Rapid dispute resolution (RDR)

When cardholders dispute a transaction, the issuing bank may initiate a chargeback. To help merchants mitigate Visa compliance risks and control chargeback rates, Antom integrates Rapid dispute resolution (RDR)—a solution provided by Verifi (a Visa subsidiary).

RDR automatically verifies and processes eligible refunds based on pre-configured merchant rules (e.g., refund thresholds) before chargebacks are officially recorded, thereby reducing chargeback rates, optimizing operational costs, and protecting brand reputation. Verifi pre-configures these rule sets during system onboarding.

Key features

- Expedited refund experience: RDR enables buyers to receive refunds within days, enhancing satisfaction by eliminating months-long traditional resolution cycles.

- Chargeback rate control: RDR can reduce chargeback rates and safeguard account operational stability.

- Automated chargeback processing: RDR can automate the handling of chargeback cases, significantly reducing the operational resources required.

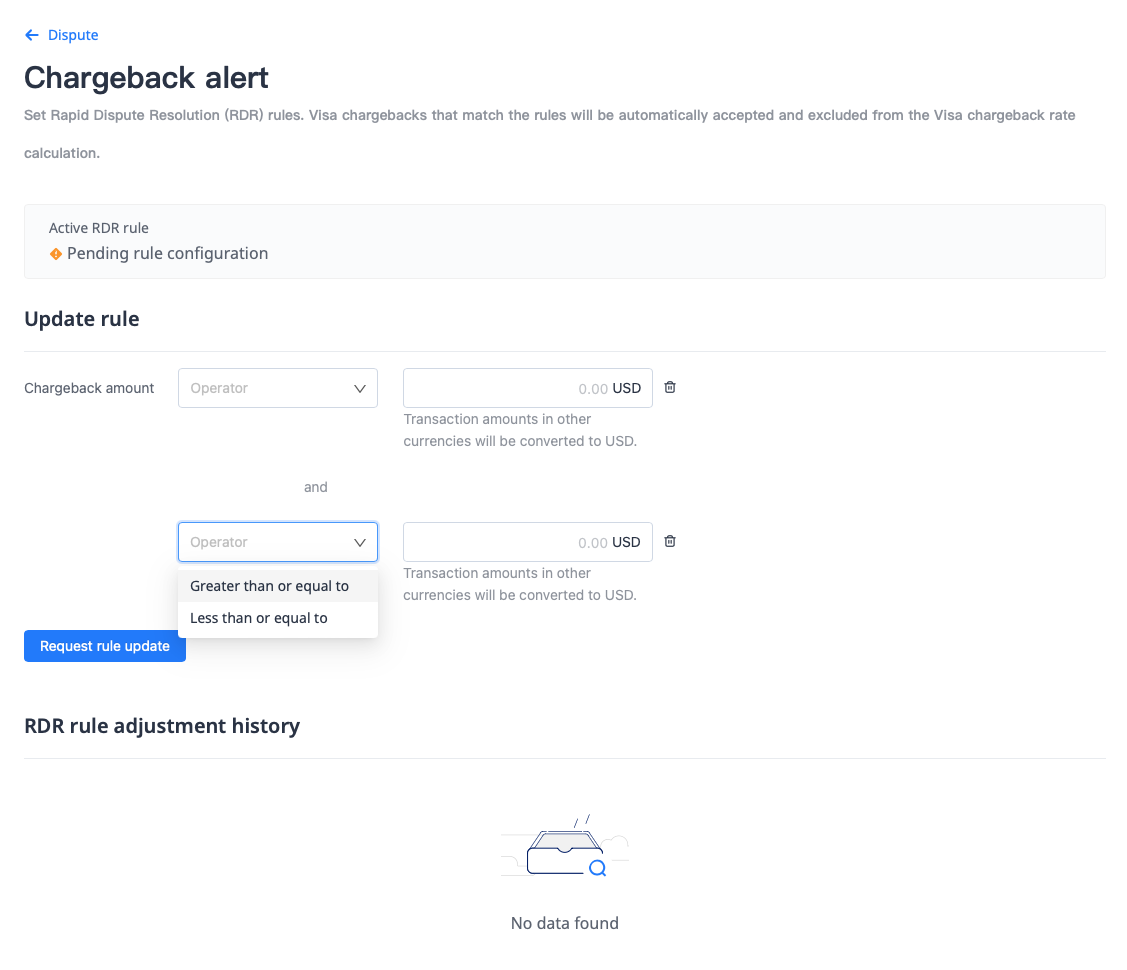

- Agile rule configuration: No additional integration is required to use RDR. Antom Dashboard allows for flexible definition and configuration of refund rules, as shown in the following image.

