Bank related payments

The bank SDK enables you to display bank-related payment methods in various categories and facilitate redirection to the payment method app or webpage to deliver an optimal user experience.

This article guides you on how to integrate the bank SDK.

The bank SDK provides the following features:

- Display a list of bank-related payment methods categorized by payment method, payment method type, and payment method country.

- Manage the redirection process between a merchant client and a payment method client.

- Intelligently determine the redirection policies based on the payment method capabilities and whether the buyer has installed the payment method app.

- Support multiple languages on a merchant page: English, Indonesian, and Thai are supported.

Integration

The integration process of the bank SDK is shown as follows:

Figure 1. The integration process of the bank SDK

Prerequisites

Before integrating the SDK, familiarize yourself with the Integration guide and API Overview. This will enable you to understand the steps for integrating server APIs and notes for calling the APIs. Also, ensure that you have completed the following tasks:

- Obtain a client ID in Antom Dashboard.

- Properly configure keys in Antom Dashboard.

- Configure a URL for receiving an asynchronous notification of a payment result. For details, see Notifications.

Integration steps

When implementing a bank SDK integration, two parties are involved:

- Server-side: Your sever sends a single API call that creates payment sessions, and obtain the payment result.

- Client-side: Your client displays payment methods and imports the SDK package.

Follow these steps to complete the integration:

- Create an SDK instance:

After your client creates the payment method page and implements the monitoring of the payment button click event, run theAMSCashierPaymentmethod to create the SDK instance. - Call the createPaymentSession API:

After a buyer selects a payment method for payment, your server uses the buyer's order information to send a createPaymentSession request to the Alipay server. - Call the SDK:

Run thecreateComponentmethod by using the response parameter paymentSessionData of the createPaymentSession API to call the SDK. - The buyer completes the payment:

The buyer completes the payment on the corresponding payment method page. - Obtain and display the payment result:

Your server obtains the payment result by receiving asynchronous notifications via notifyPayment or calling the inquiryPayment API. You must display the payment result on your payment result page.

For more detailed information about bank SDK integration on Web/WAP, Android, or iOS clients, learn the following topics:

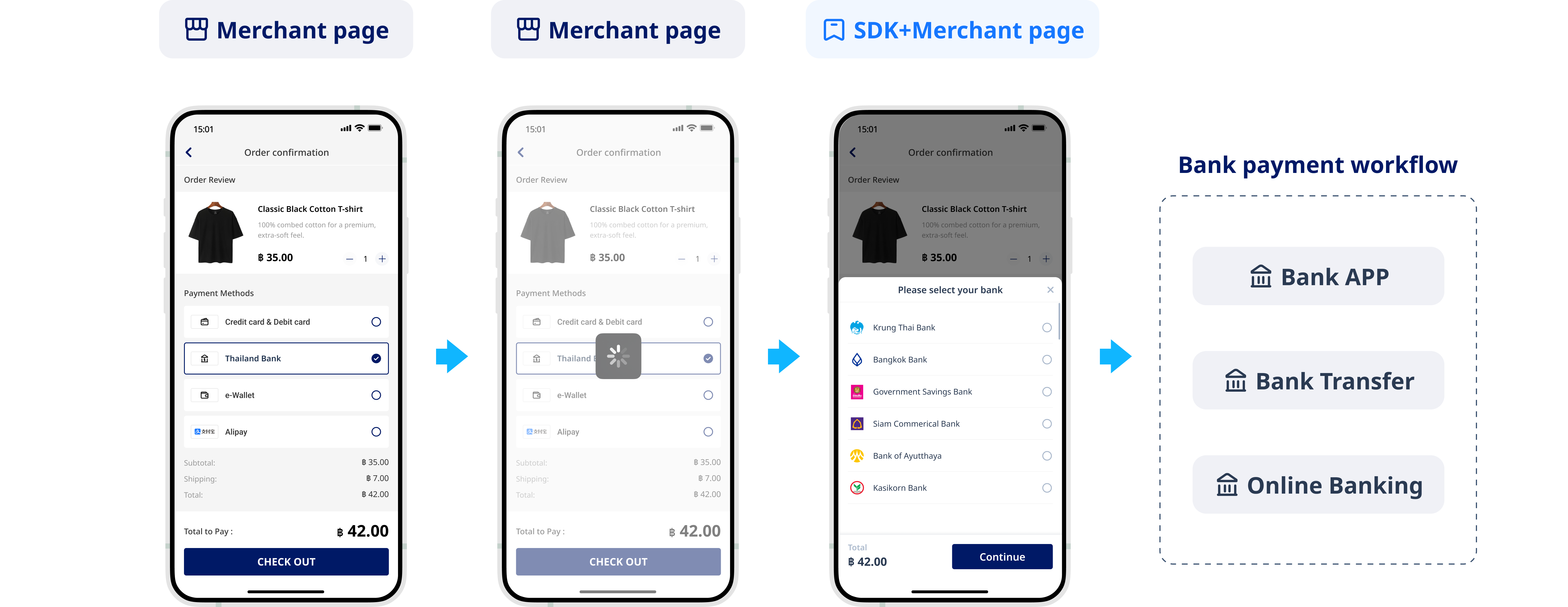

User experience

In each mode, when the buyer proceeds to the bank payment workflow, the bank SDK intelligently redirects the buyer to either the bank app, online banking page, or bank transfer page to complete the payment based on the relevant redirection rules.

