SDK integration

This article guides you on how to integrate card payment using SDKs. This SDK integration does not require merchants to be PCI-qualified and is suitable for those who prefer lightweight integration and do not require much customization of a payment process.

The card payment SDK allows you to easily integrate card payment methods by using components, requiring minimal development efforts. Furthermore, this solution reduces redirections during the payment process, and thus facilitates payment conversion rates and delivers a premium payment experience to buyers.

The card payment SDK provides the following functions:

- Provide a payment information collection page. The SDK uses popups to collect card payment factors, reducing redirections and facilitating payment success rates.

- Help collect the device information, which is also referred to as a Device Data Collection (DDC) process.

- Handle the redirection to the 3D verification page.

- Display a page prompting that the payment is being processed.

- Make the language of cashier pages consistent with that of the browser. English, Portuguese, Korean, Spanish, French, German, Italian, and Dutch are supported.

Deployment process

To integrate card payment methods by using the card payment SDK, follow these steps:

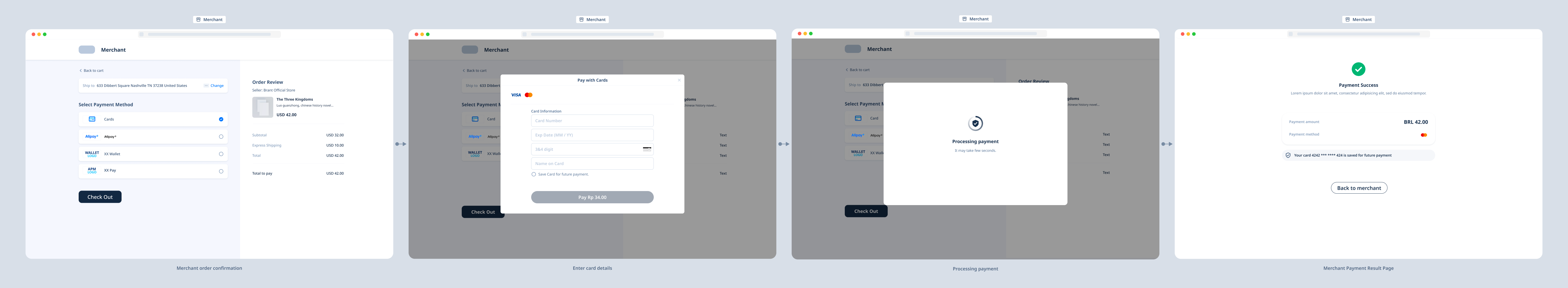

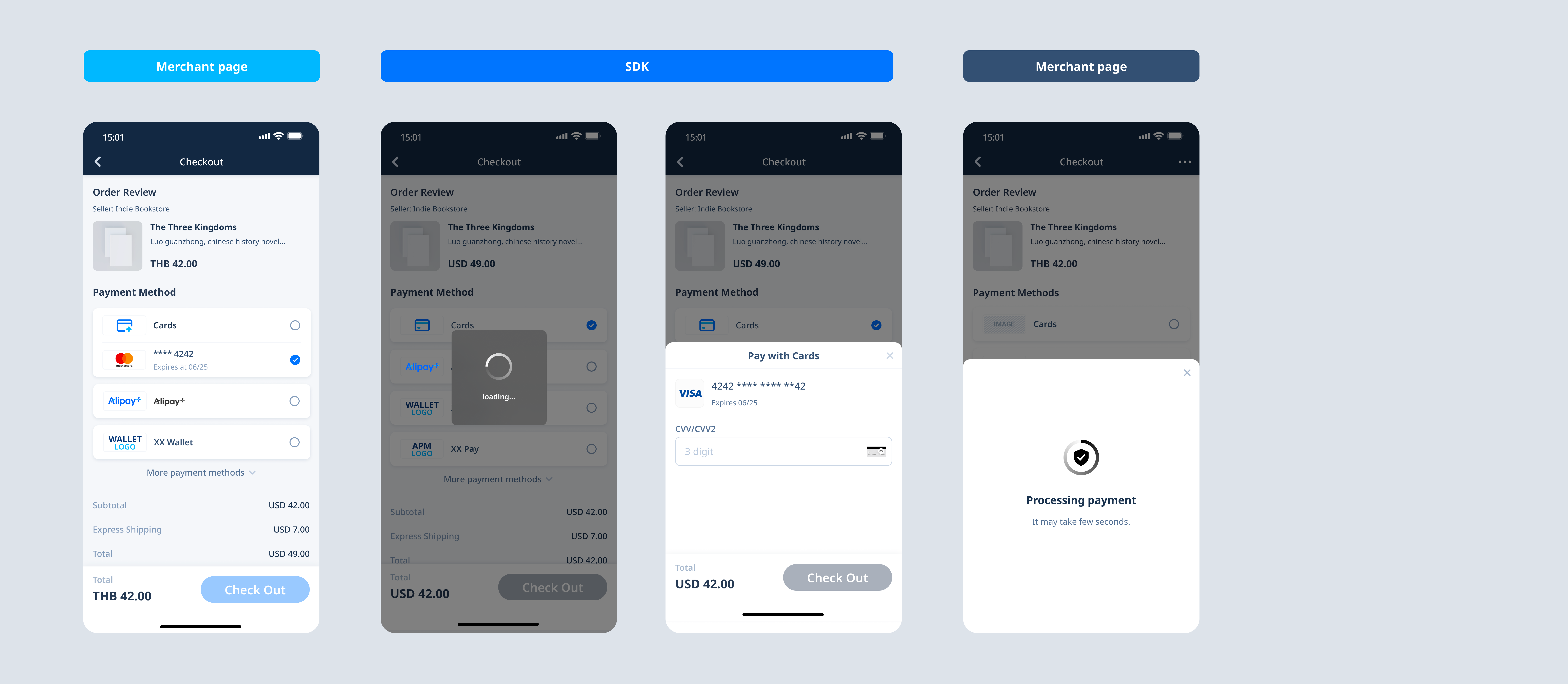

Figure 1. Payment process using the card payment SDK

- Create an SDK instance: After your client creates the payment method page and implements the monitoring of the payment button click event, run the

AMSCashierPaymentmethod to create the SDK instance. - Call the createPaymentSession API: Your server uses the buyer's order information to send a createPaymentSession request to the APO server. In this step:

- You can specify whether the subsequent capture is automatic or manual. The default mode is automatic capture.

