Settle and reconcile

Alipay provides financial reports to help you streamline your business workflows:

- Use the settlement reports to check the total number of transactions in a period of time and the settlement amount.

- Use the transaction report to check details of all successful transaction records, including records of payments and refunds.

With these reports, financial tasks such as validating funds received and reconciling balances can be completed more efficiently.

Settlement

Alipay performs a merchant settlement at the end of each settlement period. This process occurs at the end of each settlement cycle or occurs when the settlement amount reaches a pre-defined level of imbalance (trigger-point).

Settlement cycle

The settlement cycle for AlipayCN and other Alipay+ Mobile Payment Provider (Alipay+ MPPs) are different. You can check the settlement cycle details for each wallet in the following section. If a shorter settlement cycle is desired, contact technical support for a customization assessment.

For each settlement cycle, the exchange rate used for settlement is different. The exchange rate used for settlement is the exchange rate between order.orderAmount.currency and settlementStrategy.settlementCurrency.

Settlement cycle details

The following table shows the settlement cycle details for each wallet:

Wallet | Settlement cycle |

AlipayCN | For AlipayCN, the settlement cycle is T+N (Transaction day + N days), where N is determined by the settlement scenario:

|

Other Alipay+ MPPs | For other Alipay+ MPPs, the settlement cycle is T+4 (Transaction day + 4 days). |

Table 1. Settlement cycle information for each wallet

Note: When the payment method is Easypaisa, the settlement cycle is determined in the contract between the merchant and Easypaisa.

Exchange rate applied

If a currency conversion for your transaction needs to be performed and a refund is issued, the following exchange rates apply for each wallet with different settlement cycles:

Wallet | Settlement cycle | Exchange rate |

AlipayCN | T+N (N≥1) | The exchange rate on the date of the original payment will apply for payment and refund. |

AlipayCN | T+N (N≥2) | The exchange rate on the next day of the original payment will apply for payment and the exchange rate on the next day of the refund will apply for refund. |

Other Alipay+ MPPs | T+4 | The exchange rate on the next day of the original payment is used for payment and the exchange rate on the next day of the refund is used for refund. |

Table 2. Exchange rate for each wallet with different settlement cycles

Notes:

- Time zone: cross-border settlement GMT+8 local settlement time

- If remittance fails due to insufficient funds, there will be no settlement files.

- Currently, the settlement cut-off time is 23:59:59 UTC+8:00 on the settlement day. However, for transactions completed on Friday, weekends, and certain holidays, more time might be required for settlement. For the exact settlement period, contact Alipay Technical Support for details.

Settlement modes

If multiple payment methods are supported in your system for payment service, two settlement modes exist:

- Settlement by single payment method: For Alipay+ MPPs, the settlement can be combined or conducted individually. For all the other payment methods, the settlement is conducted individually.

- Settlement by multiple payment methods: Combined settlement of all the Alipay+ MPPs and other payment methods.

Notes:

- For Settlement by multiple payment methods mode, all payment methods must be settled together, without the option of choosing to just settle some of the payment methods together.

- The settlement that can be used is determined by your contract. Please check your contract before choosing the settlement mode.

The settlement mode specified in the contract influences the file name of these reports: Settlement Summary, Settlement Items, and Transaction Items. For example, if you specify the Settlement by multiple payment methods mode when signing the contract, the Settlement Summary and Settlement Items reports will be generated with the file naming rules of Settlement by multiple payment methods, even if only one payment method is involved for settlement. For more details about the report names, see Obtain reports.

Reconciliation

For reconciliation, use the following three types of reports:

- Settlement Summary: provides summary information, such as the total number of transactions in a period of time and the amount for settlement. For every clearing cycle, a settlement summary report is created, therefore, with the Settlement Summary report, you can check the summary of all clearing data in each clearing cycle.

- Settlement Items: provides transaction details within a settlement cycle. This file is provided in document form and is generated along with the summary file of the settlement cycle.

- Transaction Items: provides all successful transaction details on T day, including records of transactions and refunds. This file is generated on the T+1 day.

Reports generation and tasks

The above-mentioned three types of reports are provided on specific days:

- The Settlement Summary and Settlement Items reports are generated one day after the settlement date.

