Card

Cards carry the payment capabilities of card payment methods. A card can either be a debit card that is issued by a local settlement network or an international card that is issued by a card scheme.

User experience

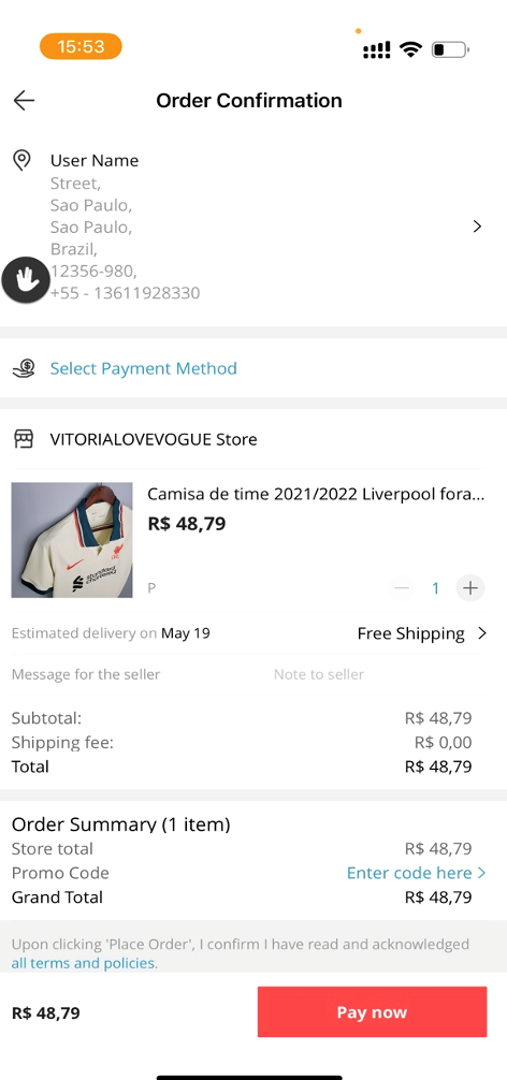

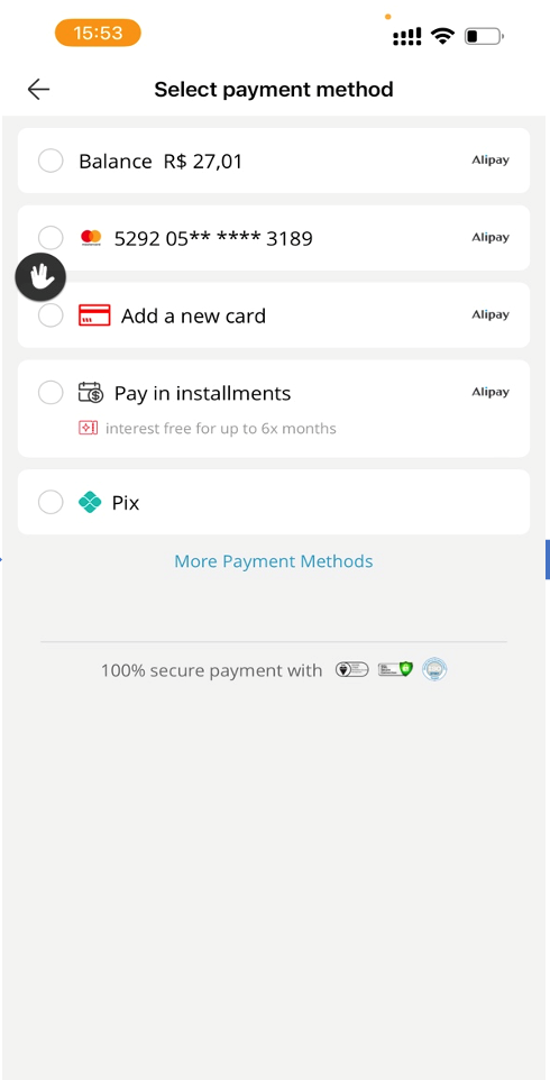