- Automatic capture: In any of the following situations, APO will automatically initiate a capture after authorization is completed:

- You specify the value of the paymentFactor.captureMode field of the createPaymentSession API is

AUTOMATIC. - The paymentFactory. captureMode field of the createPaymentSession API is empty or not passed.

- Manual capture: After a successful authorization, you manually call the capture API. You need to specify the paymentFactor.captureMode field value of the createPaymentSession API as

MANUAL.

- You can choose whether to use More features:

- 3D verification: You can choose whether to subject payment to a 3D verification by specifying the is3DSAuthentication parameter.

- AVS check: An AVS check compares the billing address used in the transaction with the issuing bank's address information on file for that cardholder to detect fraud.

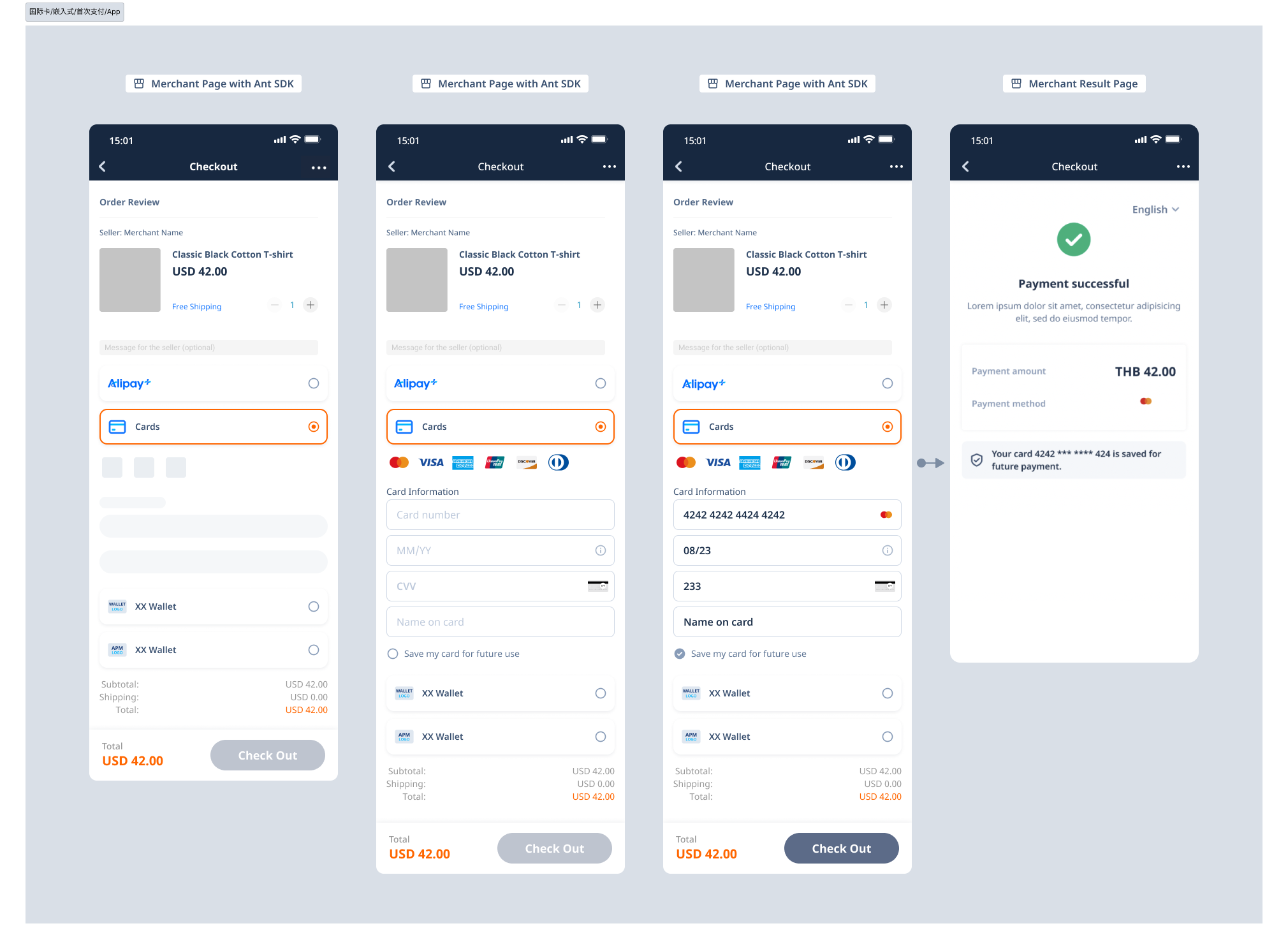

- Card information storage: If a buyer agrees to save their card information during the first payment, they do not need to re-enter the card information for subsequent payments.

- MPI capability: Merchants prioritize buyers to complete third-party verification before initiating transactions, pass in verification result information in payment requests, and specify non-3D verification. If the merchant does not collect card information, this function is not available.

