How the dispute works

Dispute is divided into three stages: retrieval request, refund escalation, and chargeback, which may vary depending on the different payment support.

- Retrieval request: A dispute can begin with a retrieval request, which occurs when the payer requests for transaction-related information from the merchant.

- Refund escalation: An escalation can be initiated by an issuer when a payer wishes to dispute a payment and get a refund.

- Chargeback: A chargeback occurs when a payer disputes a payment and contacts the issuer to initiate a chargeback. The payer can file a chargeback for various reasons. including suspected fraud, being charged more than they expected, and not receiving the product or service. A chargeback will lead to a payment reversal.

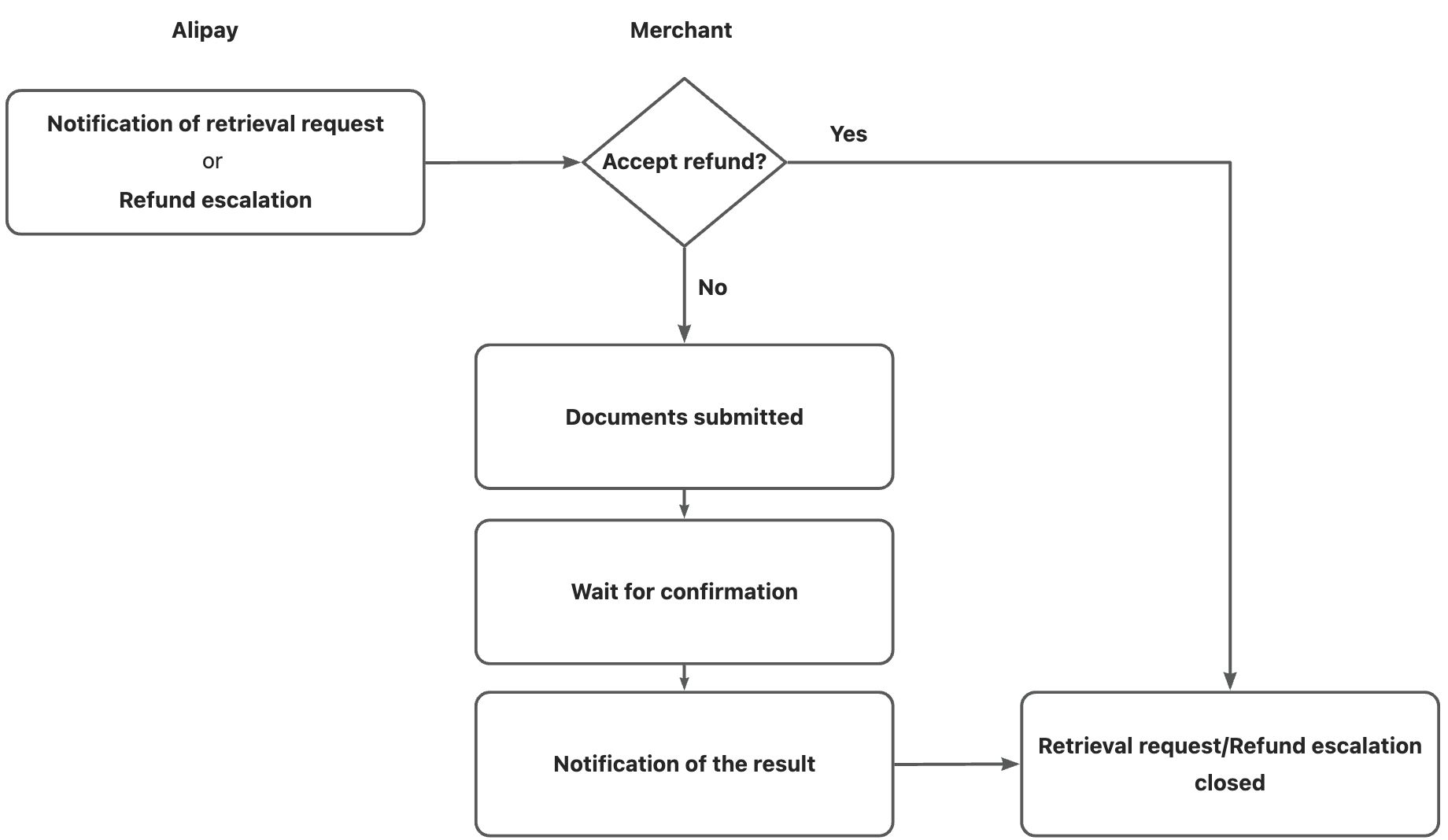

Retrieval request/refund escalation workflow

The retrieval request and refund escalation flows are shown in the following graphic:

Figure 1: Flow chart of a retrieval request and refund escalation

Chargeback workflow

The general chargeback process is shown in the following graphic:

Figure 2: Flow chart of Chargeback

Note: This process varies by the regulatory requirement of different regions and card schemes, and is subject to alignment between you and Alipay. For more information, contact BD.

The process composed of three stages:

- Notification of Chargeback (NoC) - The cardholder’s bank (the issuer) creates a formal chargeback and assigns it a chargeback code, which describes why the cardholder wants a refund. Before you can receive an NoC, you must configure a notification address as instructed in Configure an address for receiving an NoC.

Once a chargeback is issued, the disputed amount, and a separate dispute fee (if applicable), will be deducted from your account.

- Challenge or accept the chargeback - you need to decide how you want to respond to the chargeback.

- Accept. If you agree with the chargeback and the specific reason given, you can accept the chargeback.

- Challenge. If you want to defend against the chargeback, you will need to submit evidence within the required time frame.

- Ignore. If you ignore the chargeback, it will expire after a certain amount of time and you will no longer be able to respond to it. The result is usually the same as that of accepting the chargeback.

- Await the outcome - Once you submit evidence, the issuer or card scheme will review it and decide whether to accept or decline liability for the disputed amount.

- Chargeback won. If the issuer is satisfied with the evidence that you provide, the chargeback is won in your favor. Once the won results come out, the disputed amount will be transferred back to your account.

- Chargeback lost. If the issuer is not satisfied with the evidence that you provide, the chargeback is won in the cardholder’s favor.