Introduction

What is Digital Wallet Solution?

A digital wallet is used to enable payments using a stored-value payment account on users' electronic services.

Ant Group Digital Wallet Solution is the digital wallet powered by Ant Group that provides customized digital wallet services for merchants, with the "look and feel" of your own brand that your users are already used to seeing and experiencing. Since 2017, Ant Group has launched digital wallets in more than 18 countries globally. With those successful experiences, we provide digital wallet service with the most comprehensive and reliable function capabilities within the merchant's app and website.

Quick look on Ant Group Digital Wallet Solution:

- Modularized wallet functions to integrate easily

- Fully licensed and responsible to regulators

- Professionally trained AML and risk control systems to secure transactions

- Broad coverage on financial network for fast and low-cost fund transfer

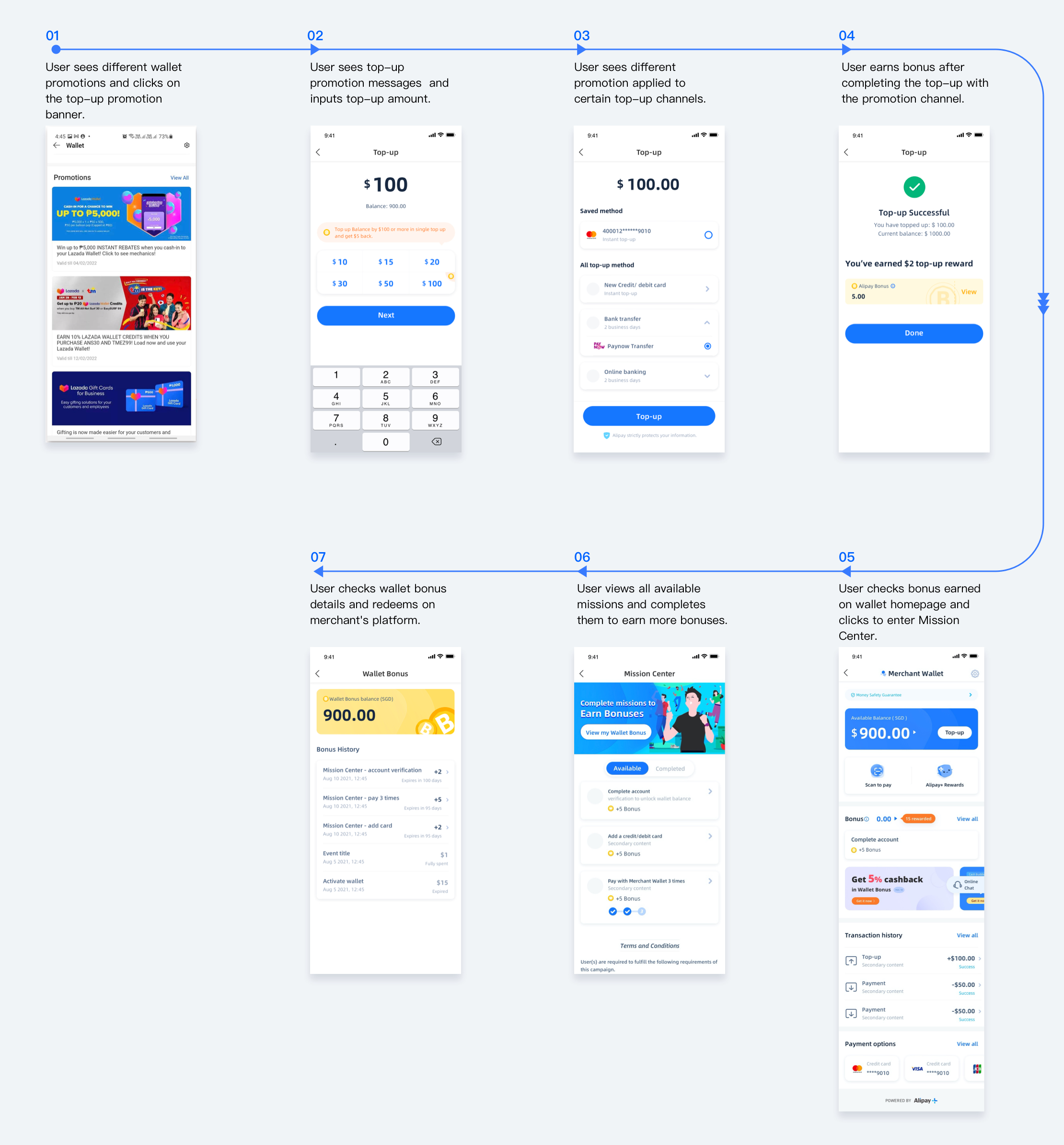

- Diverse payment and promotion use cases to bring in additional business values

What are the benefits?

With Digital Wallet Solution (DWS), merchants can enjoy the following benefits:

- User growth with smooth payment experience

- GMV brought by wallet users is much higher than non-wallet users.

- Payment success rate of wallet payments is the highest among all payment methods.

- Wallet promotions can successfully boost up merchant's user acquisition and retention.

- Fast transactions at low cost

- Connected to more than 70 local financial channels including banks and other local issuers

- Significantly lower merchants' fund transfer costs and capital loss

- License and security

- Provided Ant Group self-owned licenses issued by local regulators to develop services that only license acquirers can operate