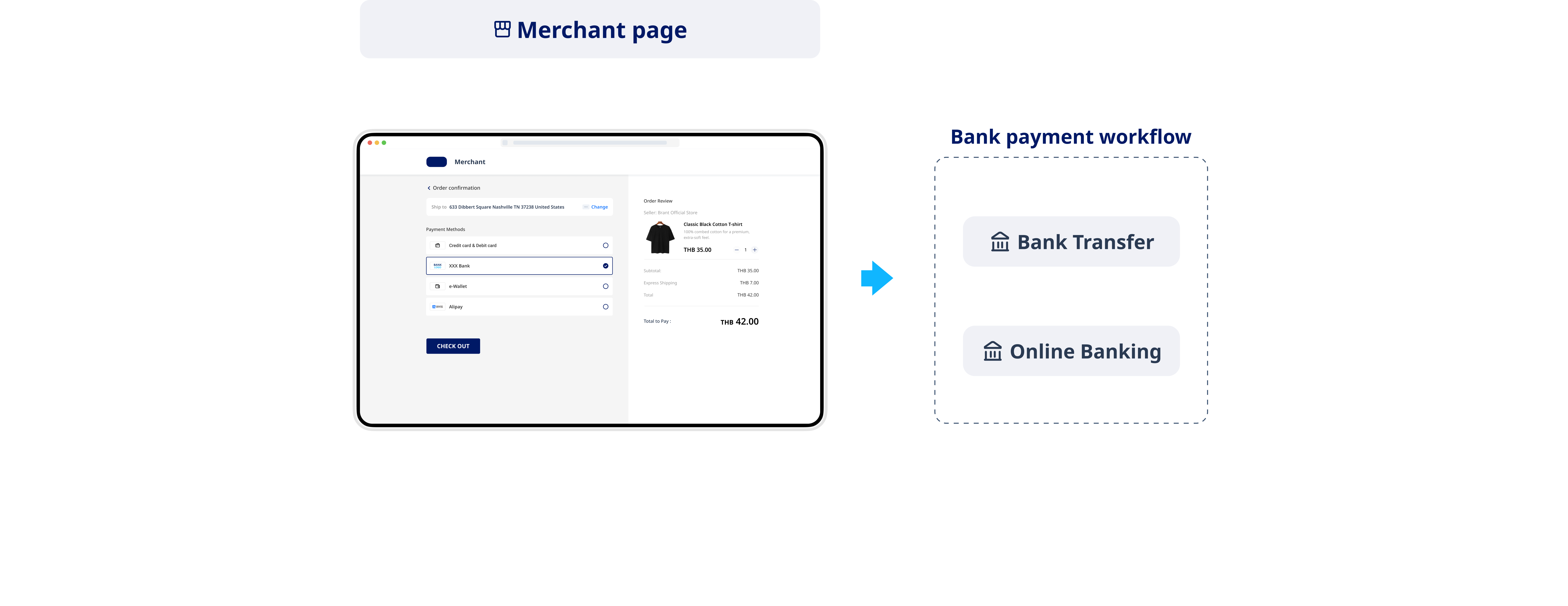

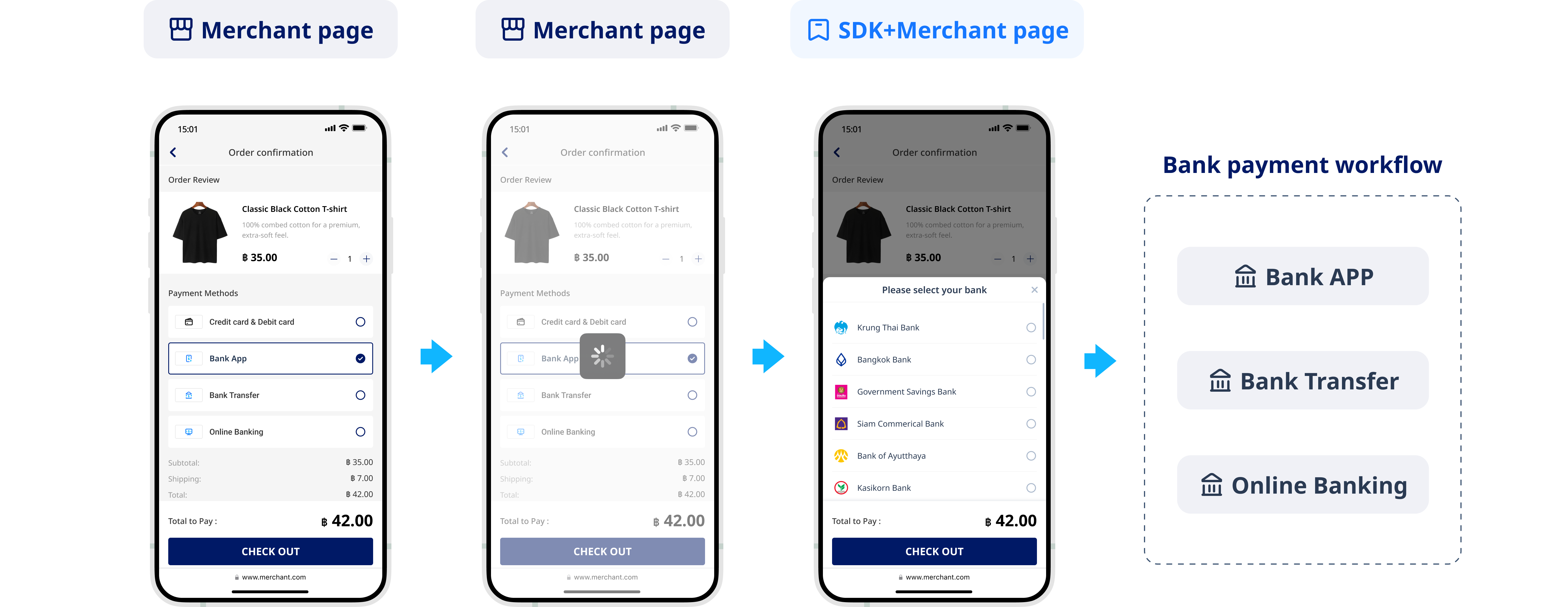

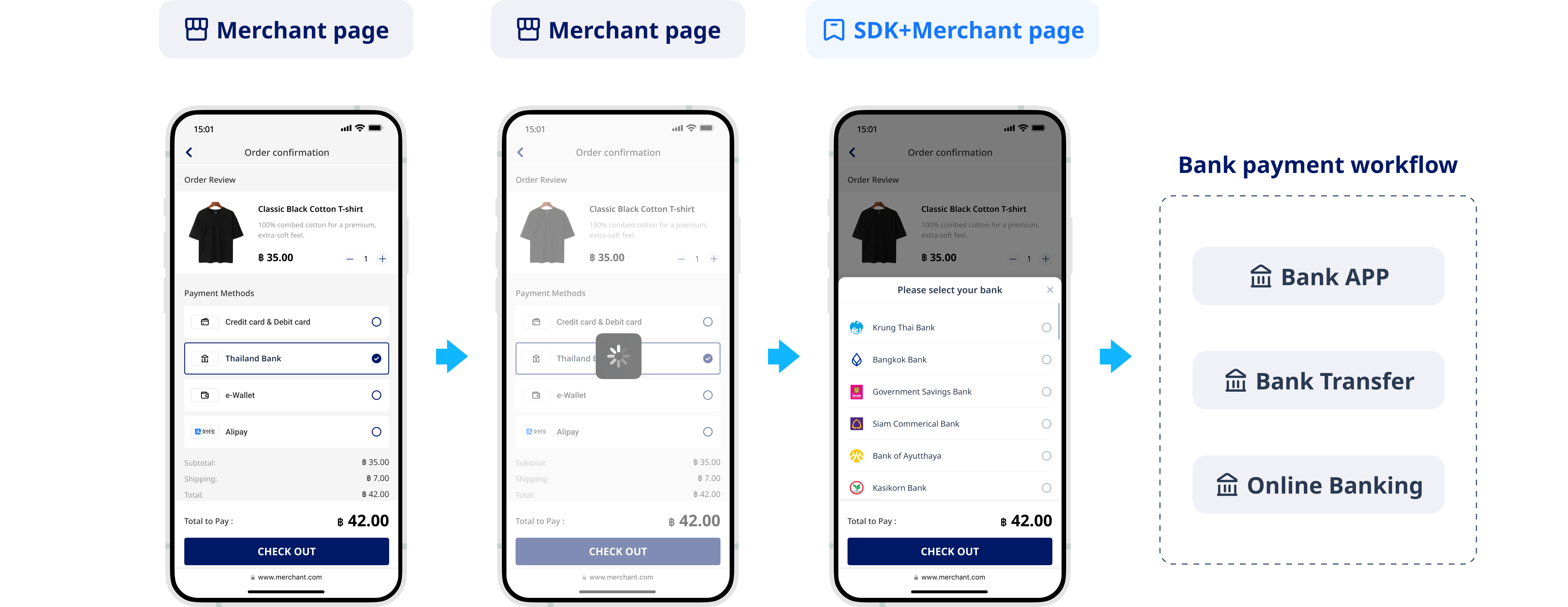

Single bank mode

In this mode, the bank-related payment methods are displayed by bank:

Figure 1. The bank-related payment methods are displayed by bank

After the buyer selects the payment bank, the page redirects to the Bank payment workflow to complete the payment.