- Create the component for collecting payment factors: Run the createComponent method by using the response parameter paymentSessionData of the createPaymentSession API to create the component for collecting payment factors. In the pre-bound card mode, a payment element supplementary collection page may appear, or a payment element collection page may no longer be required, only the payment waiting page.

- Guide the buyer to complete the payment: The buyer enters the information about the payment factors on the payment factor collection page and completes the payment. If the card payment method used for the payment supports installments, the buyer can specify an installment plan on this page.

- Obtain and display authorization results: You can obtain an authorization result by receiving asynchronous notifications or calling the inquiryPayment API, and display the authorization result to the buyer on your authorization result page.

Get started

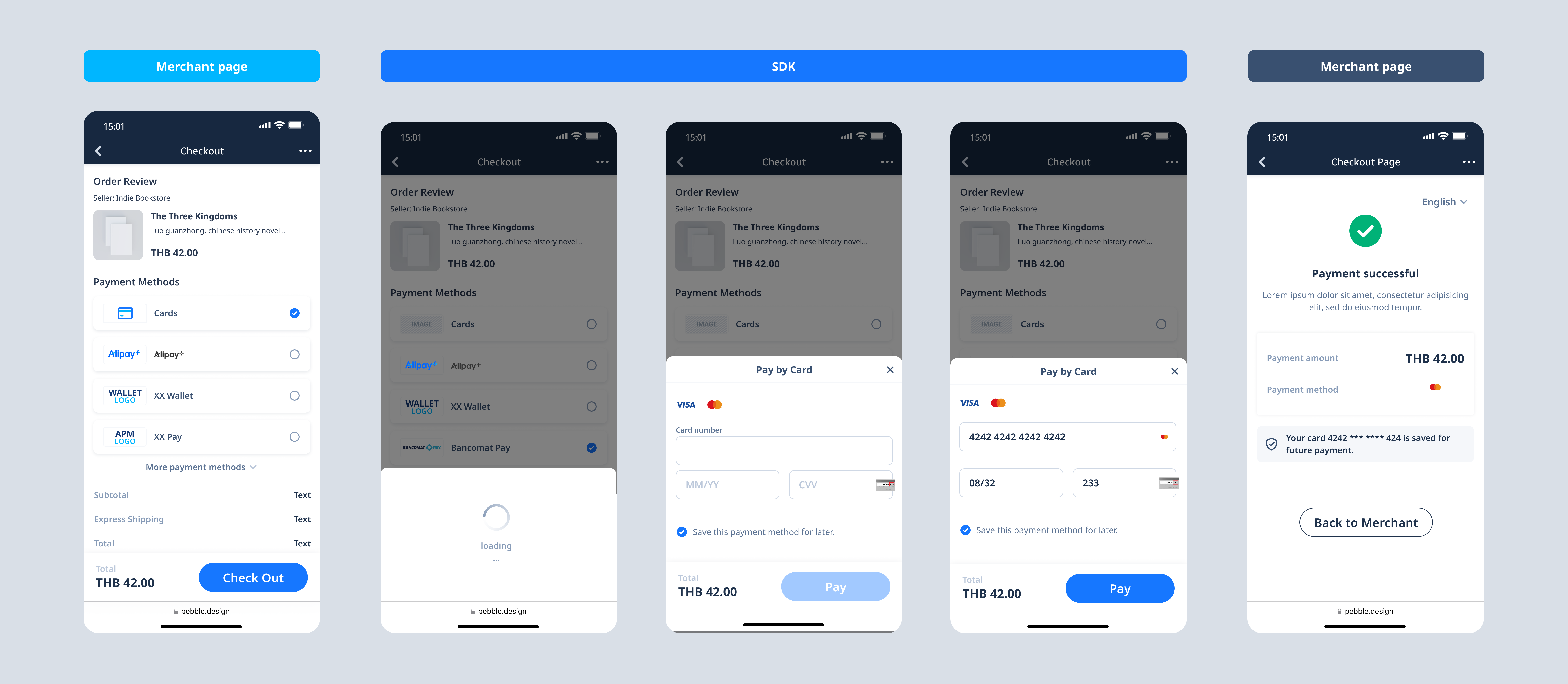

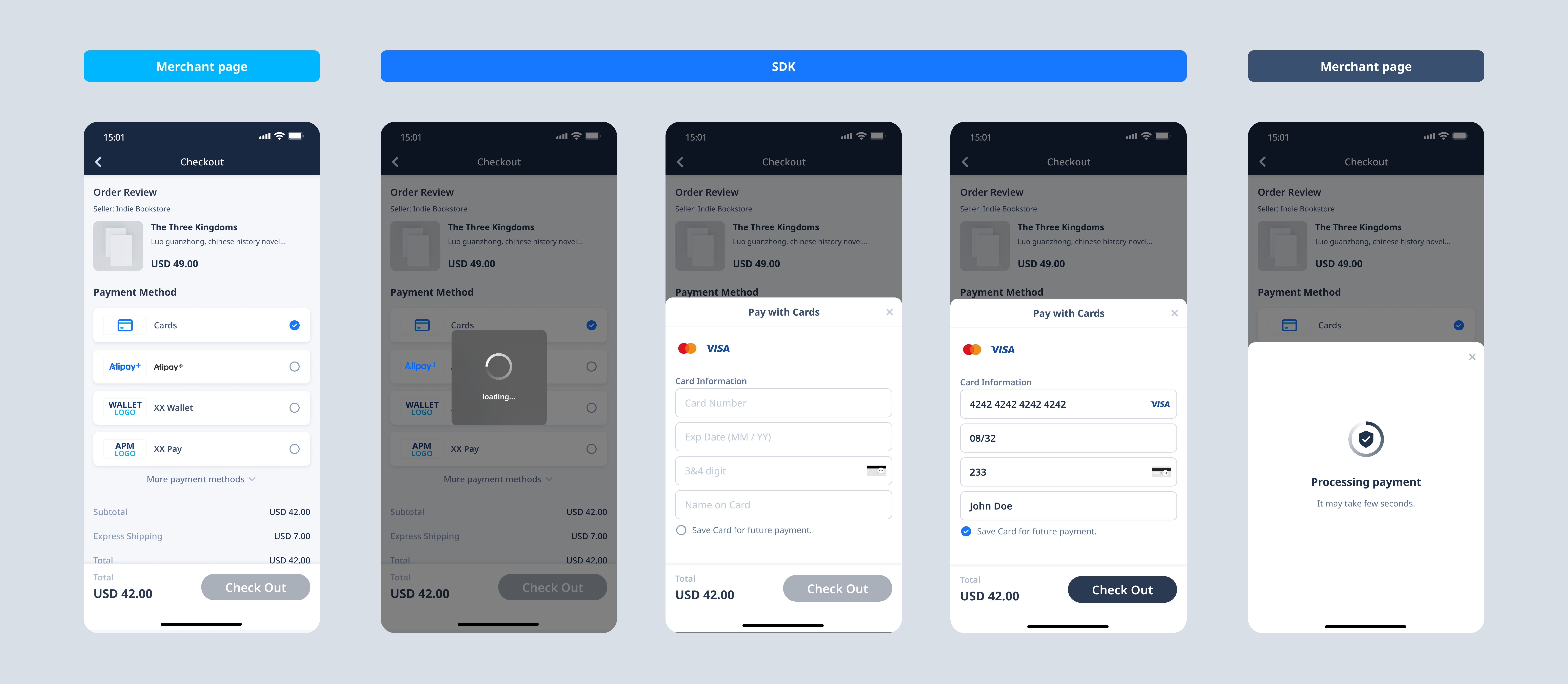