- The Transaction Items report is generated one day after the transaction date (T+1).

- The settlement occurs at the end of each settlement period. If settlement fails due to insufficient funds, there will be no settlement files.

Each report is designed for specific tasks and you can download a report sample from the following table:

Report | Tasks | Report sample (SFTP) |

Settlement Summary | Generated one day after the settlement date. You can use it to:

| |

Settlement Items | Generated one day after the settlement date. You can use it to:

| |

Transaction Items | Generated one day after the transaction date, which is the T+1 day. You can use it to:

|

Table 3. Reports and tasks

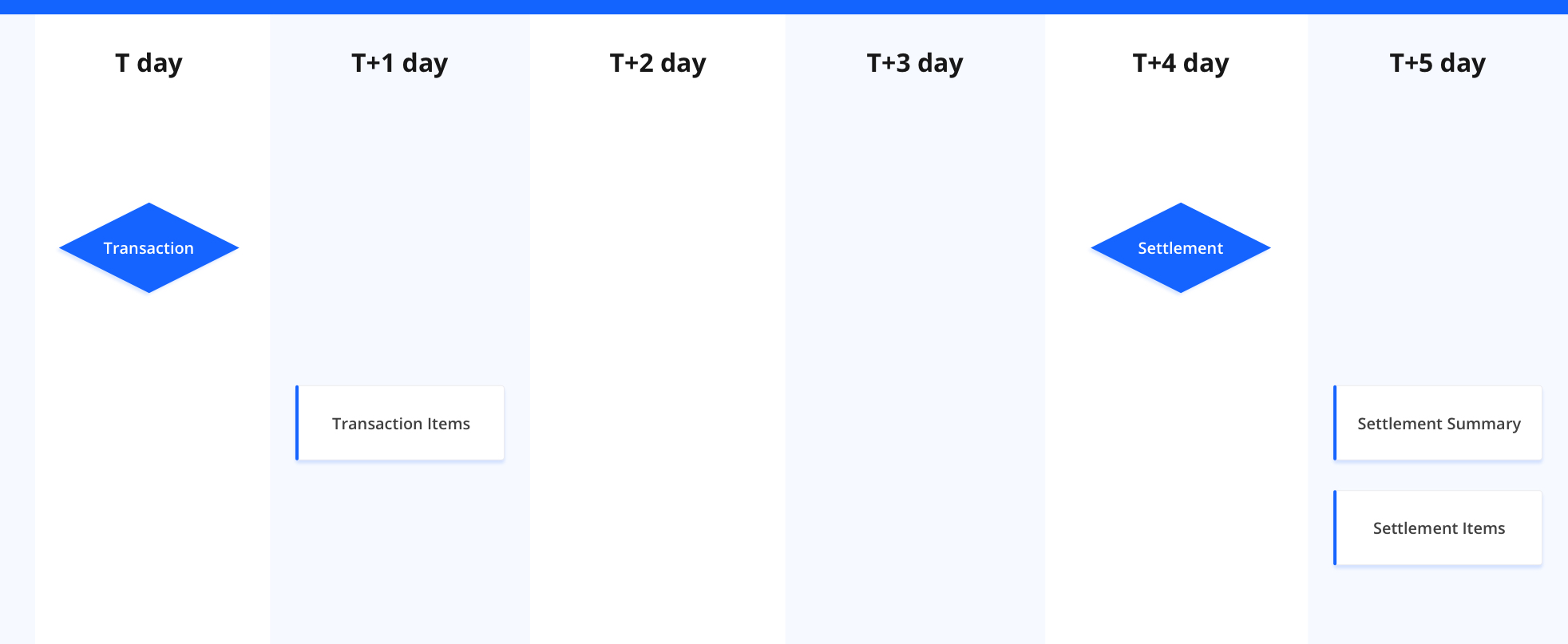

The following graphic shows the reports generation date and settlement date by assuming that the transaction day is the T day and the settlement day is the T+4 day:

Figure 1. Reports generation dates

Notes:

- About the commission fee:

- In the sandbox environment, the commission fee is a fixed value of 10 and is in the currency's major unit. For example, for a transaction in USD, the commission fee is 10 cents.