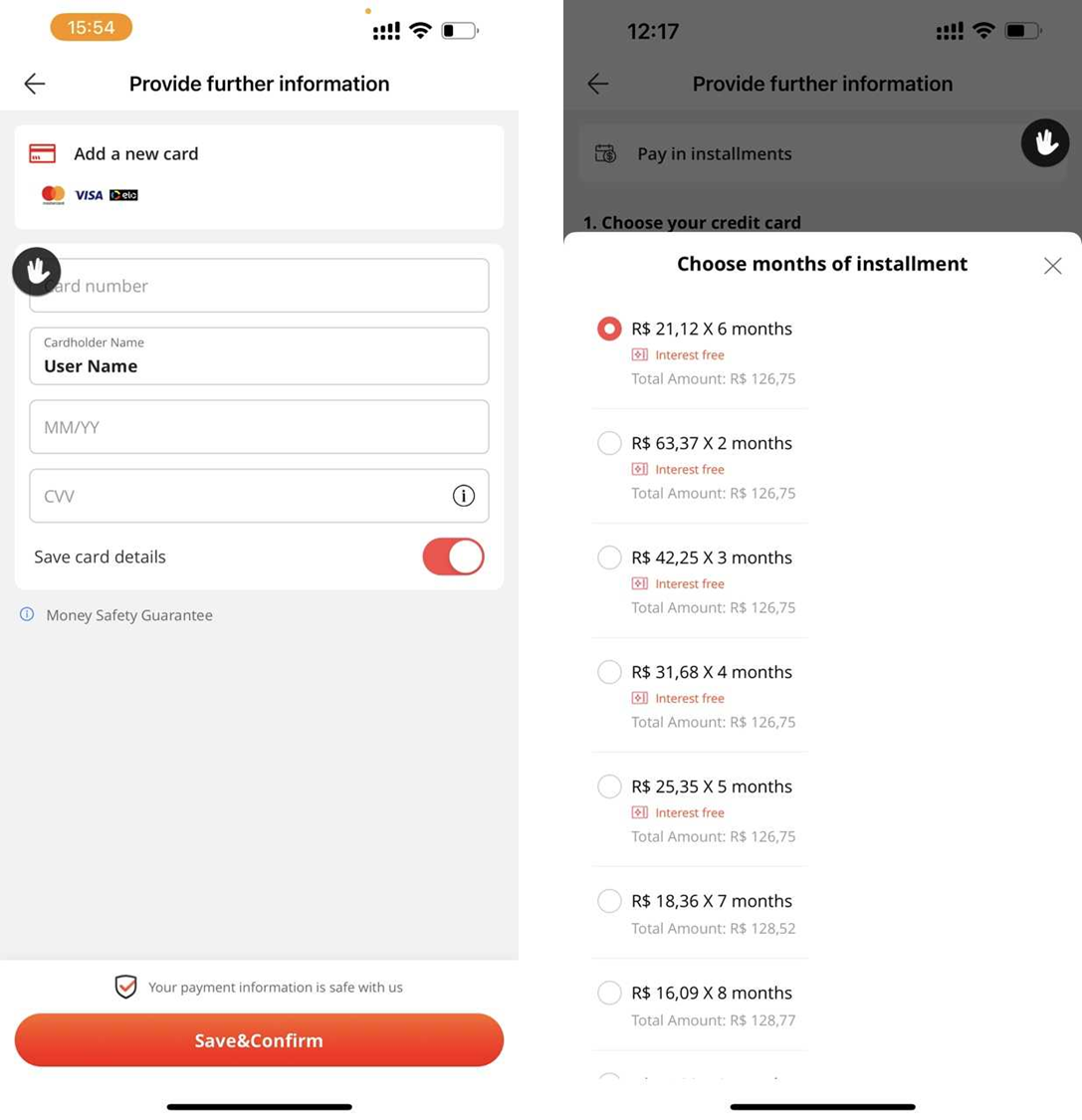

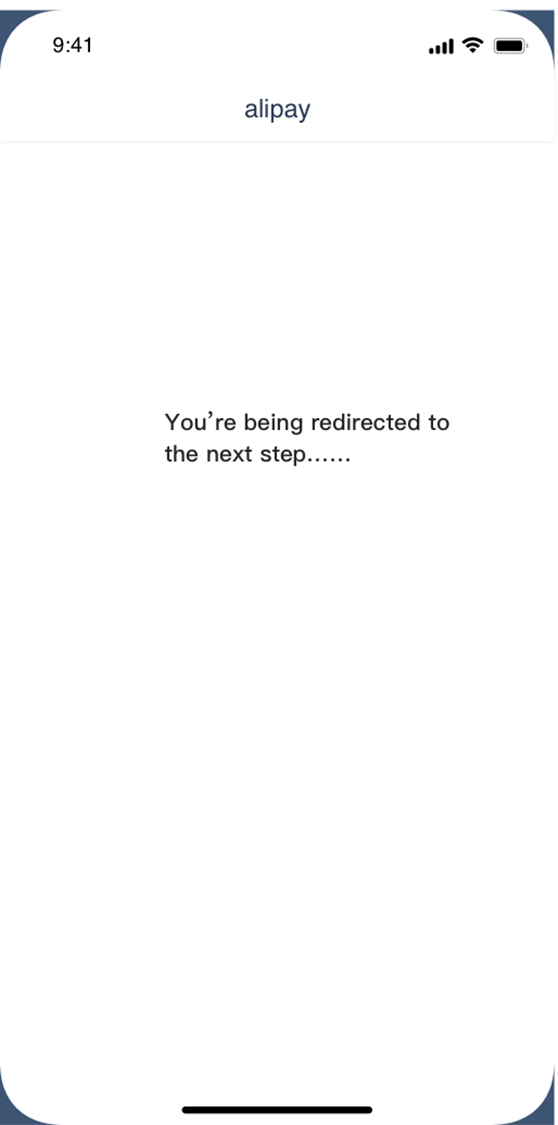

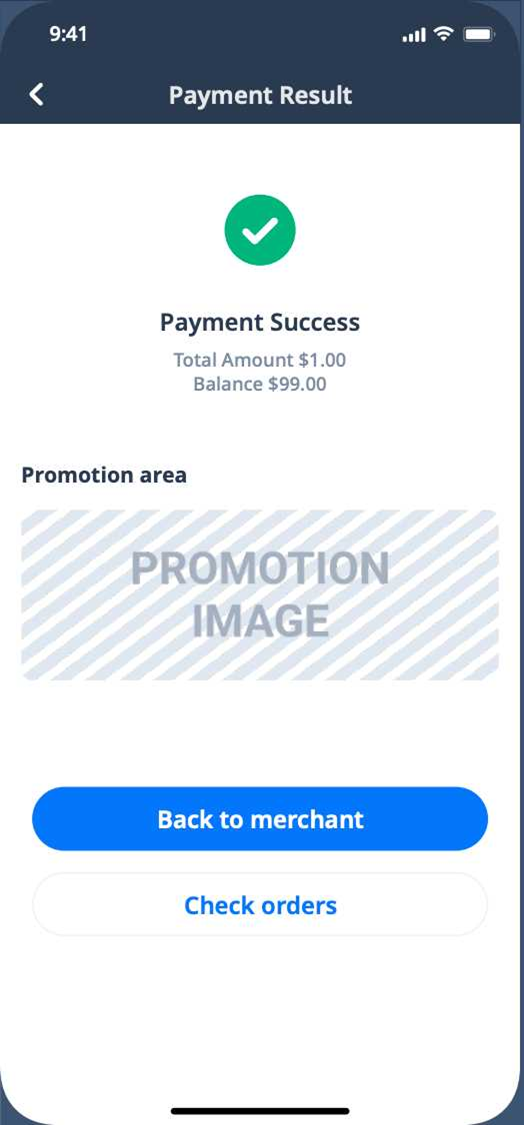

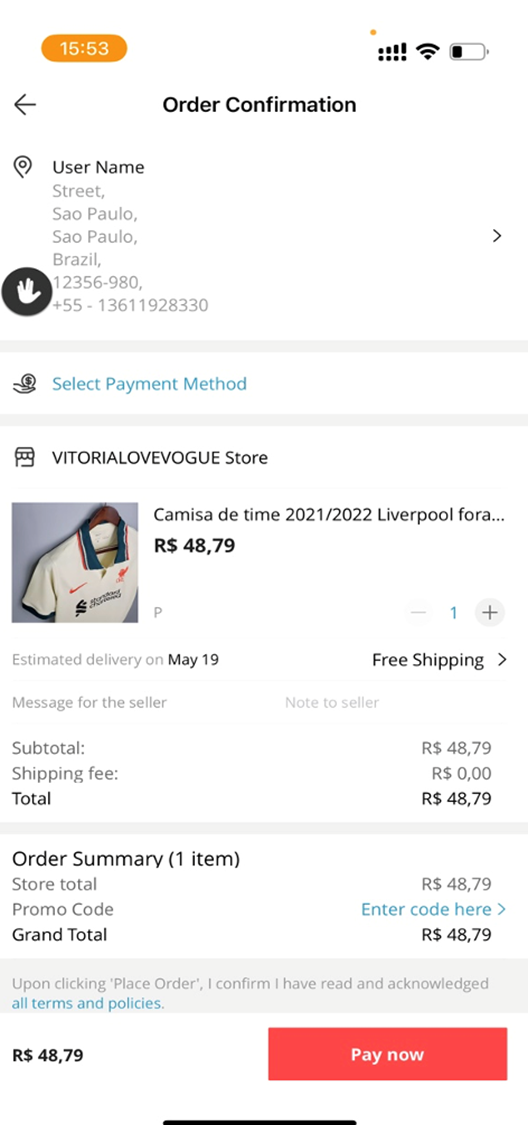