- Mature fraud and AML control engines to minimize the risk with professional data security systems

- Advanced level of balance in risk intervention and customer payment experience

- Easy integration and system stability

- Multiple integration solutions with customized function selections

- Standardized integration process to minimize integration workload

- System with high availability and stability, backed with reliable support team

Currently, our operation covers Singapore, Malaysia, the Philippines, the Europe (12 countries), Brazil, Vietnam, and the United Kingdom (licensed but not yet launched). We have served e-commerce unicorns such as Lazada and AliExpress with high cross-border transaction volumes and achieved marvelous business results.

Check out our success stories:

1. Wallet payment has increased checkout success rate by 10%

The primary use-case for the wallet will be to make a purchase on your website without a bank account – this makes it easier for users to understand the merchant's wallet, all while being exposed to your platform.

2. Promotions with merchants can increase user retention and build user loyalty

GMV brought by wallet users has been 20% higher than non-wallet users with diverse wallet promotions.

Rebate execution will not take the form of 'fake currency' – meaning that your users will have a more tangible feel of your rewards. The wallet can also work in tandem with any loyalty play you have in mind. Merchants can partner with other brands for them to disburse rebates as a reward for partner brands.

3. Strong risk management and authentication which is clearly lower than industry average

We offer competitive fraud loss rates in different markets based on data integration mode with merchants.

How it works?

