Overview

Scan to Link enables buyers to conveniently authorize payments on devices such as PCs, game consoles, and smart TVs by scanning the authorization code with their mobile phones. After authorization, subsequent payments can be completed with just one click. Buyers can directly scan the QR code on your page to authorize payments, eliminating the need to be redirected to the payment method page, thereby increasing payment success rates.

Key features

Scan to Link boasts the following product highlights:

- Minimalist payment experience: Enhance payment conversion rates by enabling one-click subsequent payments for buyers through successful payment authorization on their mobile phones.

- Local payment methods: Provide local buyers with trusted and familiar payment methods to maximize authorization success rates.

- Light-weight Integration: Integrate only once to enjoy the latest payment methods and payment experiences without incurring additional development costs, enabling you to rapidly expand into new markets.

User experience

Buyers authorize payments by scanning the authorization code on their mobile phones. For subsequent payments, buyers only need to click once on your client to complete the payment.

Scenario 1: First-time payment

Buyers scan the code to authorize payments, thus enabling subsequent payments without verification for this payment method.

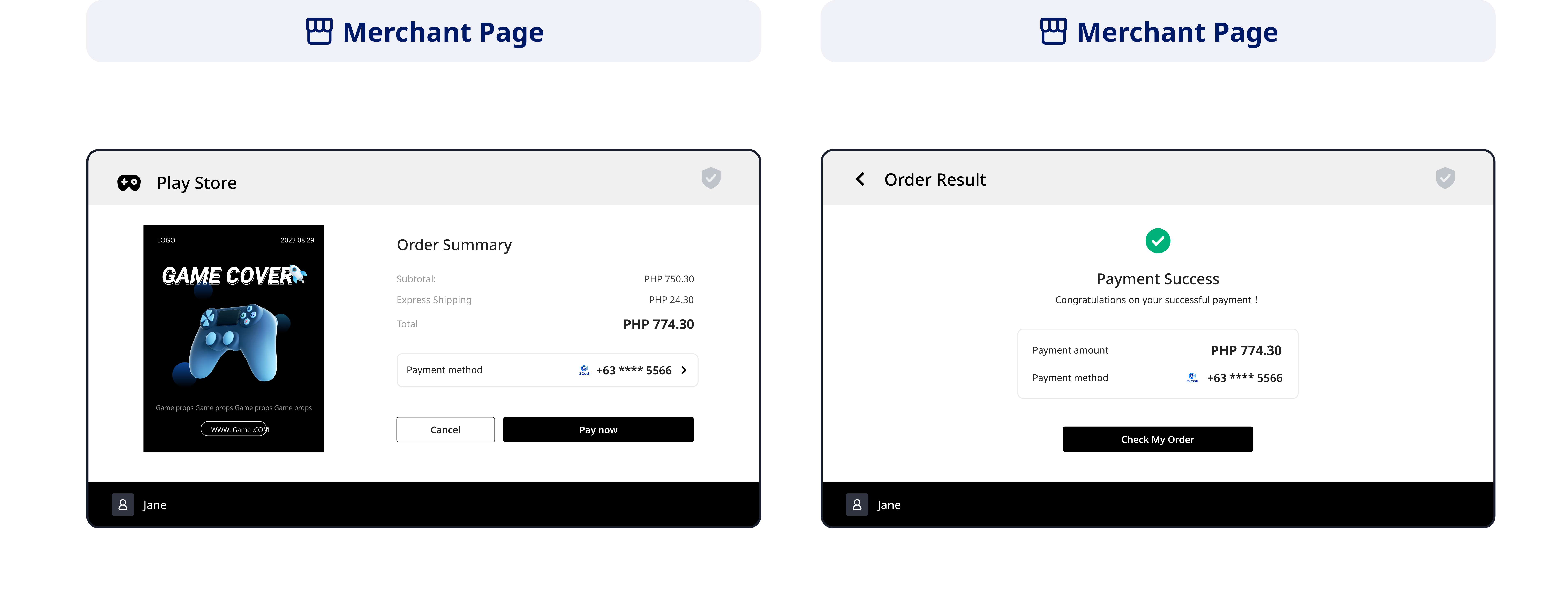

Scenario 2: Subsequent payments

Buyers select the authorized payment method for a subsequent payment and complete the payment directly with one click.

Capabilities and resources

- To integrate the Scan to Link service, see Obtain authorization to obtain a buyer's authorization, and see Pay to initiate a payment after you have obtained the buyer's authorization.

- For information about the operations after the payment, see Refund, Cancel, and Notifications.

- The following table lists all the APIs, notifications, and reports for Scan to Link, serving the purpose of facilitating the payment and after-the-payment processes:

Capabilities | Development resources | |

| Server APIs | Server Notifications/Reports | |

Obtain authorization | ||

Revoke authorization | ||

Apply for a payment token | None | |

Initiate a payment | ||

Cancel a payment | None | |

Refund a payment | ||

Declare goods | None | |

Settle and reconcile | None | |

Table 1. APIs, notifications, and reports used for Scan to Link

Supported payment methods

The following payment methods are supported for Scan to Link. Their capabilities are listed as follows:

Payment method | Buyer country/region | Supported currency | Refund | Partial refund | Chargeback/Dispute | Minimum payment amount | Maximum payment amount | Refund period |

| Alipay | China | CNY | ✔️ | ✔️ | ❌ | 0.1 CNY | Unlimited | 365 days |

AlipayHK | Hong Kong, China | HKD | ✔️ | ✔️ | ❌ | 0.01 HKD | 50,000 HKD per transaction; 200,000 HKD per year | 365 days |

DANA | Indonesia | IDR | ✔️ | ✔️ | ❌ | 300 IDR | 10,000,000 IDR per transaction; 20,000,000 IDR per day | 365 days |

| GCash | Philippines | PHP | ✔️ | ✔️ | ❌ | 1PHP | 100,000 PHP per day | 365 days |

| Kakao Pay | South Korea | KRW | ✔️ | ✔️ | ❌ | 50 KRW | 2,000,000 KRW for single transaction (Except for gaming merchants: Hana and Samsung - 500,000 KRW; Hyundai - 110,000 KRW; NH - 100,000 KRW; BC - 50,000 KRW) | 365 days |

Touch'n Go eWallet | Malaysia | MYR | ✔️ | ✔️ | ❌ | 0.05 MYR | 20,000 MYR per transaction; 25,000 MYR per month; 300,000 MYR per year | 365 days |

| TrueMoney | Thailand | THB | ✔️ | ✔️ | ❌ | 1 THB per transaction | 30,000 THB per transaction; 50,000 THB per day | 365 days |

Table 2. Supported payment methods