- In the production environment, the commission fee is calculated based on the real merchant discount rate (MDR).

- For more information about how to get the transaction and settlement reports, see Obtain reports.

Report fields details

Each reconciliation report delivers information about the transaction by using several fields. The following table shows the description about the important fields in each reconciliation report and in which reconciliation report the field will appear:

Fields and descriptions | Reports | ||

Transaction report | Settlement reports | ||

Transaction Items | Settlement Items | Settlement Summary | |

settlementBatchId Identify a settlement cycle where a group of transactions is settled at one operation | ✅ | ✅ | |

count The number of transactions in the settlement operation | ✅ | ||

summaryType Transaction type (Payment, Refund, Cancel, or Total) for the summary row | ✅ | ||

customerId The unique ID assigned by Alipay to identify a merchant | ✅ | ✅ | ✅ |

referenceMerchantId The unique ID assigned by the acquirer to identify the merchant that directly provides services or goods to users | ✅ | ✅ | |

referenceStoreId The unique ID of the store that belongs to the merchant | ✅ | ✅ | |

transactionType Transaction type, such as PAYMENT, REFUND, CANCEL, etc | ✅ | ✅ | |

transactionId The unique ID assigned by Alipay to identify a transaction | ✅ | ✅ | |

originalTransactionId An identifier for the original transaction. | ✅ | ✅ | |

transactionRequestId The unique ID assigned by the merchant to identify a transaction request | ✅ | ✅ | |

originalTransactionRequestId The original payment request ID of the transaction when the transaction type is REFUND or CANCEL | ✅ | ✅ | |

referenceTransactionId The unique ID assigned by the merchant that directly provides services or goods to users, to identify a transaction | ✅ | ✅ | |

orderDescription Description about the order | ✅ | ||

paymentMethodType The payment method used to collect the payment by the merchant or acquirer | ✅ | ✅ | |

pspName Name of the Alipay+ Mobile Payment Provider (Alipay+ MPP) | ✅ | ✅ | |

paymentTime The date and time when the corresponding transaction reaches a final status of success or failure | ✅ | ✅ | |

settlementTime The date and time when the settlement file is generated | ✅ | ✅ | |

productCode Identify the payment product that is being used | ✅ | ✅ | |

transactionAmountValue The transaction amount in the major unit of the corresponding currency. | ✅ | ✅ | |

transactionCurrency The currency used for transaction | ✅ | ✅ | |

settlementAmountValue The net settlement amount in the major unit of the corresponding currency | ✅ | ✅ | |

settlementCurrency The currency used for settlement | ✅ | ✅ | |

quoteCurrencyPair The currency pair of the settlement currency and the transaction currency, which is provided by the foreign exchange partner. The two currencies are separated with a slash and use the 3-letter ISO-4217 currency code, such as EUR/USD. | ✅ | ||

quotePrice The quotation of the exchange rate between two currencies in the currency pair specified in the quoteCurrencyPair parameter. | ✅ | ||

feeAmountValue The amount of the processing fee charged by the payment method for each transaction. The value of feeAmountValue is in the major unit of the corresponding currency. | ✅ | ✅ | |

feeCurrency The currency of the fee | ✅ | ✅ | |

nonGuaranteeCouponValue Merchant discount amount, which is not settled to the merchant and is in the major unit of the corresponding currency. | ✅ | ✅ | |

nonGuaranteeCouponCurrency The currency of the merchant discount amount | ✅ | ✅ | |

processingFeeAmountValue The amount of the processing fee that is charged for the payment processing services Alipay provided for each transaction. The value of processingFeeAmountValue is in the major unit of the corresponding currency. | ✅ | ✅ | |

processingFeeCurrency The currency of processingFeeAmountValue. The value of processingFeeCurrency is specified by a 3-letter currency code as defined in ISO 4217. | ✅ | ✅ | |

Table 4. Fields in the reports.

Note: values of the following fields are expected to be consistent with those of the same fields in the original payment or authorization request:

- referenceMerchantId

- paymentMethodType

- pspName

- productCode