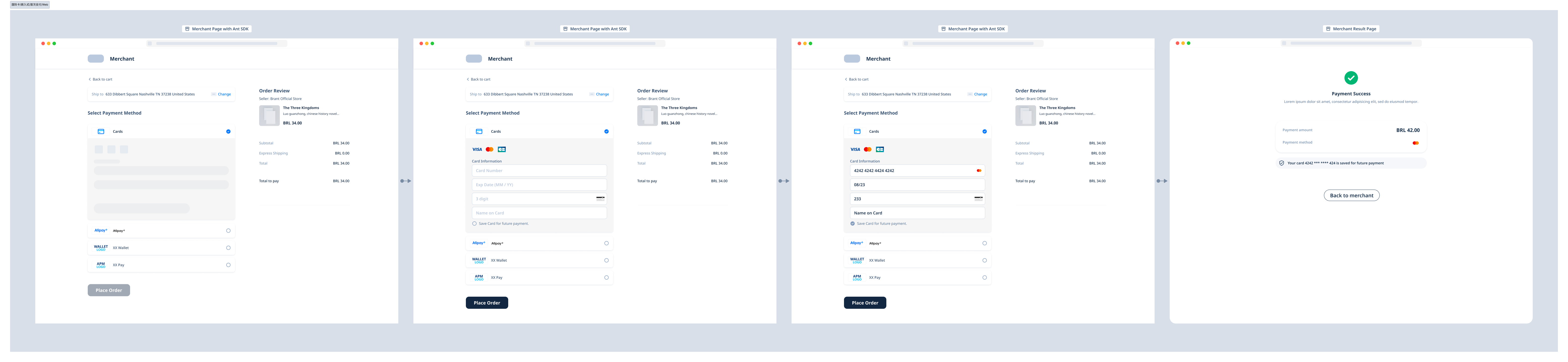

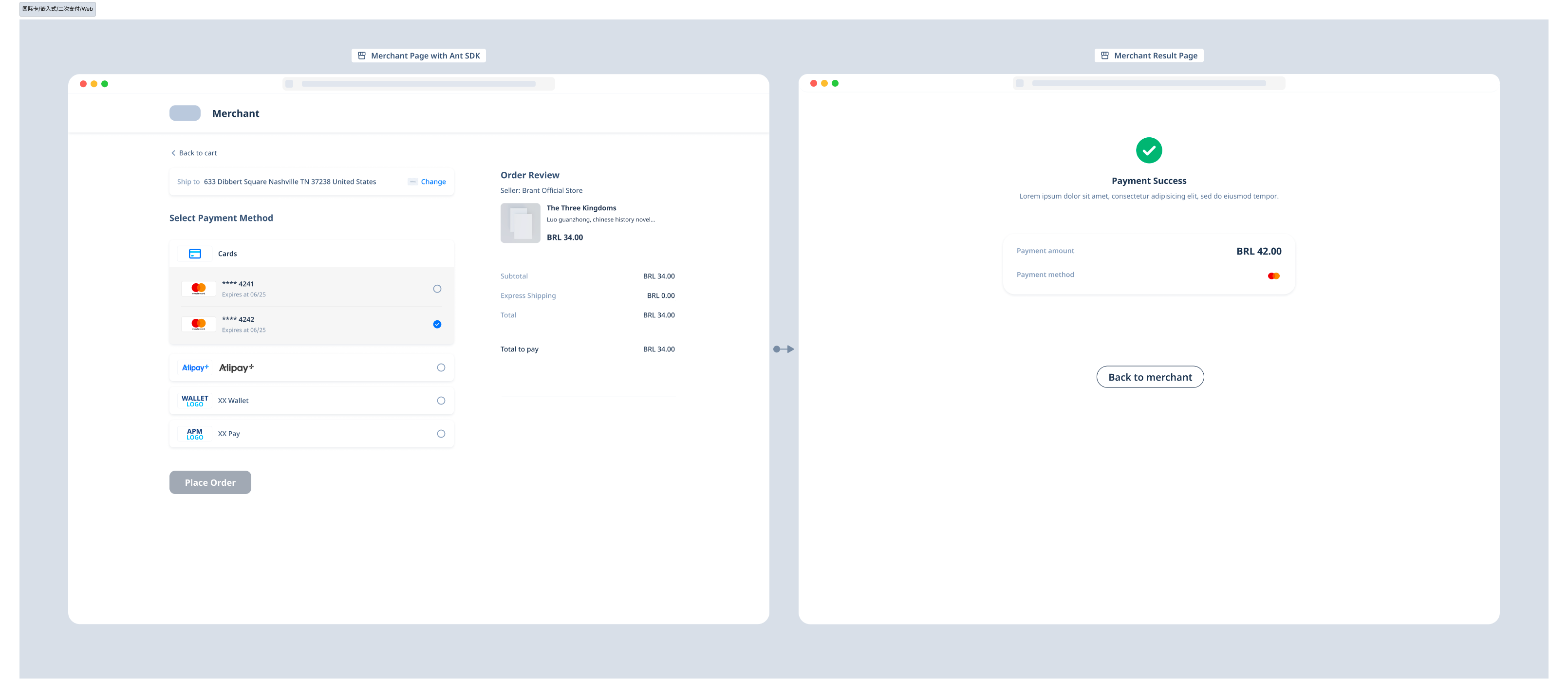

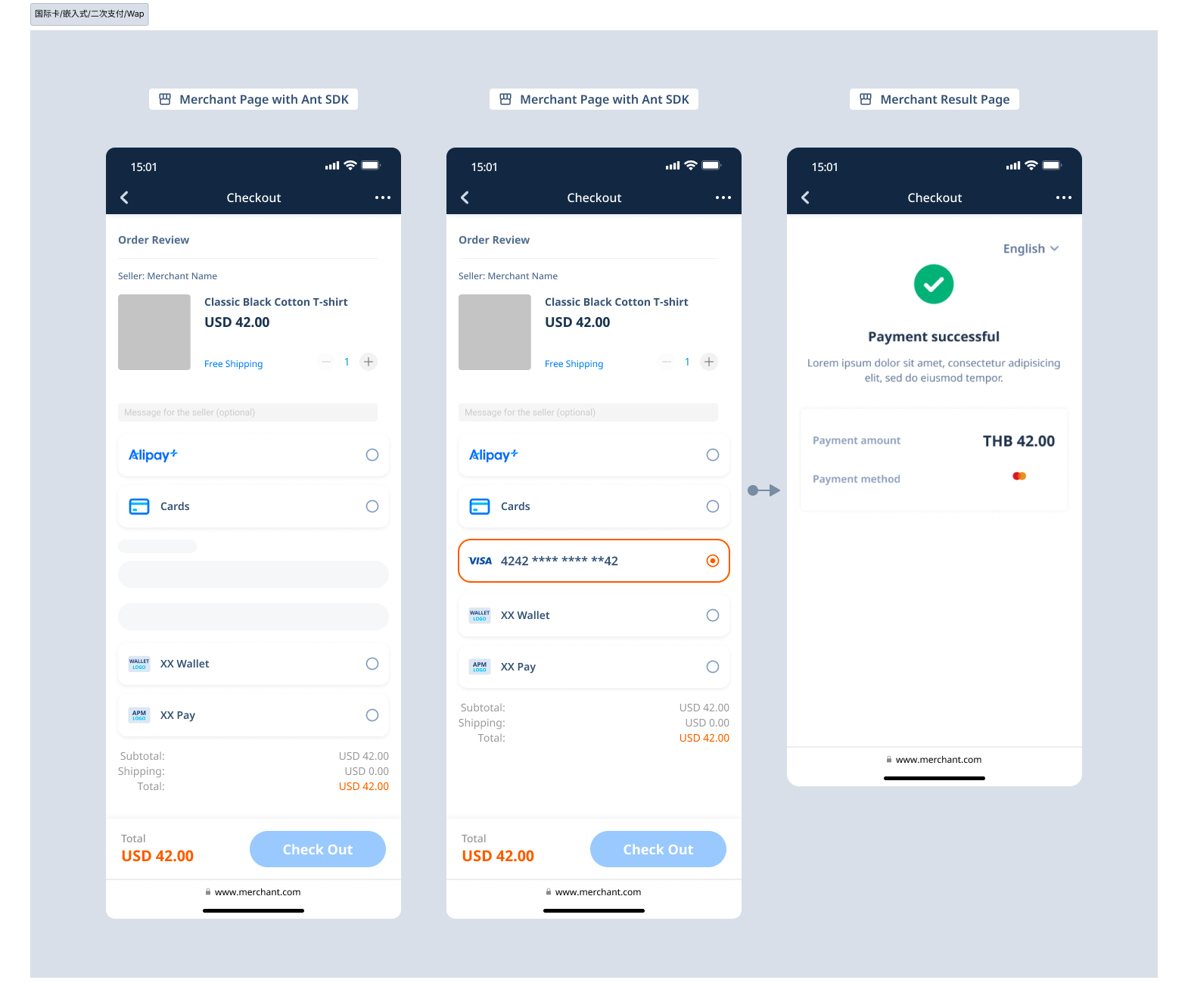

You can integrate a pop-up or embedded payment experience through SDK:

- Pop-up payment experience: It refers to the pop-up payment element collection page on your checkout page. Please refer to the following content for more details.

- Embedded payment experience: It refers to embedding the payment element collection interface directly into your checkout page. Please refer to the following content for more details.