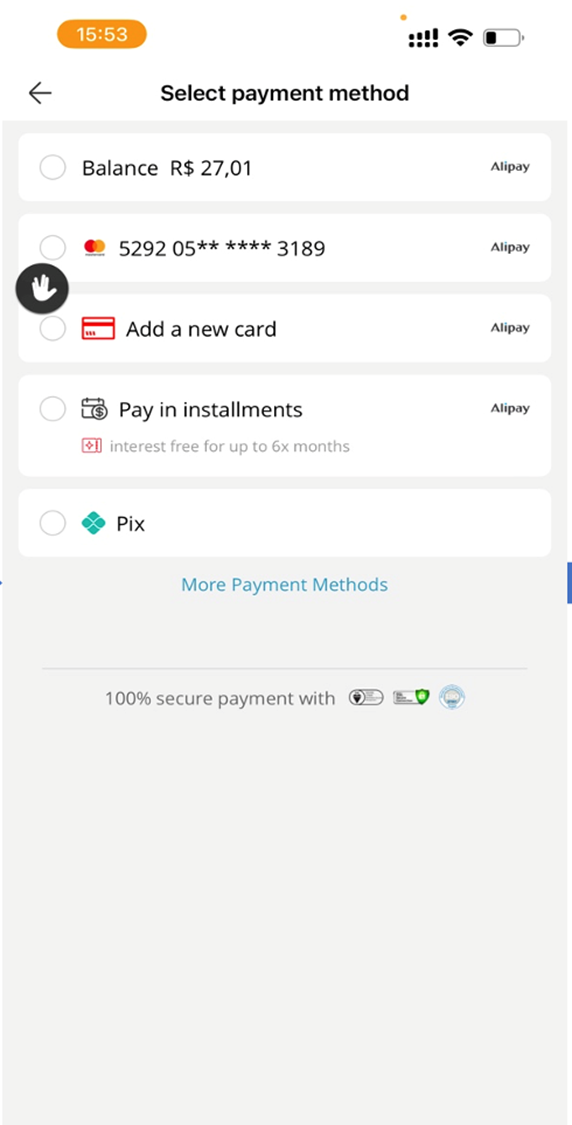

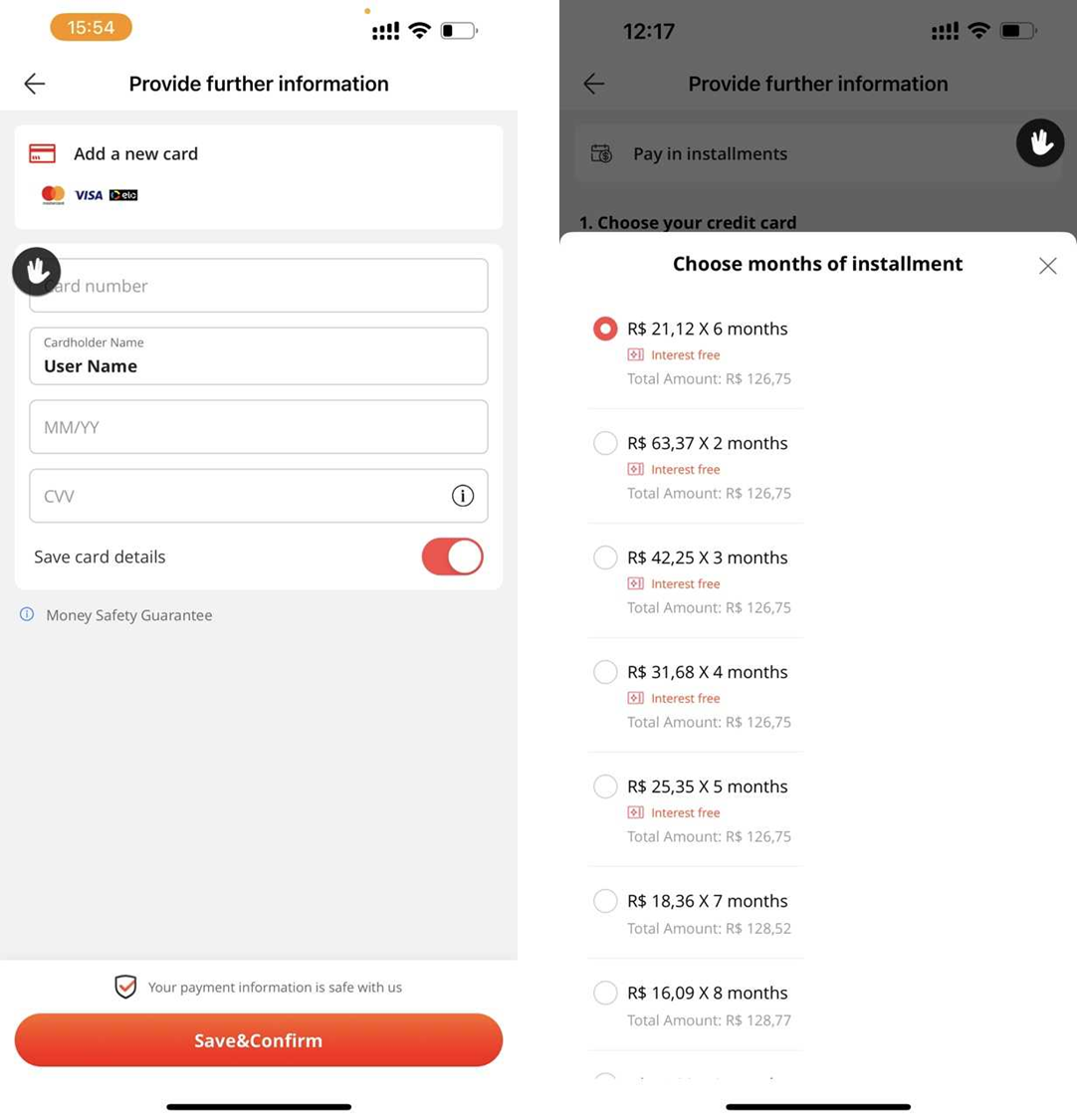

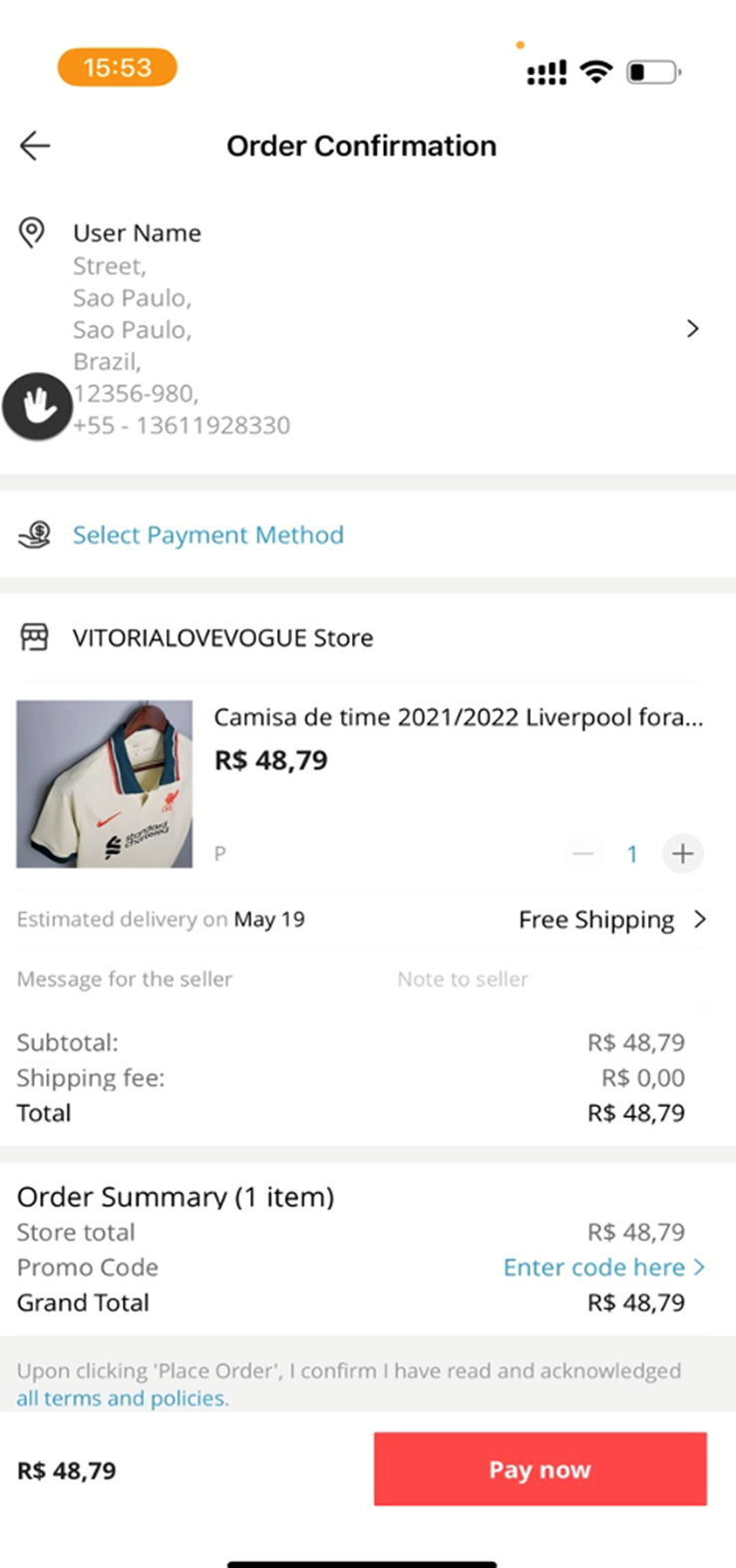

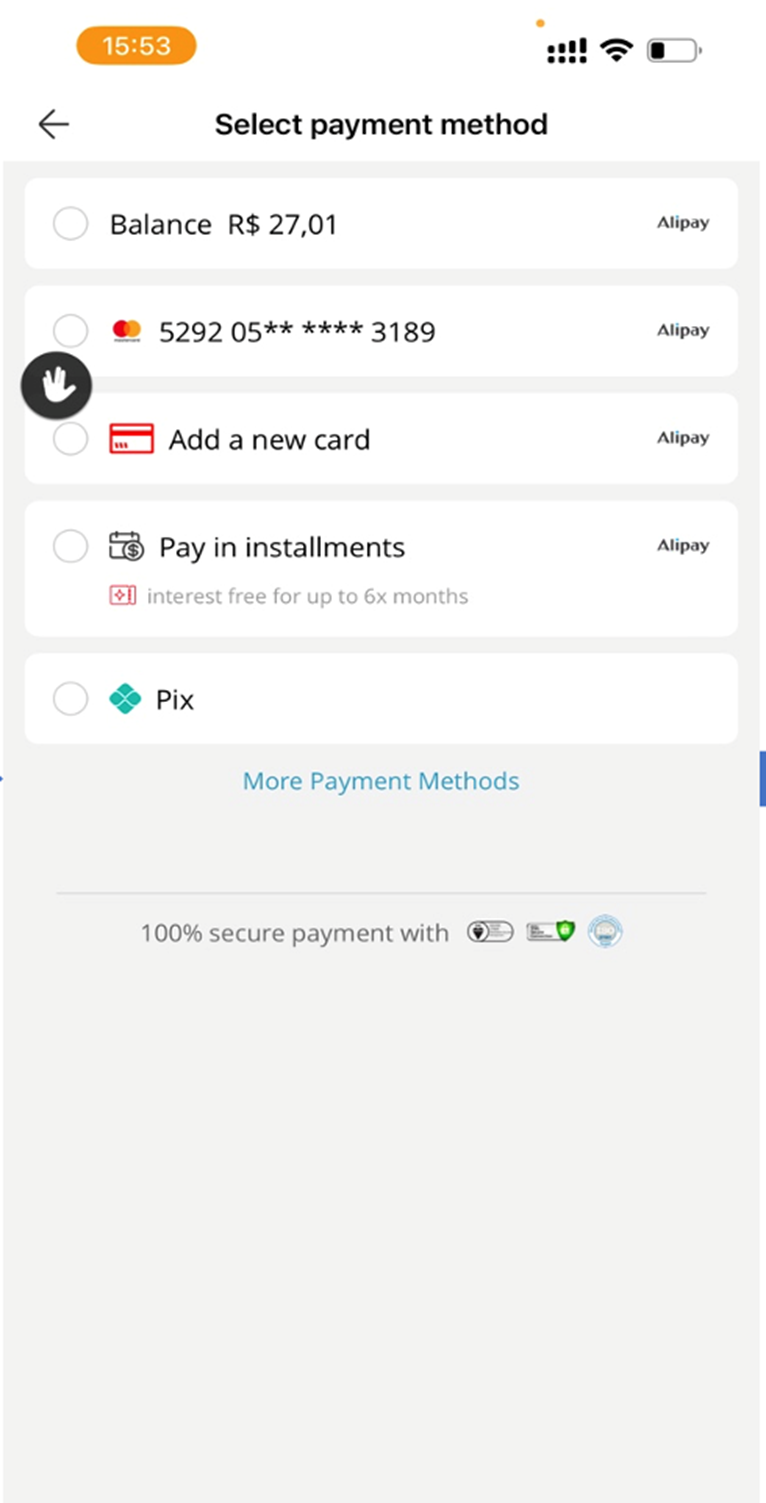