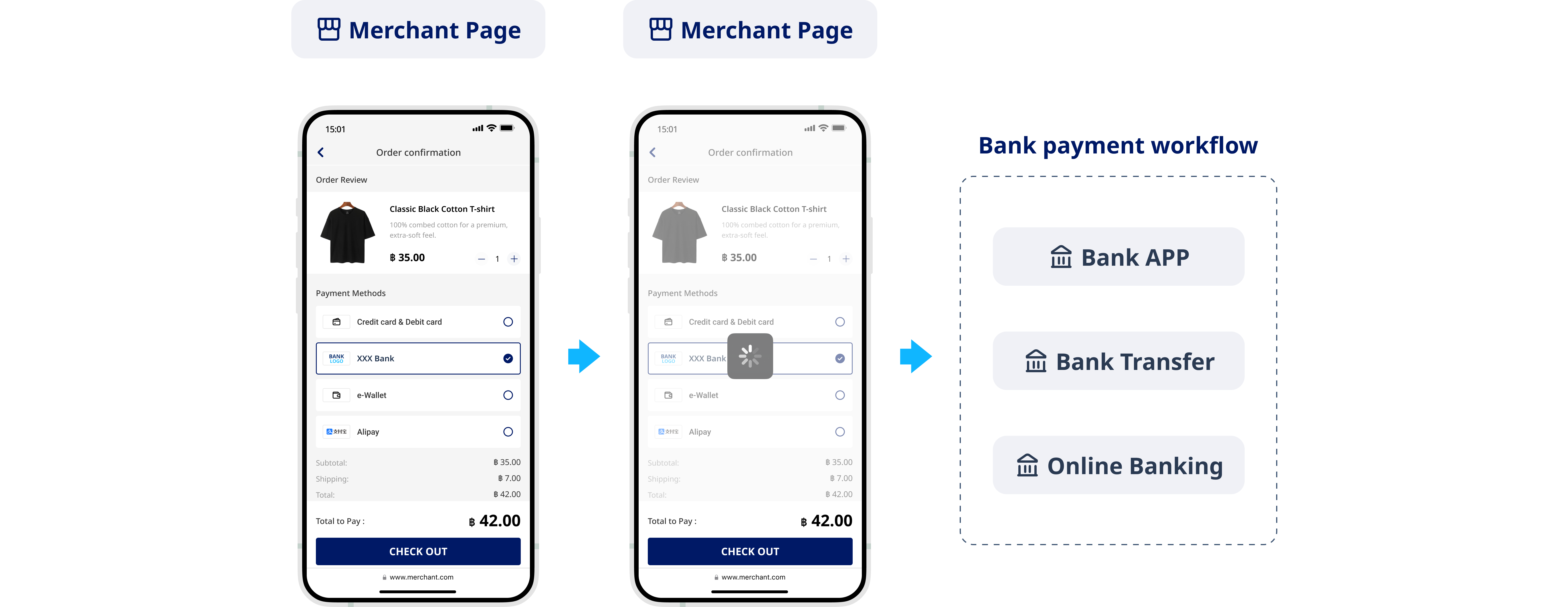

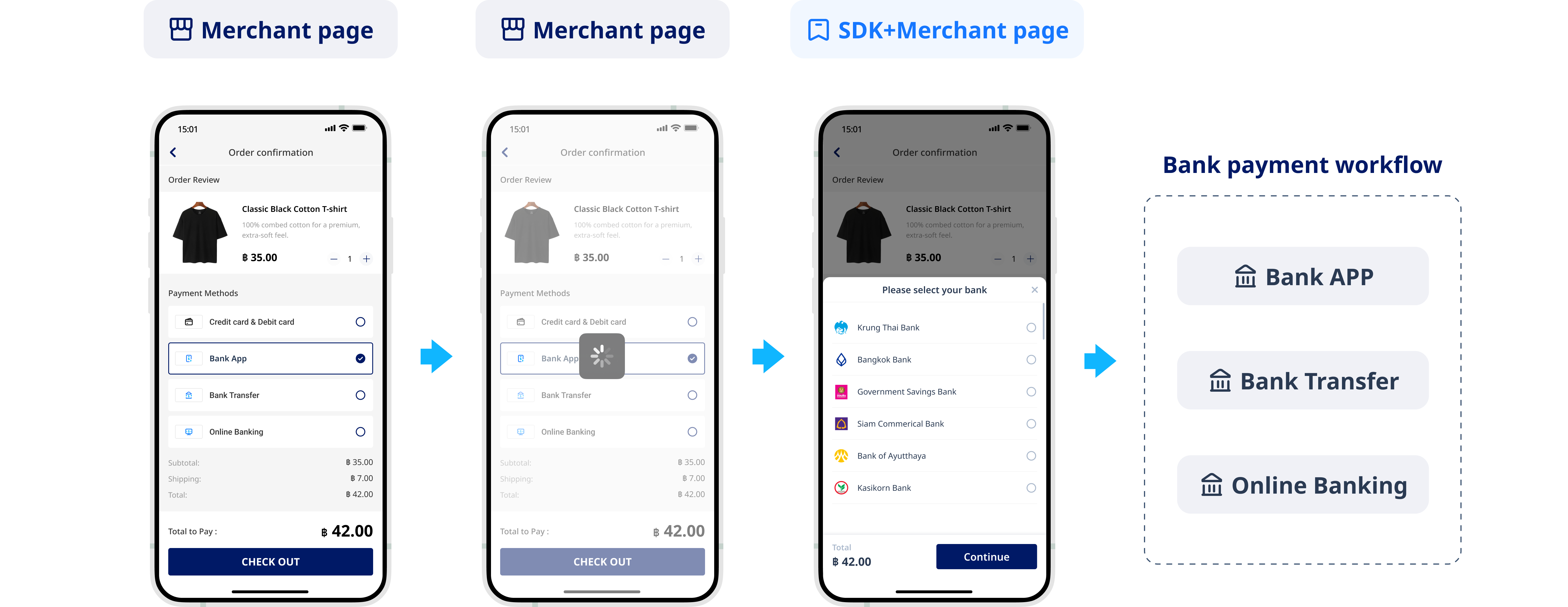

Bank type mode

In this mode, the bank-related payment methods are displayed by bank type:

Figure 2. The bank-related payment methods are displayed by bank type

After the buyer selects the payment bank, the page redirects to the Bank payment workflow to complete the payment.