Obtain authorization results

After a buyer enters card information into the popup window for collecting payment information provided by the SDK, the SDK submits the payment and the buyer completes 3D verification. Subsequently, the SDK displays the authorization result page (the page provided by the paymentRedirectUrl parameter) in a browser. You can obtain an authorization result by receiving asynchronous notifications or calling the inquiryPayment API, and display the authorization result to the buyer on your authorization result page.

Receive an asynchronous notification

You can obtain the authorization result by receiving an asynchronous notification sent by APO through the notifyPayment notification. Before you can receive the asynchronous notification, you must set a notification address by specifying paymentNotifyUrl in the pay API. When a final authorization status is achieved (that is, when the authorization is successful or failed), APO sends you the asynchronous notification through the notifyPayment notification. When you receive the notification, you must return a response as instructed in Requirements. Otherwise, APO resends the notification until a correct response is received.

Inquire about the authorization status

Due to network issues, the asynchronous notification can fail to be received or be delayed. Therefore, we recommend that you inquire about the payment status by calling the inquiryPayment API (POST/v1/payments/inquiryPayment). You can use the API in the following scenarios:

- Before the authorization result page is invoked: When the payment is initiated on the payment method page, you can automatically trigger calling the inquiryPayment API for subsequent redirection.

- When the buyer inquires about the payment result: When the buyer clicks or taps I have paid or a button with the same meaning on your page, you can call the inquiryPayment API to check the payment status.

- When the payment times out: When the payment reaches the expiration time, you can call the inquiryPayment API to check the payment status.

By receiving an asynchronous notification or inquiring about the authorization status, you can obtain the authorization results as well as the following information:

Method | Authorization result | AVS information | CVV information | 3D verification information |

Asynchronous notification | resultStatus | avsResultRaw | cvvResultRaw | threeDSResult (only applicable for payments that have undergone 3D verification) |

Inquiry about the authorization result | paymentStatus | avsResultRaw | cvvResultRaw | threeDSResult (only applicable for payments that have undergone 3D verification) |

Table 1. Key information obtained through notifications and inquiries

The following code sample shows asynchronous notifications and inquiry results:

{

"notifyType": "PAYMENT_RESULT",

"result": {

"resultCode": "SUCCESS",

"resultStatus": "S",

"resultMessage": "success"

},

"paymentRequestId": "2020010123456789XXXX",

"paymentId": "2020010123456789XXXX",

"paymentAmount": {

"value": "8000",

"currency": "EUR"

},

"paymentCreateTime": "2020-01-01T12:01:00+08:30",

"paymentTime": "2020-01-01T12:01:01+08:30",

"paymentResultInfo": {

"avsResultRaw": "A",

"cvvResultRaw": "Y",

"networkTransactionId": "sampleNetworkTransactionId123456",

"threeDSResult": {

"eci": "02",

"threeDSVersion": "2.2.0",

"caav": "cavvSample",

"dsTransactionId": "sample_dsTranasctionId"

}

}

}SDK functions

The acquiring process of card payments is completed in two steps, that is, payment and capture. The card payment SDK only works for the payment process, and you must call the capture API to complete the subsequent capture process. For more information, see Capture.

For information about the operations after the payment, see Refund and Cancel.

The integration process still requires some development on your part. The following table shows the required coding steps and how the card payment SDK can help you achieve them.

Your coding steps | SDK's functions |

|

|

Table 2. Your coding steps and the SDK's functions

User experience

You can obtain the following pages by integrating the card payment SDK.