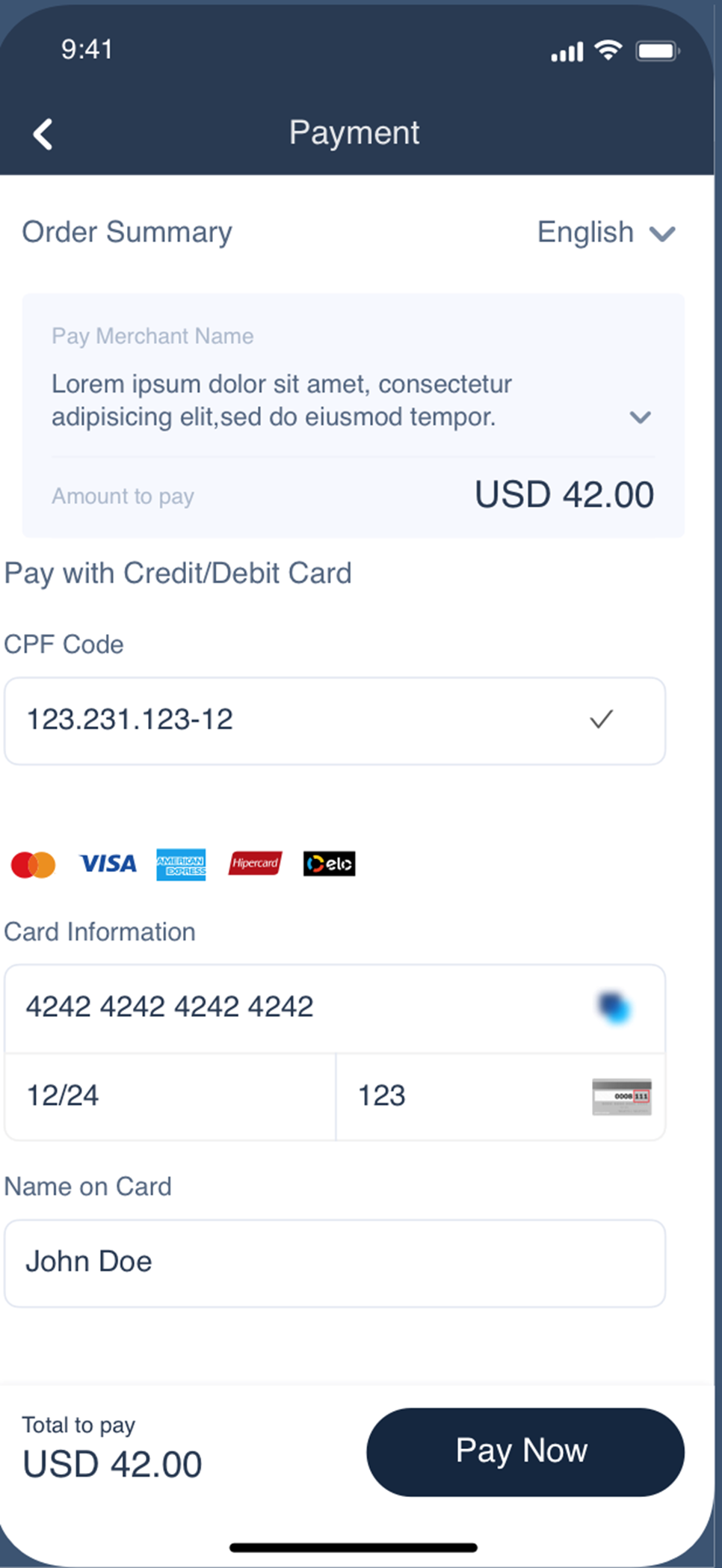

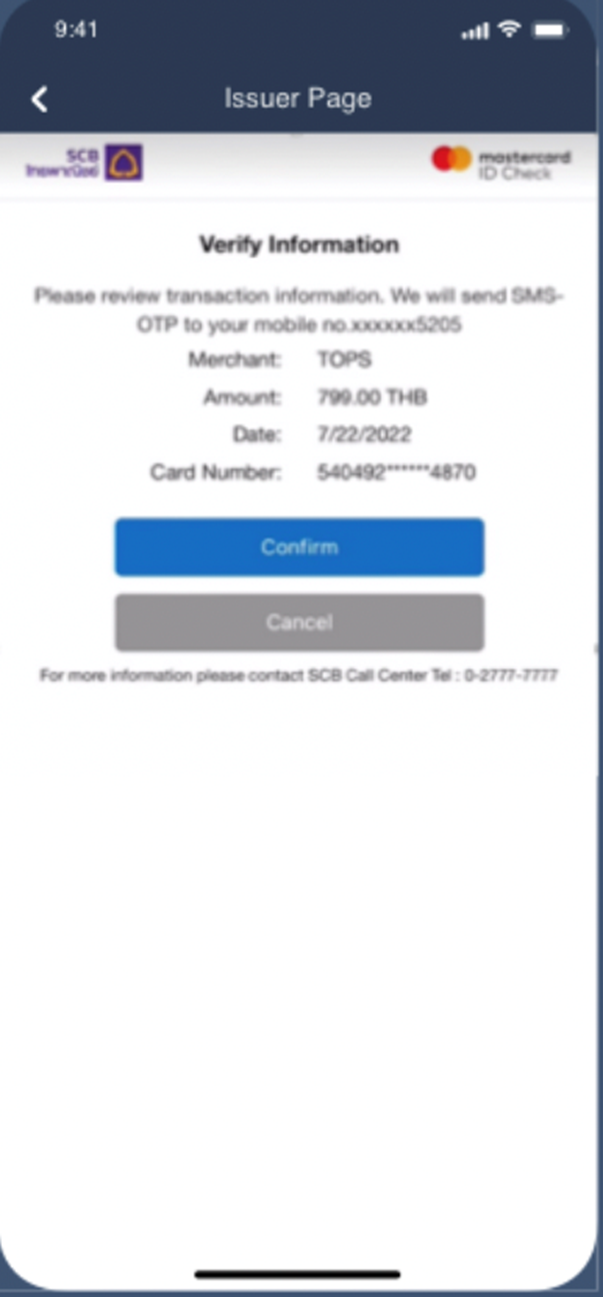

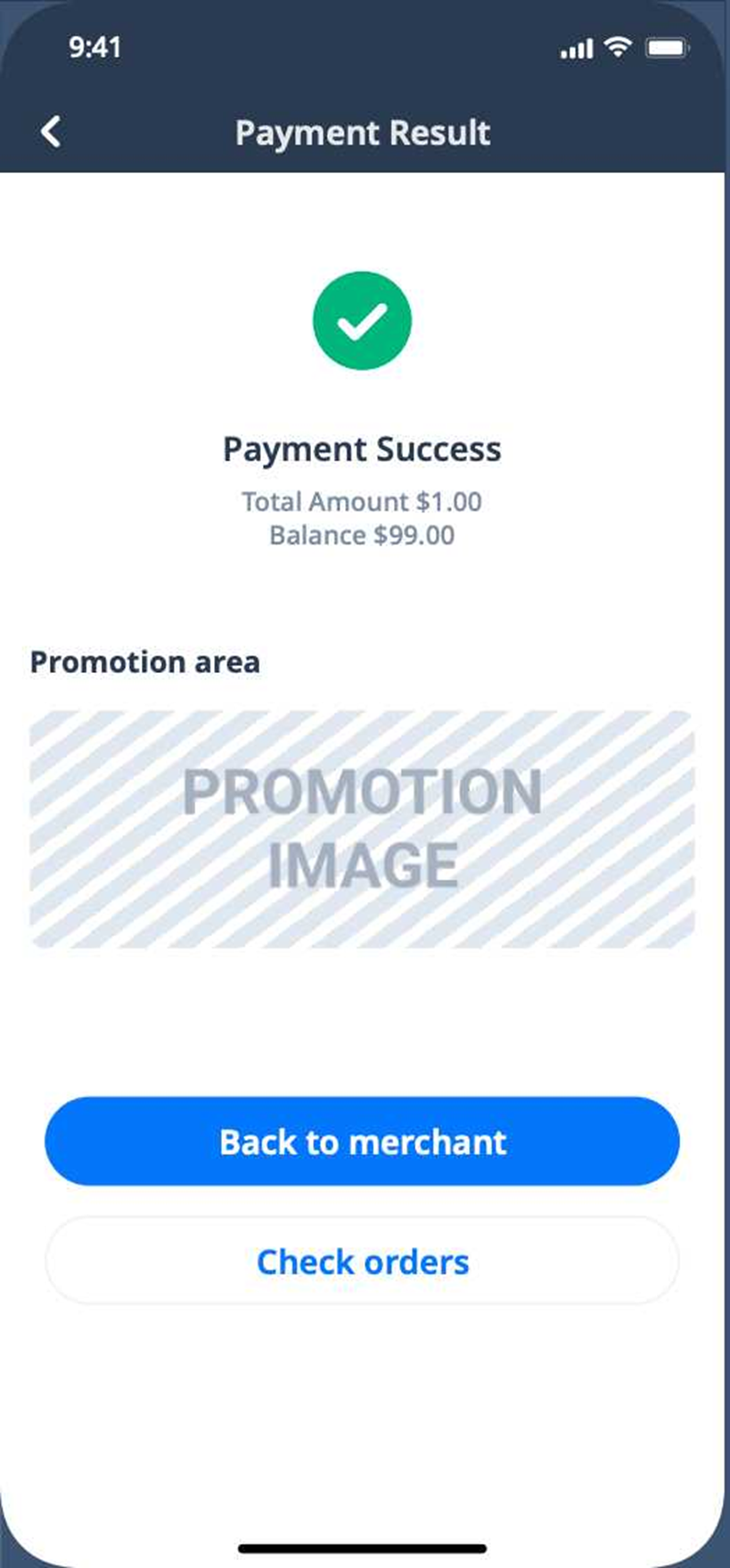

The user experience of card payment methods differs by the collection mode of card information and identity verification type. The following table shows the user experiences in different scenarios:

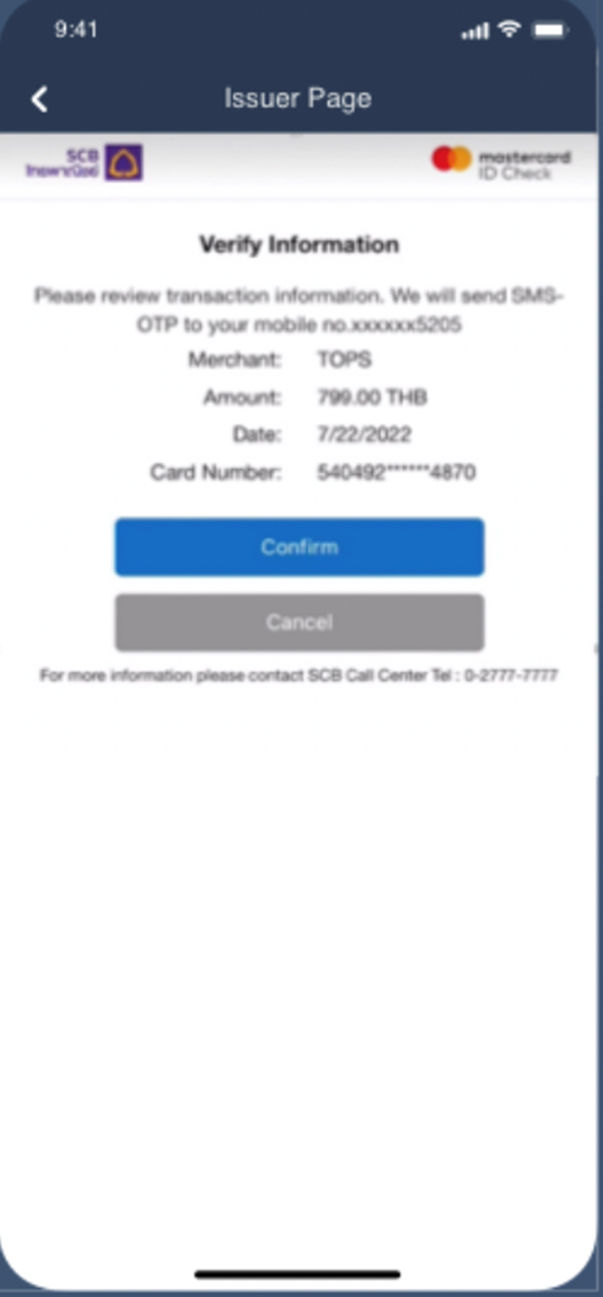

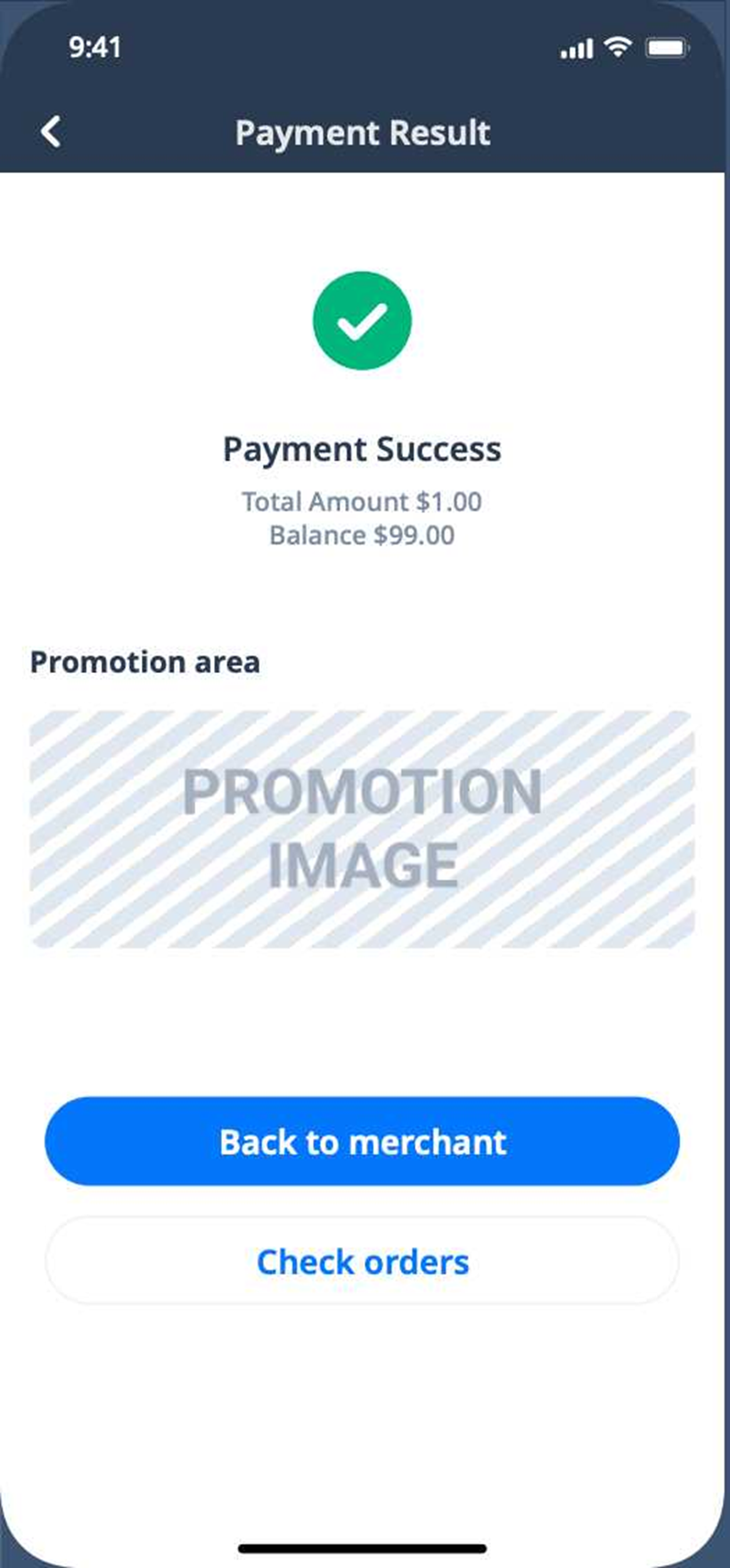