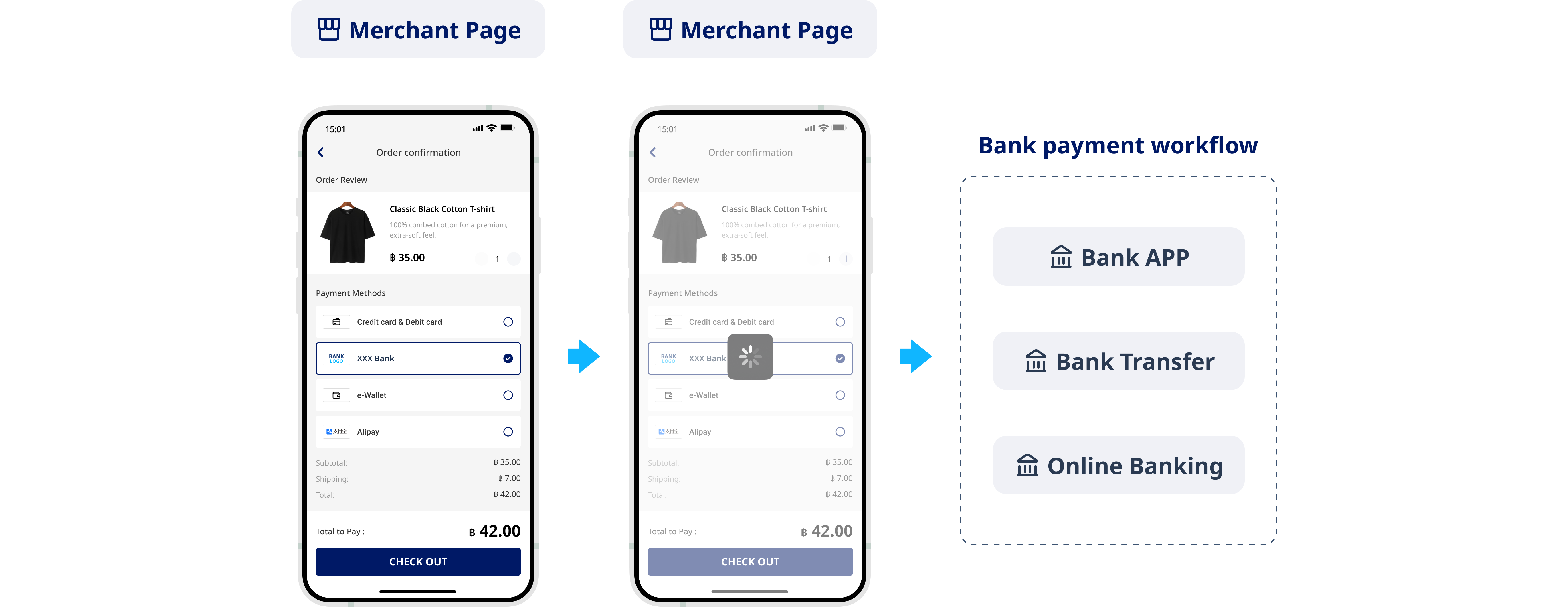

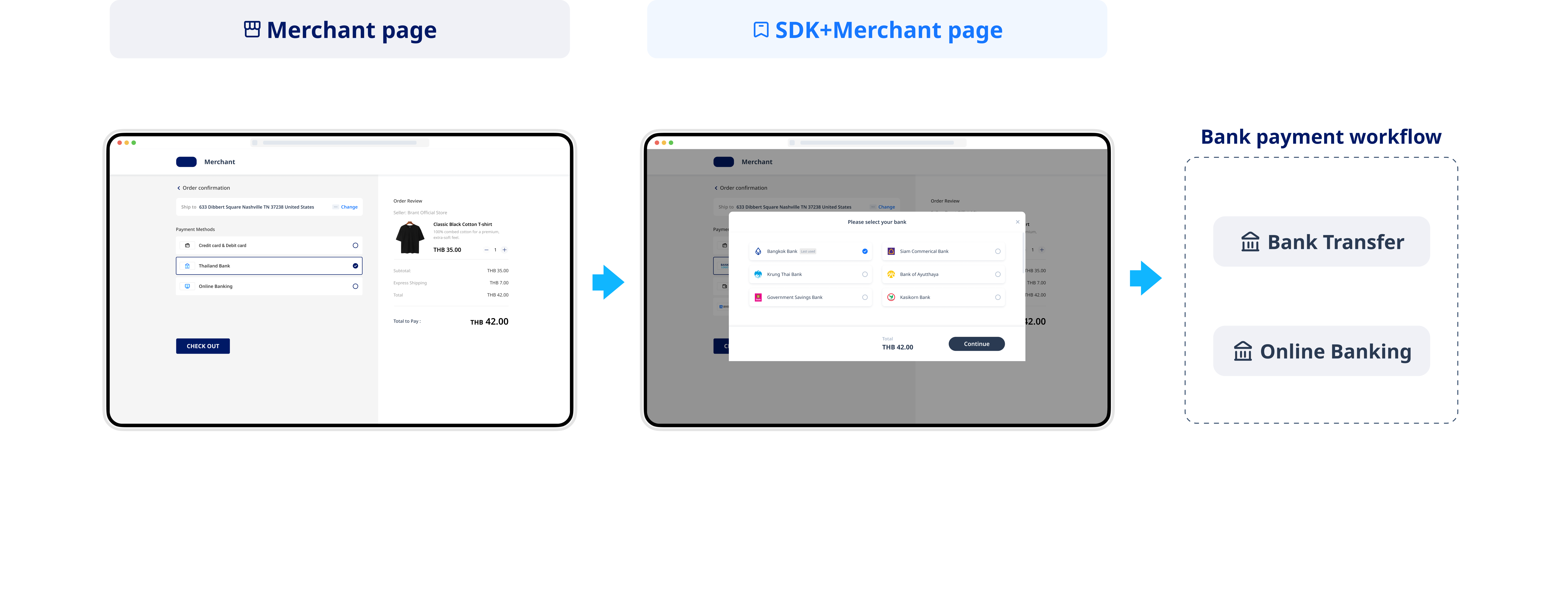

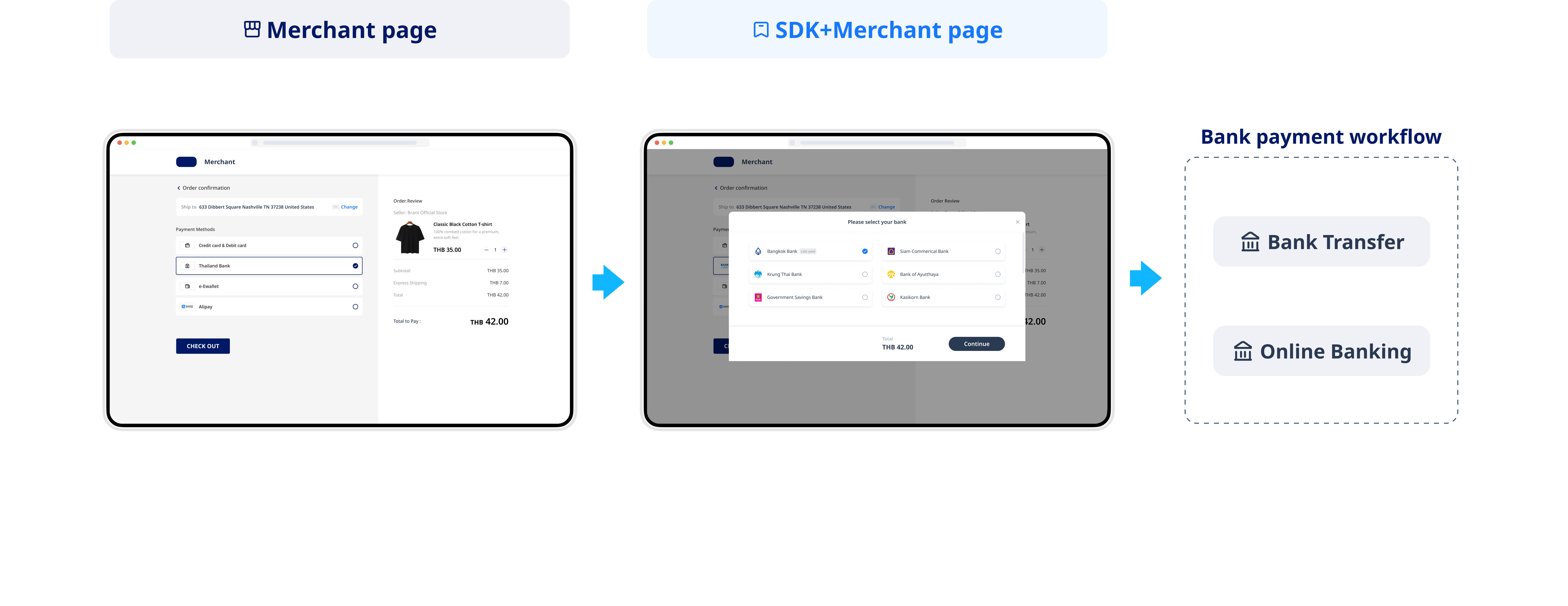

Bank country mode

In this mode, the bank-related payment methods are displayed by bank country:

Figure 3. The bank-related payment methods are displayed by bank country

After the buyer selects the payment bank, the page redirects to the Bank payment workflow to complete the payment.

Bank payment workflow

The bank SDK intelligently determines to complete the payment through one of the following three payment methods based on the payment method capability and the buyer's payment app installation status:

- Bank app payment

- Online banking payment

- Bank transfer payment

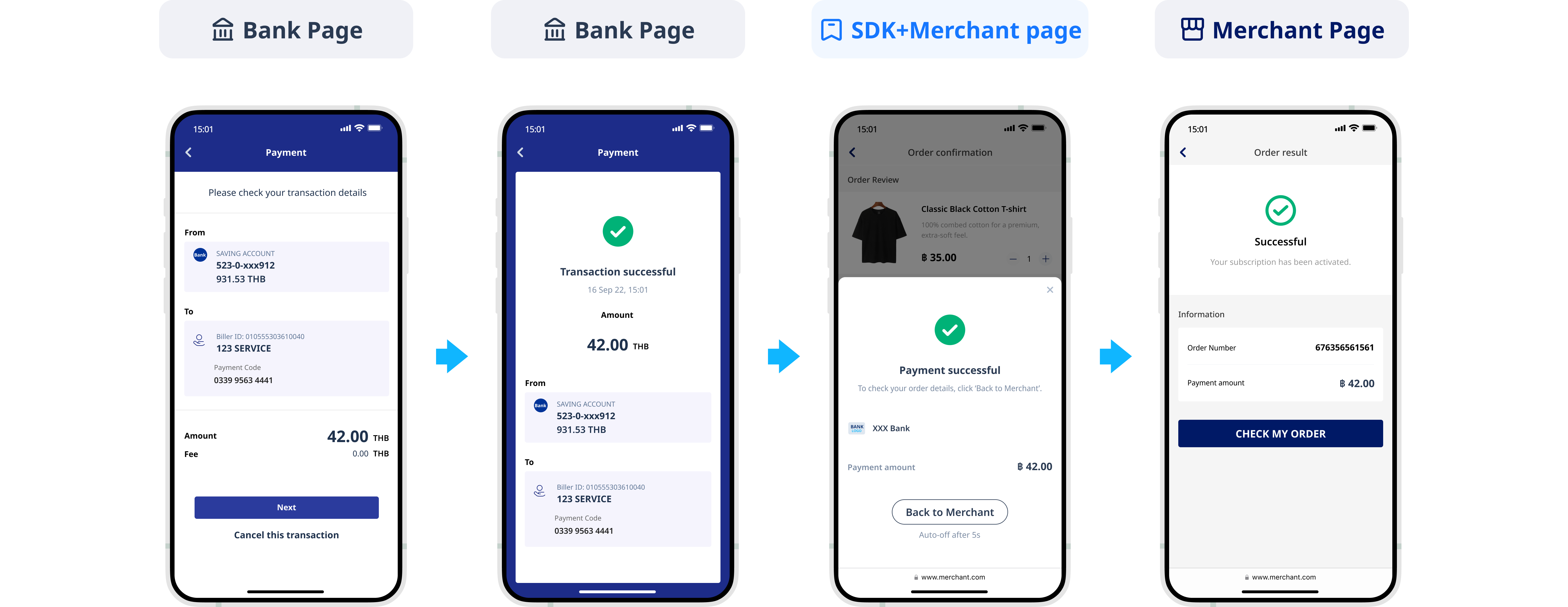

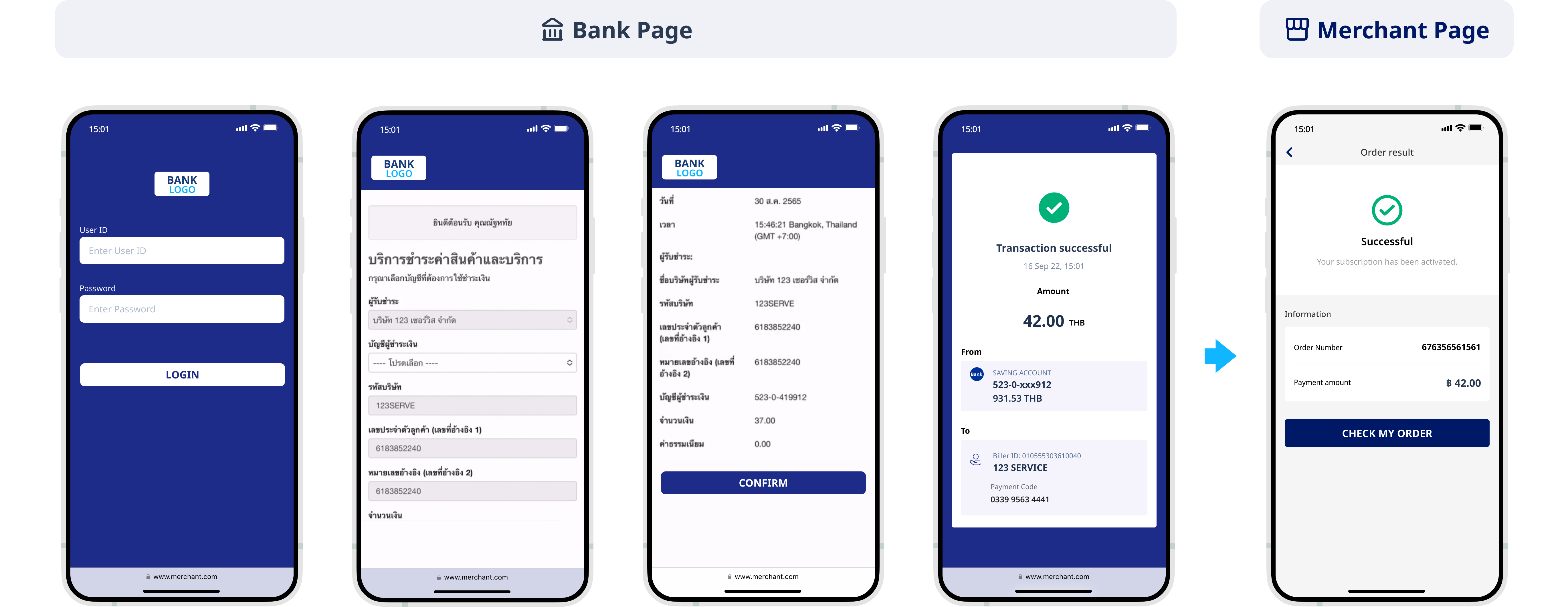

Bank app payment:If a certain bank-related payment method app is available and the buyer has installed it, the buyer will be redirected to the payment method app.