Figure 1: RDR rule configuration

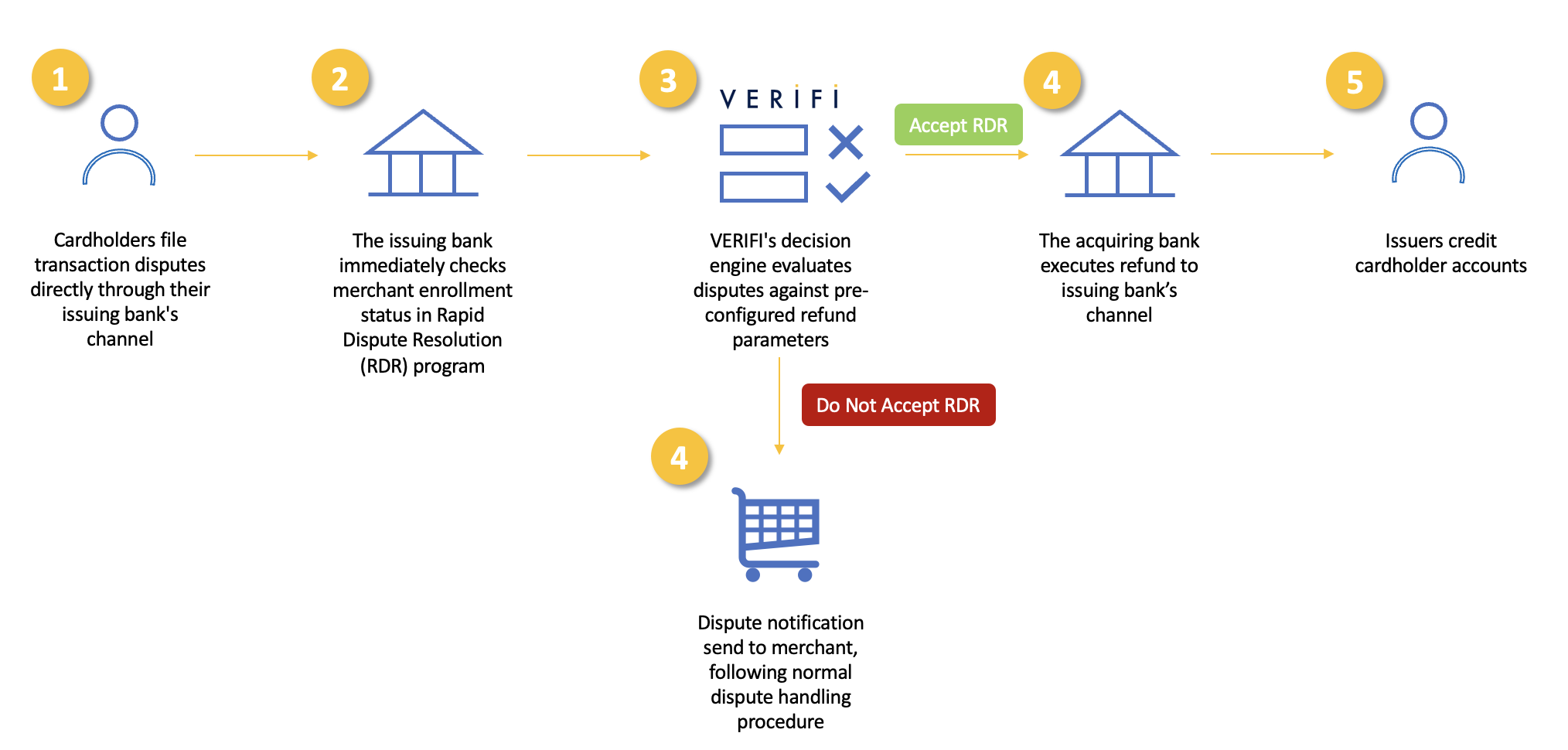

RDR operation workflow

When a buyer initiates a chargeback, RDR follows this process:

- Dispute Initiation: Buyer submits a chargeback request to the issuing bank.

- Merchant Verification: Issuing bank confirms merchant’s RDR enrollment status.

- System Assessment: RDR automatically evaluates eligibility based on preset rules.

- Eligible: Triggers automated refund processing.

- Ineligible: Routes to standard dispute resolution.

- Fund Settlement: Acquiring bank refunds the issuing bank, with funds returned to the buyer.

- Case Closure: Resolved disputes are excluded from chargeback rate metrics.

Figure 2: RDR Workflow

Get expert support

For complete product specifications and functional details, please contact: Chargeback_Support@service.alipay.com