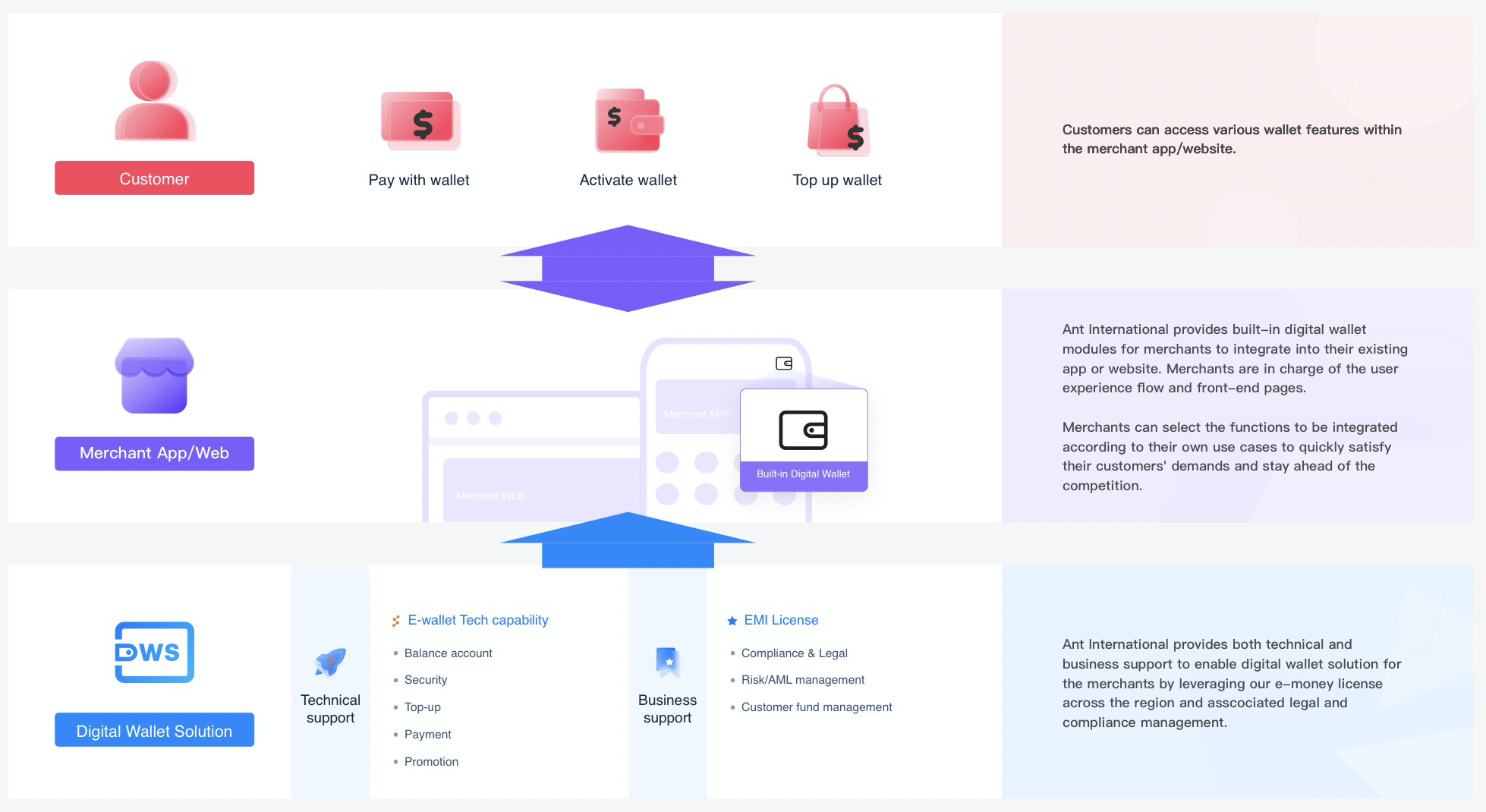

Ant Group provides the 'built-in' wallet that has the merchant's own brand in their app or on their website. Merchants can choose between two integration solutions:

- Direct APIs: Merchant builds own wallet front-end pages, and integrates with wallet APIs

(refer to API Integration Solution) - Client SDK: Merchant uses Ant Group SDK front-end pages with customized logo displayed

(refer to Client SDK Integration Solution)

Architecture of Ant Group Digital Wallet Solution

Within the merchant's app or website, users can activate wallet account, top up wallet, pay by wallet balance and enjoy other wallet functions. A merchant can choose to either use your own acquirer or Ant Group's acquiring services, whereby Ant Group digital wallet solution will settle the payment amount to the acquiring services, and the acquiring service will settle to the merchant together with other payment methods.