Figure 4. Bank payment workflow with app

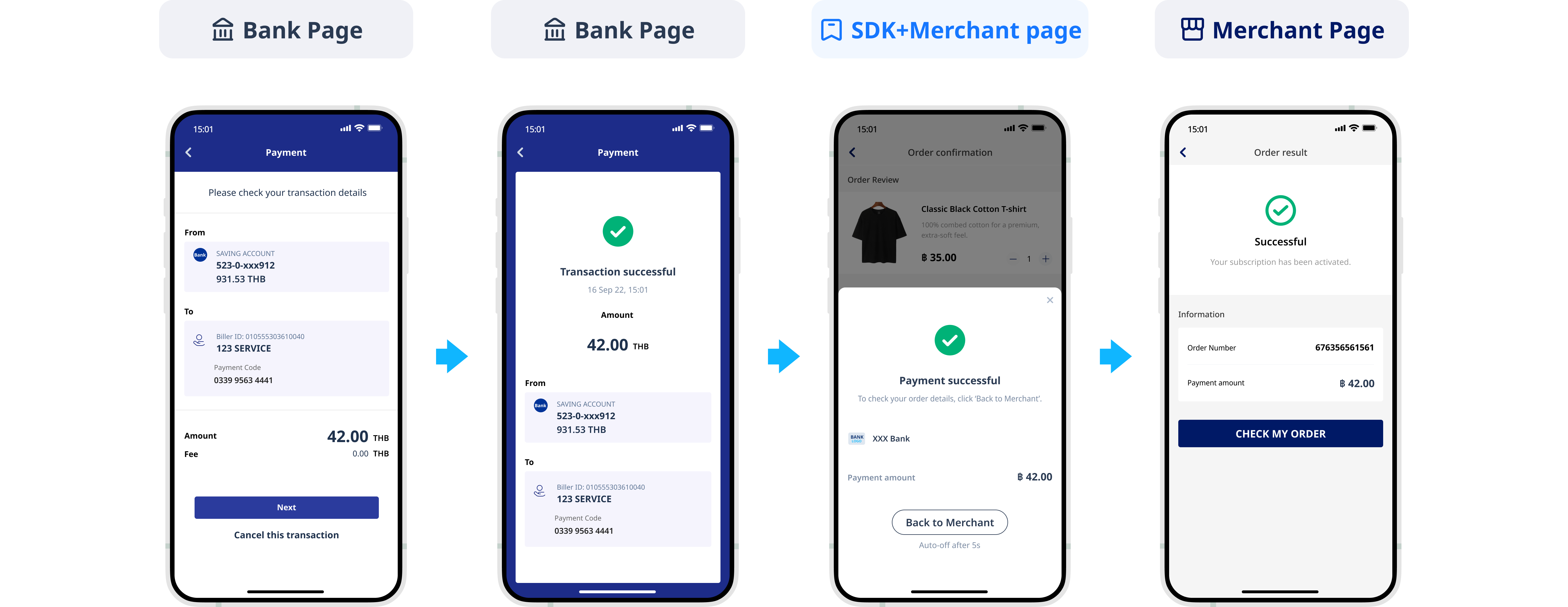

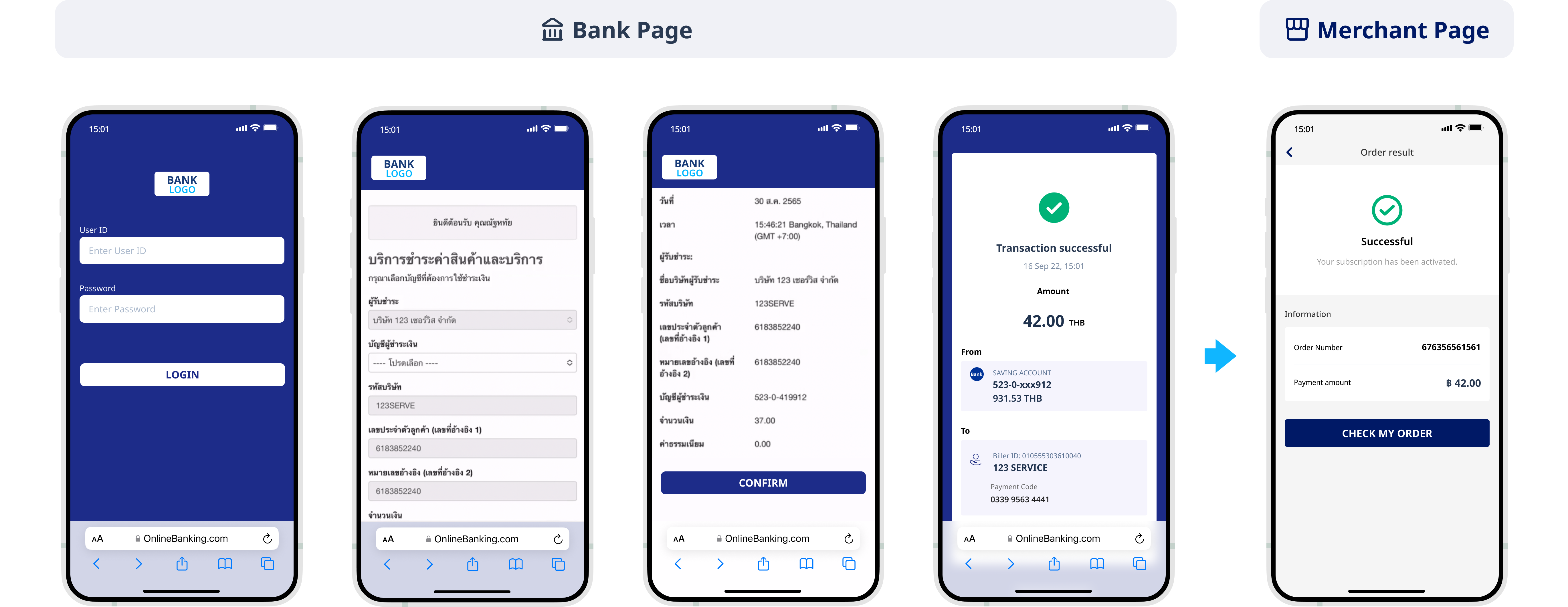

Online banking payment:If a certain bank-related payment method app is available but the buyer has not installed it, the buyer will directly access the online banking page of the payment method.

