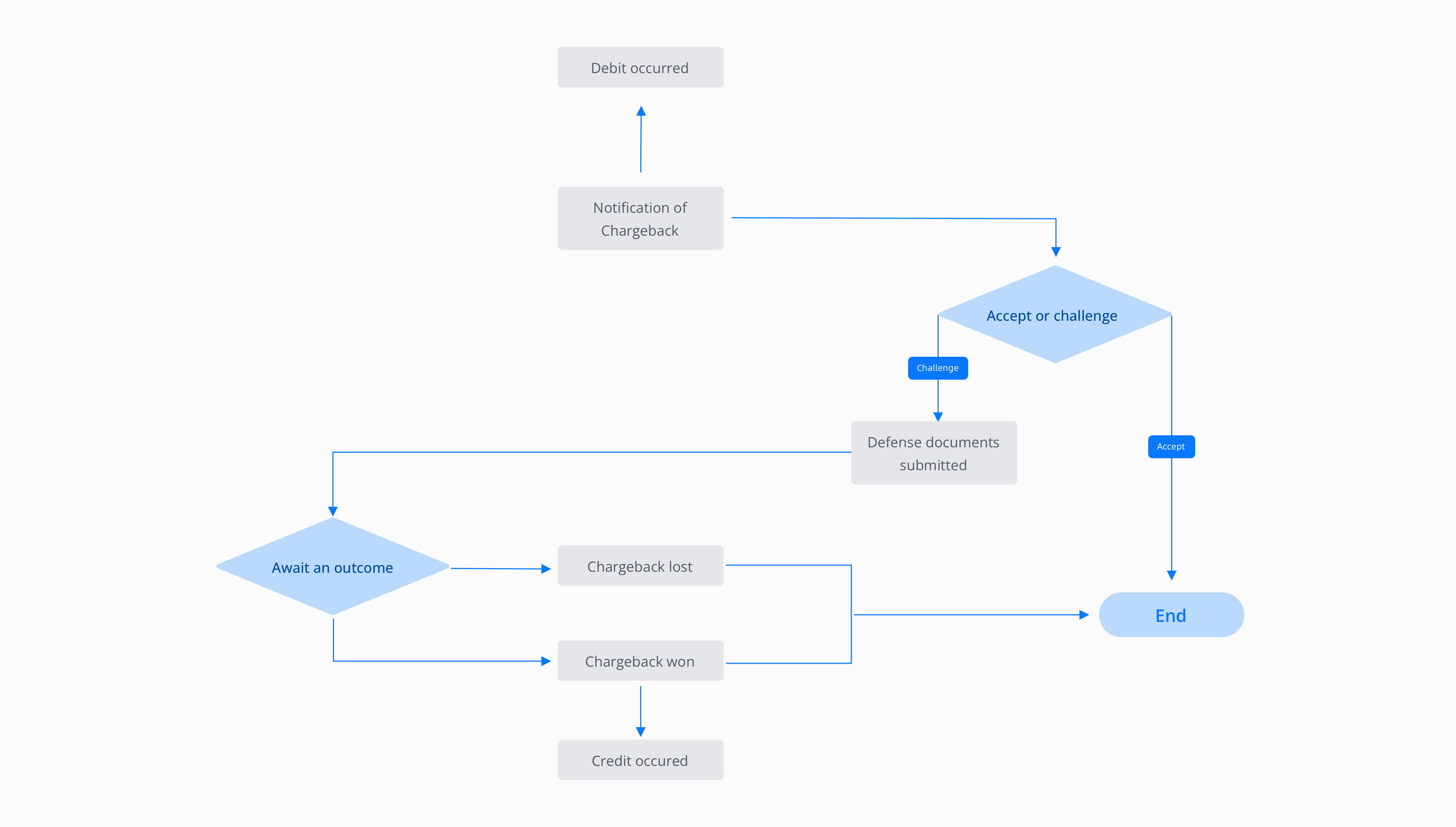

Chargeback workflow

The general chargeback process is shown in the following graphic:

Figure 2: Flow chart of chargeback

Note: This process varies by regional regulatory requirements and card schemes, and is subject to alignment between you and Antom. For more information, contact Business Development (BD).

The process is composed of three stages:

- Notification of Chargeback (NoC): The payer’s bank (the Issuer) creates a formal chargeback and assigns it a chargeback code, which describes why the payer wants a refund. Before receiving a NoC, you must configure a notification address as instructed in Configure an address for receiving a NoC.

Once a chargeback is issued, the disputed amount, and a separate dispute fee (if applicable), will be deducted from your account.

- Challenge or accept the chargeback: you need to decide how you want to respond to the chargeback.

- Accept: If you agree with the chargeback and the specific reason given, you can accept the chargeback.

- Challenge: If you want to defend against the chargeback, you will need to submit evidence within the required time frame.

- Ignore: If you ignore the chargeback, it will expire after a certain amount of time and you will no longer be able to respond to it. The result is usually the same as that of accepting the chargeback.

- Await the outcome: Once you submit evidence, the Issuer or card scheme will review it and decide whether to accept or decline liability for the disputed amount.

- Chargeback won: If the Issuer is satisfied with the evidence that you provide, the chargeback is won in your favor. Once the won results come out, the disputed amount will be transferred back to your account.

- Chargeback lost: If the Issuer is not satisfied with the evidence that you provide, the chargeback is won in the payer’s favor.