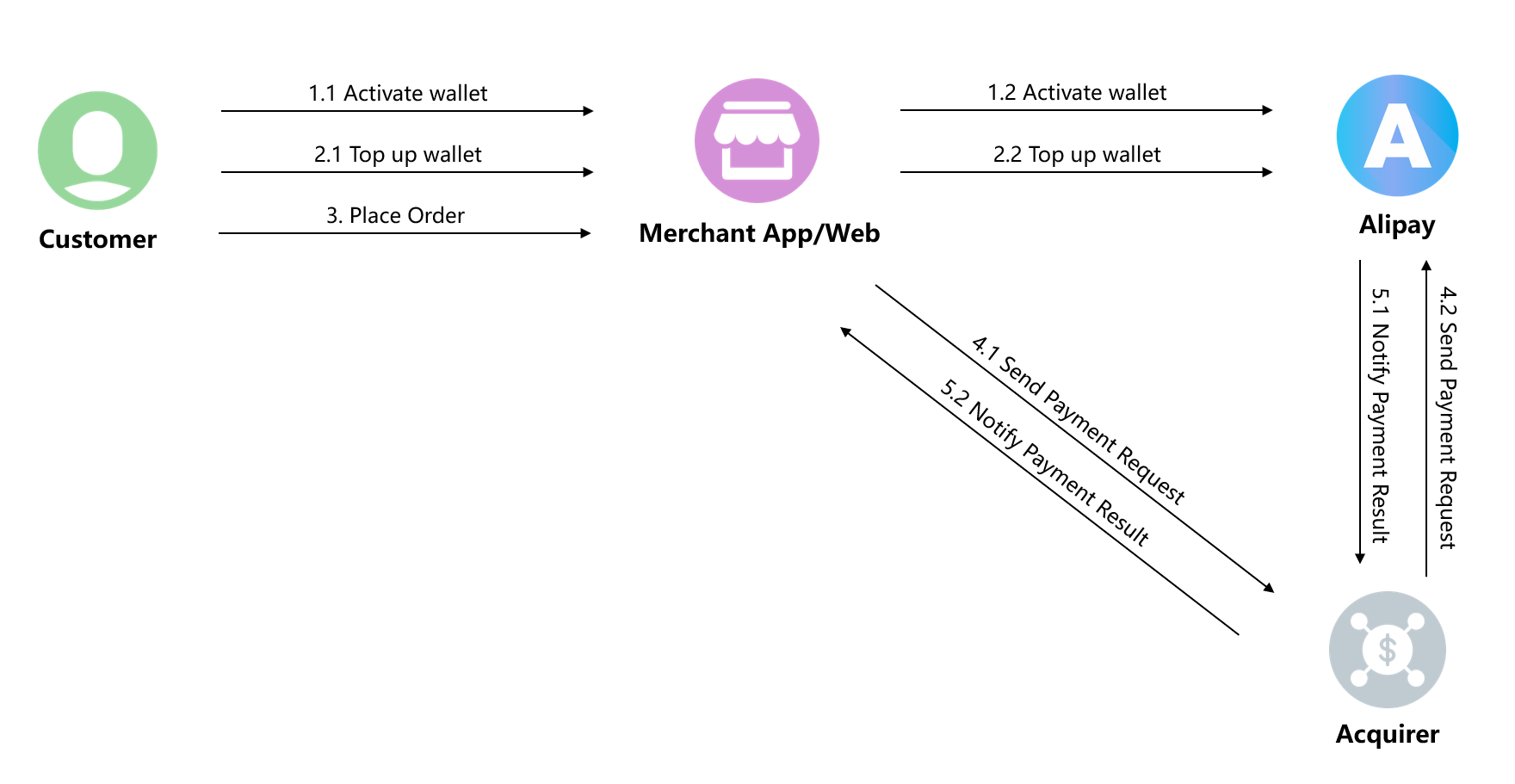

In a balance payment of Ant Group Digital Wallet Solution, the following roles are involved:

- Customer: An individual that uses the wallet service

- Merchant: A company or individual that trades on goods or services

- Ant Group: Ant Group that provides the digital wallet solution

- Acquirer: An institution that processes payments on behalf of merchants

Workflow of Ant Group Digital Wallet Solution

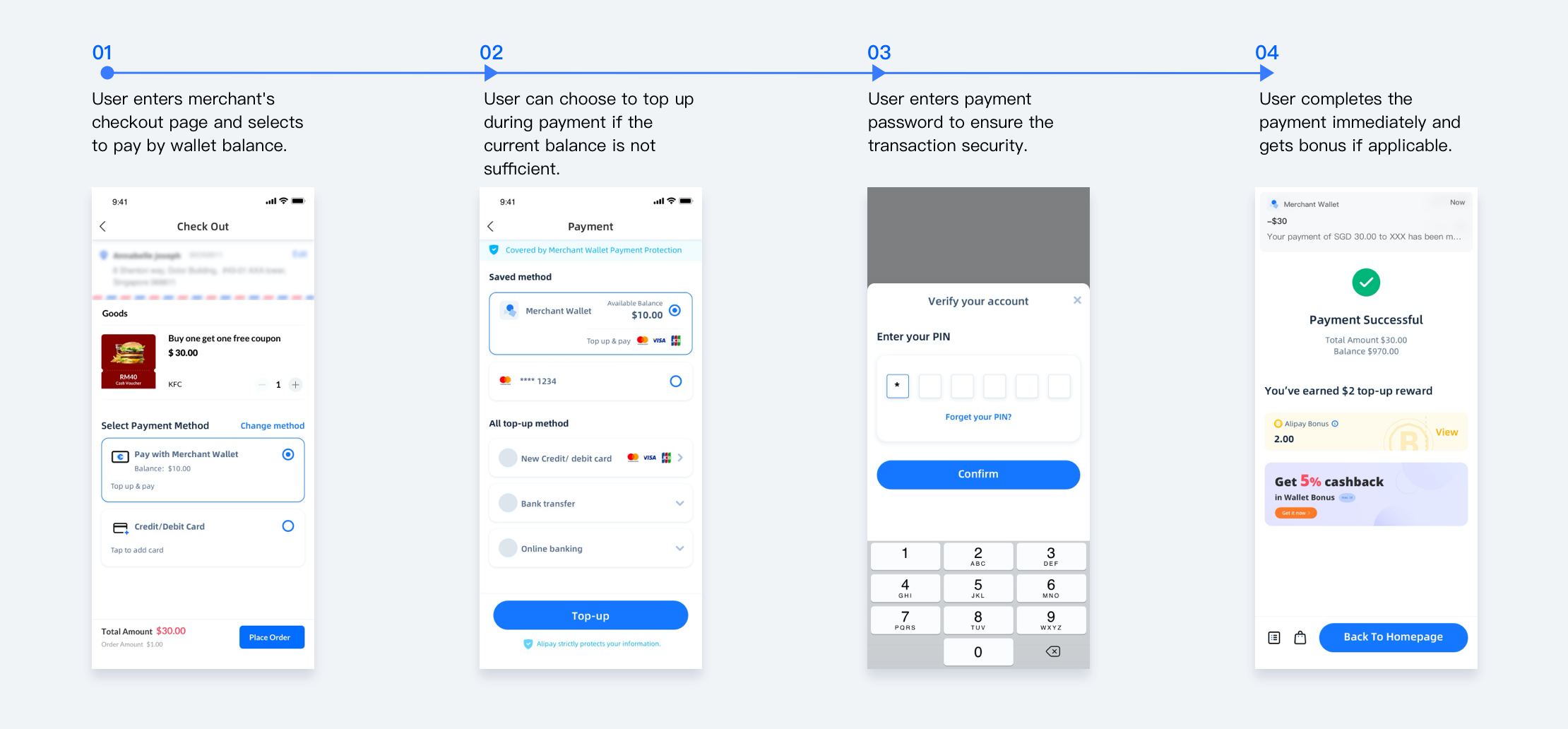

A balance payment contains the following steps:

- Open account

1.1 Customer activates wallet on merchant's app or website

1.2 Merchant activates user's wallet account in Ant Group - Top up wallet

2.1 User initiates a top-up to wallet balance on merchant's app or website

2.2 Merchant sends the top-up request to Ant Group - Place order

3.1 User places an order on merchant's app or website, and selects wallet balance as payment method - Pay with wallet balance

4.1 Merchant sends the payment request to acquirer

4.2 Acquirer sends the payment request to Ant Group - Notify payment result

5.1 Ant Group notifies payment result to acquirer

5.2 Acquirer notifies payment result to merchant

What are the key features?

Ant Group Digital Wallet Solution provides functions in the 5 areas:

- Member: To manage users' assets that can increase transaction processing efficiency; to collect users' identity information that can prevent AML and fund loss

- Security: To prevent fraud transactions, account stolen by providing PIN, OTP, device fingerprint and authentications

- Fund: To provide top up, transfer, withdraw, disbursements and refund to wallet functions

- Payment: To pay using wallet balance, bonus, pay later in online, offline, pre-authorization and recurring scenarios.

- Promotion: To issue bonus for merchants and manage promotion assets.