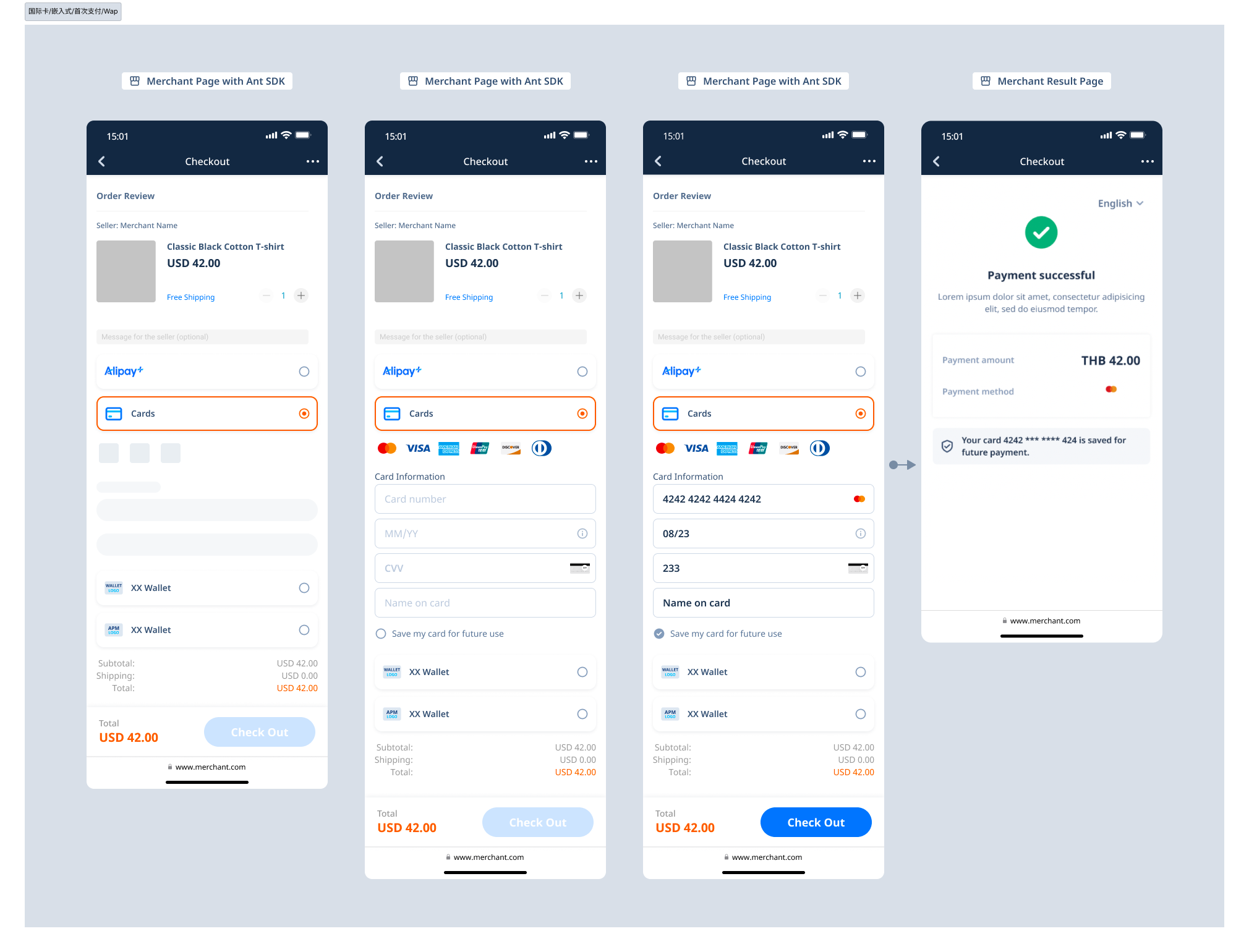

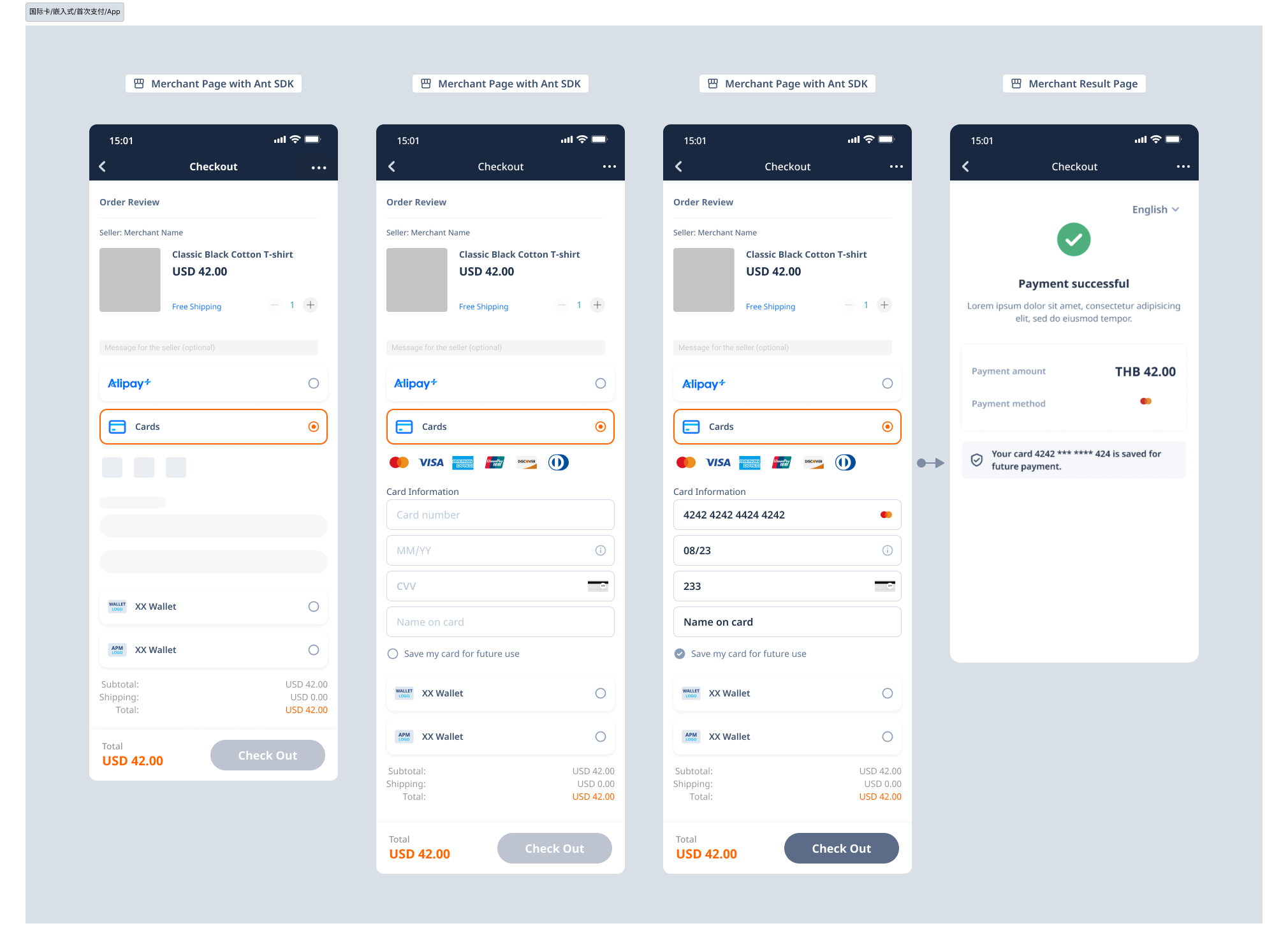

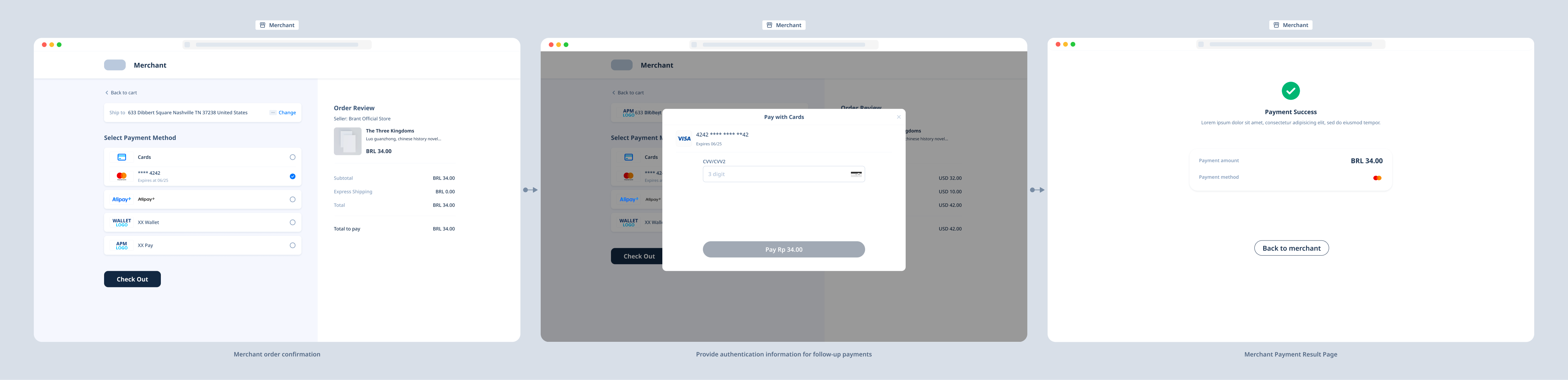

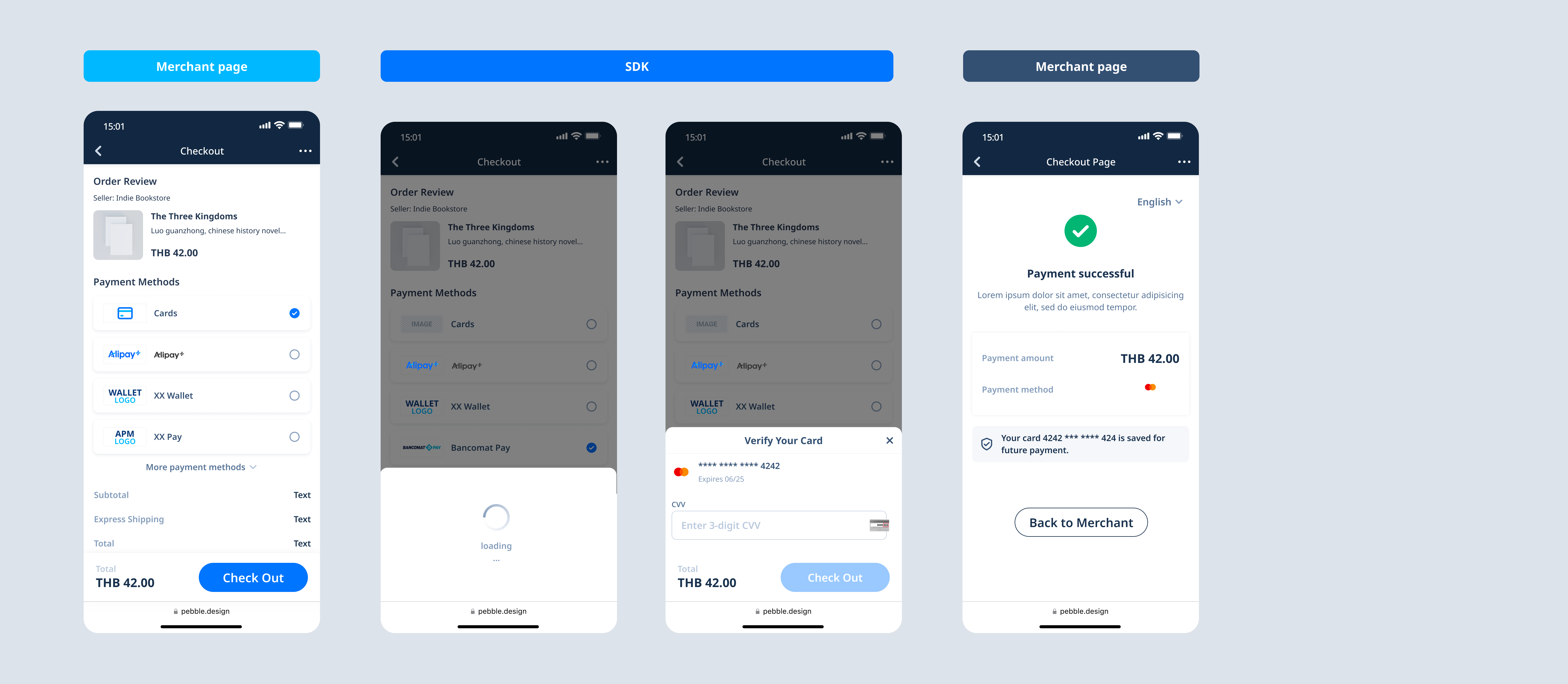

- Payment method selection page: Implemented by the merchant client itself.

- Waiting page before payment element collection: Provided by SDK.

- Payment element collection page: Provided by SDK.

- Alert page during payment processing: Provided by SDK.

- Payment result display page: Merchant client's implementation.

Scenario 1: First-time card payment

Pop-up payment experience

Embedded payment experience

Scenario 2: Subsequent card payment

Pop-up payment experience

Embedded payment experience

Scenario 3: An exception occurs during the payment