Figure 5. Bank payment workflow with online banking

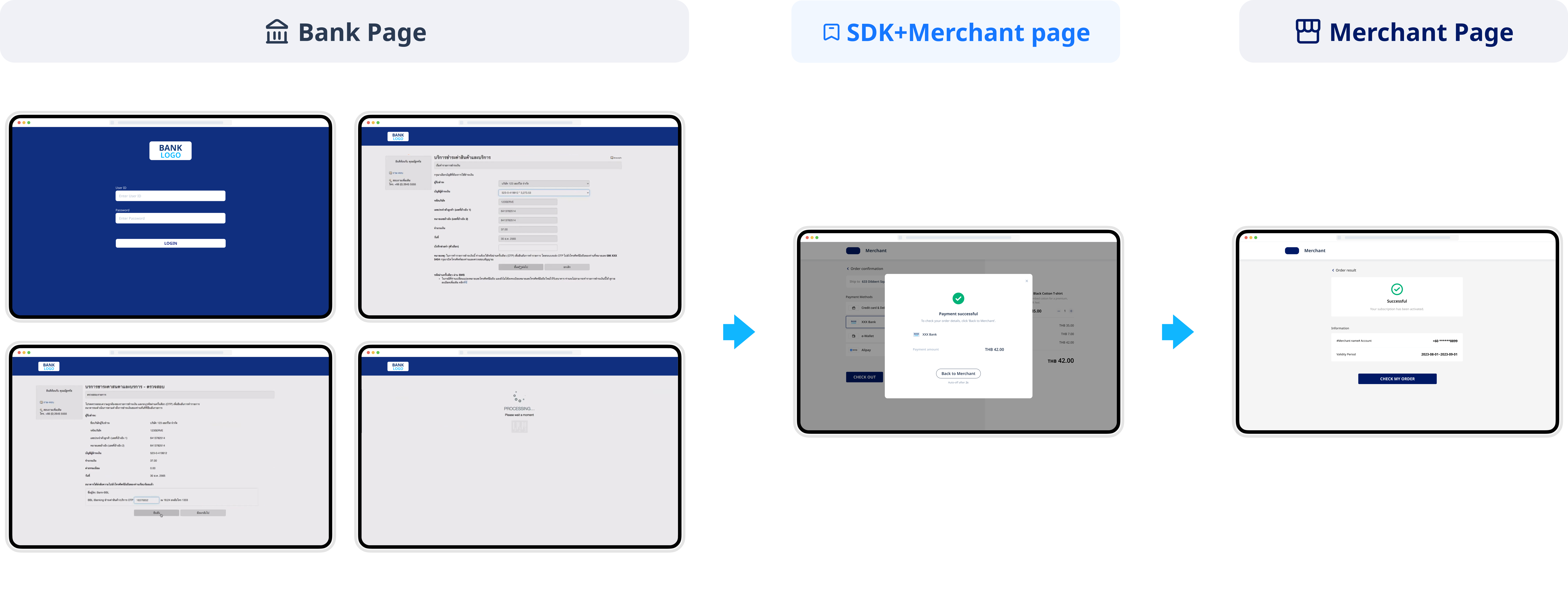

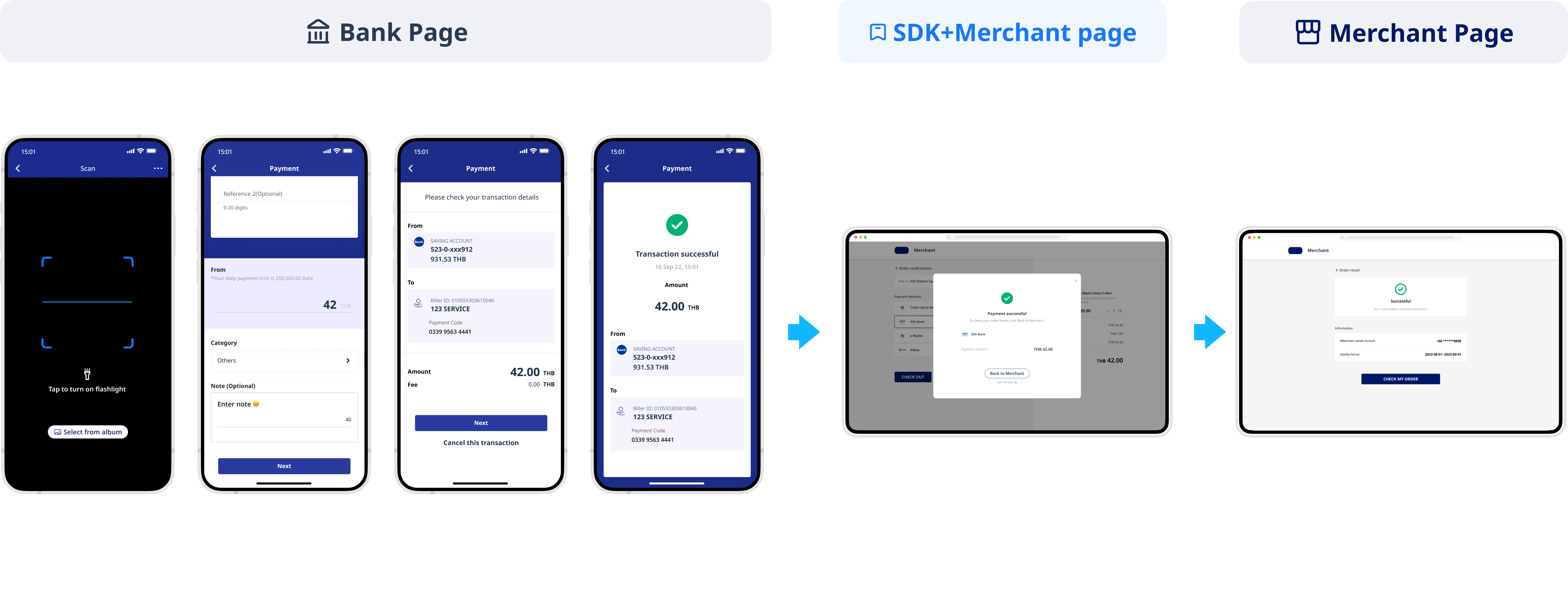

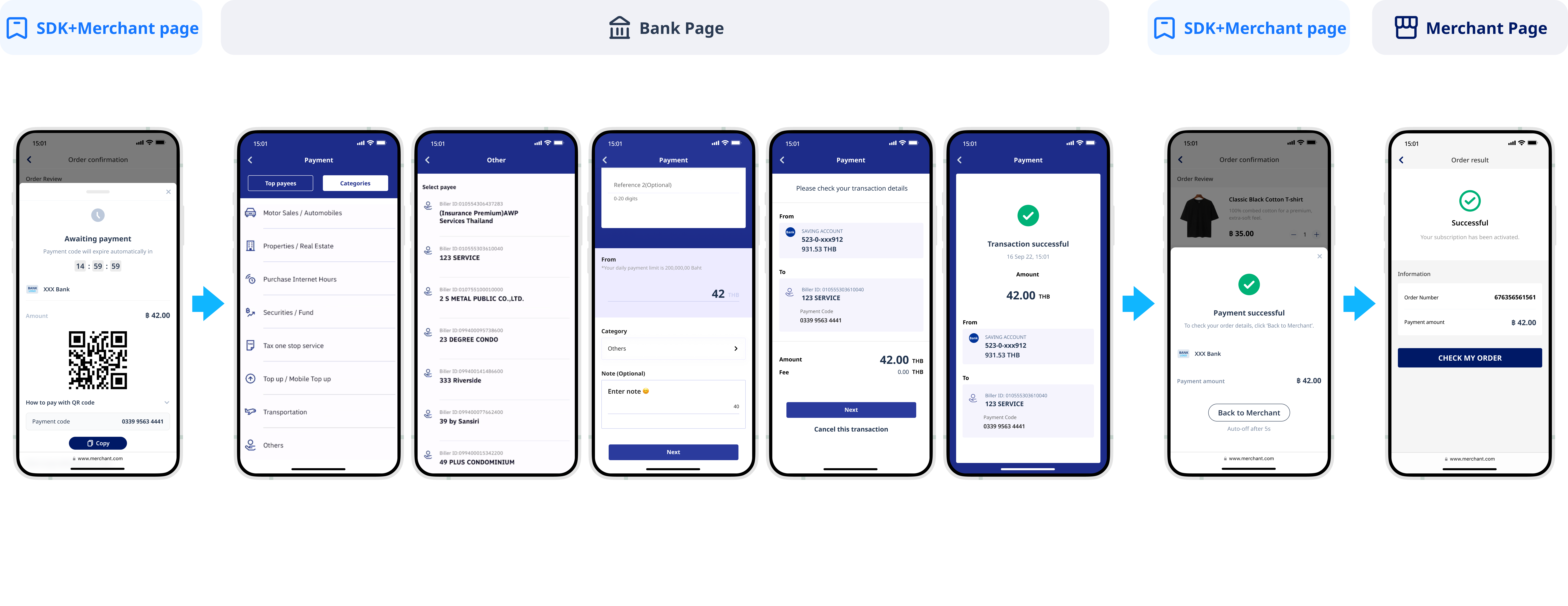

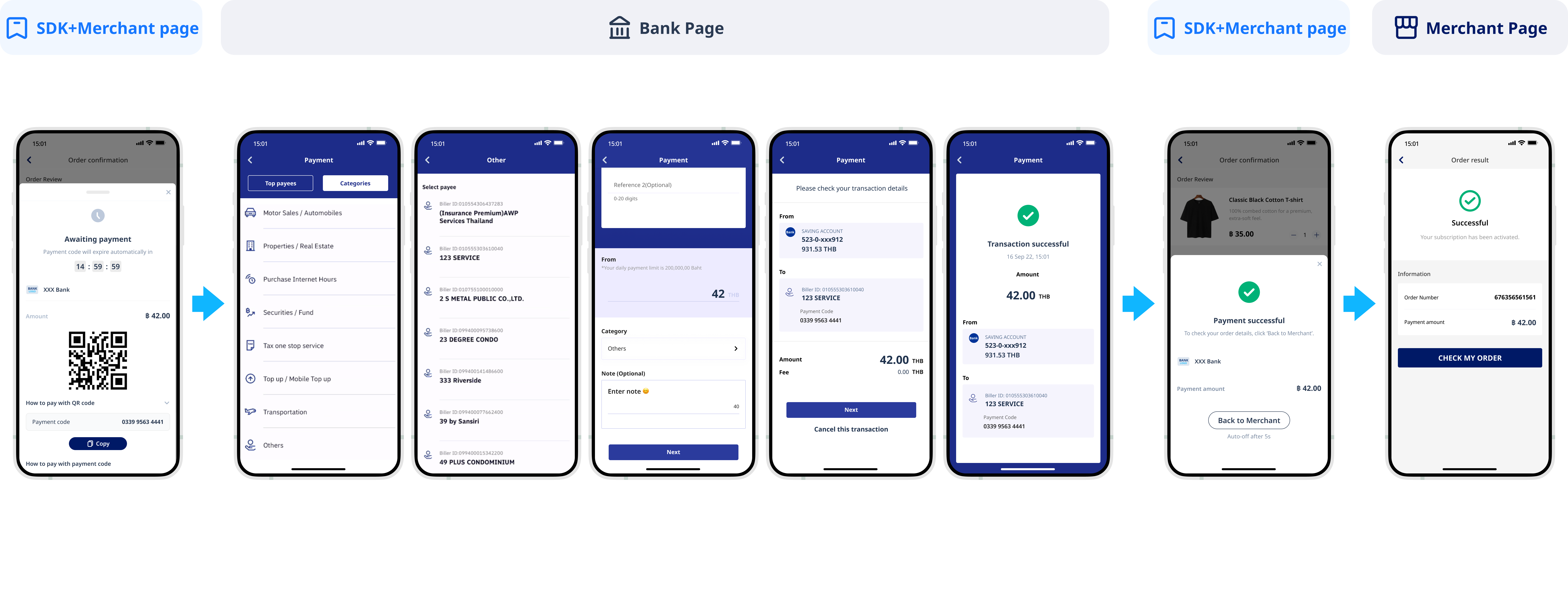

Bank transfer payment:If a certain bank-related payment method does not support redirection to the payment method app, the buyer will directly access the bank transfer page of the payment method.

Figure 6. Bank payment workflow with bank transfer

Supported payment methods

The bank SDK supports the following payment methods, whose capabilities are shown as follows:

| Consumer country/region | Payment method |

| Indonesia | Indonesia ATM |

| Indonesia | BNI |

| Indonesia | BRANKAS |

| Indonesia | BSI |

| Indonesia | CIMB Niaga |

| Indonesia | OCTO Clicks |

| Indonesia | Mandiri |

| Indonesia | Maybank |

| Indonesia | Permata |

| Indonesia | Qris |

| Thailand | Bangkok Bank |

| Thailand | Bank of Ayudhya |

| Thailand | Government Savings Bank |

| Thailand | Kasikorn Bank |

| Thailand | KrungThai Bank |

| Thailand | PromptPay |

| Thailand | Siam Commerical Bank |