In these 5 areas, functions can be divided into Basic Package and Advanced Package.

- To support a basic wallet balance payment flow, a merchant will only need to integrate with Basic Package.

- To achieve more use cases, a merchant can select one or more functions in the Advanced Package.

For the detailed function lists of the basic and advanced packages, please refer to the tables below:

Basic Package

Basic Package consists of the most fundamental product features of a digital wallet, from account opening until balance payment:

Areas | Level 1 Function | Level 2 Function | Description |

Member | Account management | Open an account | Allows users to register for wallet and activate account balance using mobile number |

Check balance | Check wallet balance to display on wallet's homepage | ||

Check and update mobile number | Update mobile number | ||

Check and update email address | Update email address (if required) | ||

Delete account | Delete wallet account | ||

Security settings | Set PIN | Allows users to set PIN | |

Change PIN | Allows users to change PIN | ||

Reset PIN | Allows users to reset PIN | ||

Asset management | Bind a payment card | Allows users to add payment card assets | |

Check assets | Allows users to check payment card assets | ||

Unbind a payment card | Allows users to remove payment card assets | ||

Transaction Management | View transaction history | Allows users to view history and details of transactions | |

Security | Authentication | Verify OTP | To verify user's identity with OTP |

Verify PIN | To verify user's identity with PIN | ||

Fund | Top-up | Top-up with card | Allows users to use debit or credit card as a top-up channel to perform a top-up within Merchant site |

Payment | Online payment | Pay with balance | Allows users to pay from wallet balance |

Advanced Package

Advanced Package includes extra product features to be offered to your customers, from additional top-up channels, alternative security controls and authentication methods, more payment options as well as promotions to reward and retain your customers.

Areas | Level 1 Function | Level 2 Function | Description |

Member | Assets management | Bind, unbind and update a bank account or e-wallet | Allows users to manage inquire/add/remove bank account or e-wallet assets |

KYC | Verify identify | Allows users to verify identity by providing ID document and personal info as well as capture selfie photo | |

Security | Authentication | Biometric authentication | To verify user's authentic identity by biometrics such as fingerprint or biometric based on users device security setting |

Money Safety Guarantee | Money Safety Guarantee | Allow users to pay confidently with assurance of compensation for unauthorized transactions performed without unauthorized access | |

Fund | Top-up | [SG] Top-up with PayNow | Allows users to use PayNow as a top-up channel to perform a top up within Merchant site |

[MY] Top-up with online banking | Allows users to use online banking as a top-up channel to perform a top-up within merchant site | ||

Disbursement | Allows users to receive the funds from merchants bulk top up disbursements. Allows merchants to make batch top up request and disburse the funds to individual customers' wallet balance | ||

Refund | Refund to wallet | Allow users to refund to wallet balance | |

Transfer | Wallet to wallet transfer | Allow users to transfer funds to another wallet balance | |

Withdrawal | Withdrawal to bank account | Allow users to withdraw from their wallet balance to a bank account | |

Payment | Online payment | Pay with bonus | Allows users to pay using bonus for online purchase |

Pay with card | Allows users to pay using card for online purchase | ||

Direct debit | Direct debit with balance | Allows users to pay using balance for recurring purchase | |

Direct debit with card | Allows users to pay using card for recurring purchase | ||

Pre-authorization payment | Pre-authorize with balance | Allows users to pay from balance account for pre-authorization purchase | |

Pre-authorize with card | Allows users to pay from card for pre-authorization purchase | ||

Offline payment - C scan B | QR pay (C scan B) with balance | Allows users to pay from balance account for offline payment - C scan B | |

QR (C scan B) pay with bonus | Allows users to pay using bonus for offline payment - C scan B | ||

Offline payment - B scan C | QR pay (B scan C) with balance | Allows users to pay from balance account for Offline Payment-B scan C purchase | |

QR (B scan C) pay with bonus | Allows users to pay using bonus for Offline Payment-B scan C purchase | ||

Promotion | Promotion asset issuance | Issue bonus | Allow merchants to issue bonus to user's bonus account |

Issue bonus for channel promotion | Allow merchants to issue bonus to users when users top up using a certain payment channel |