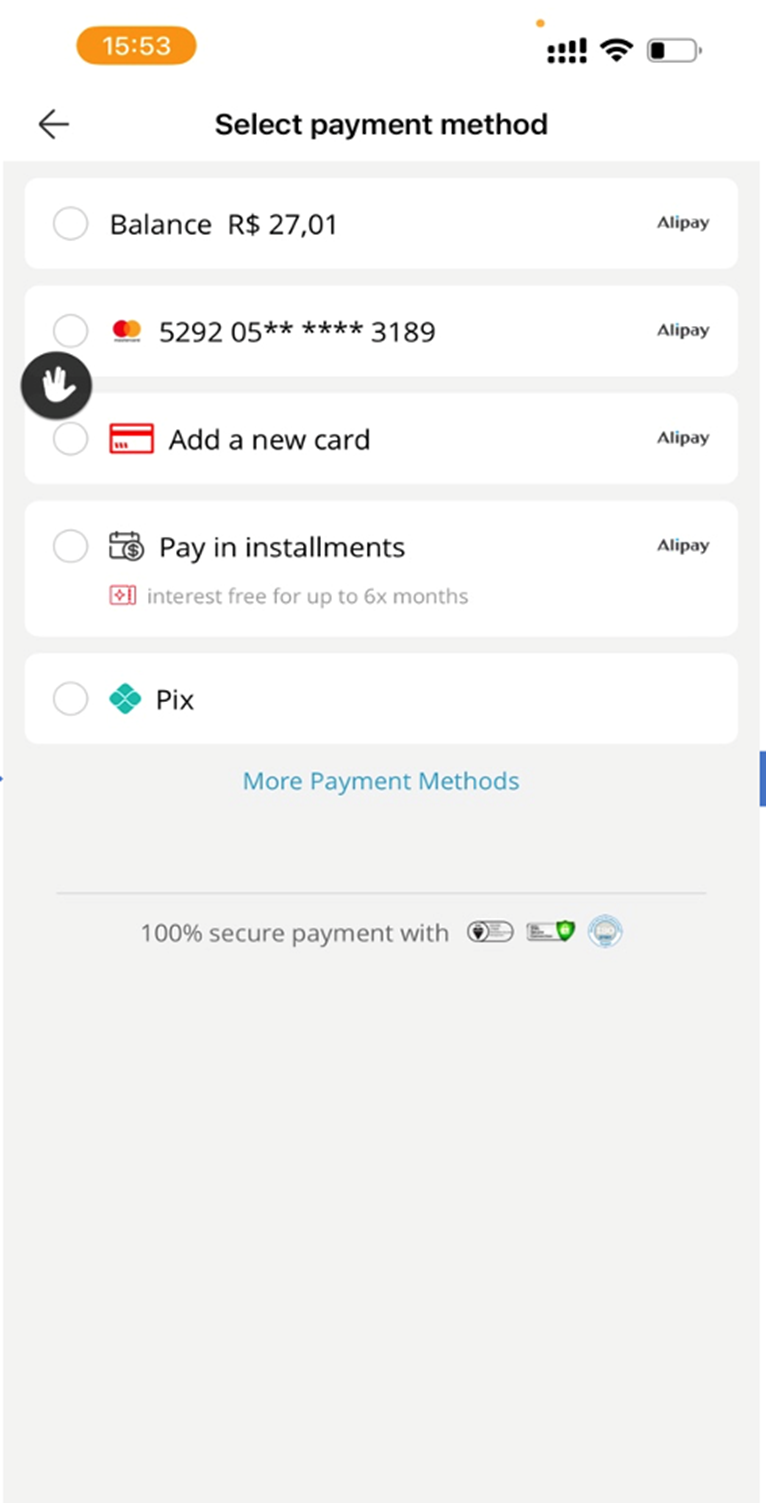

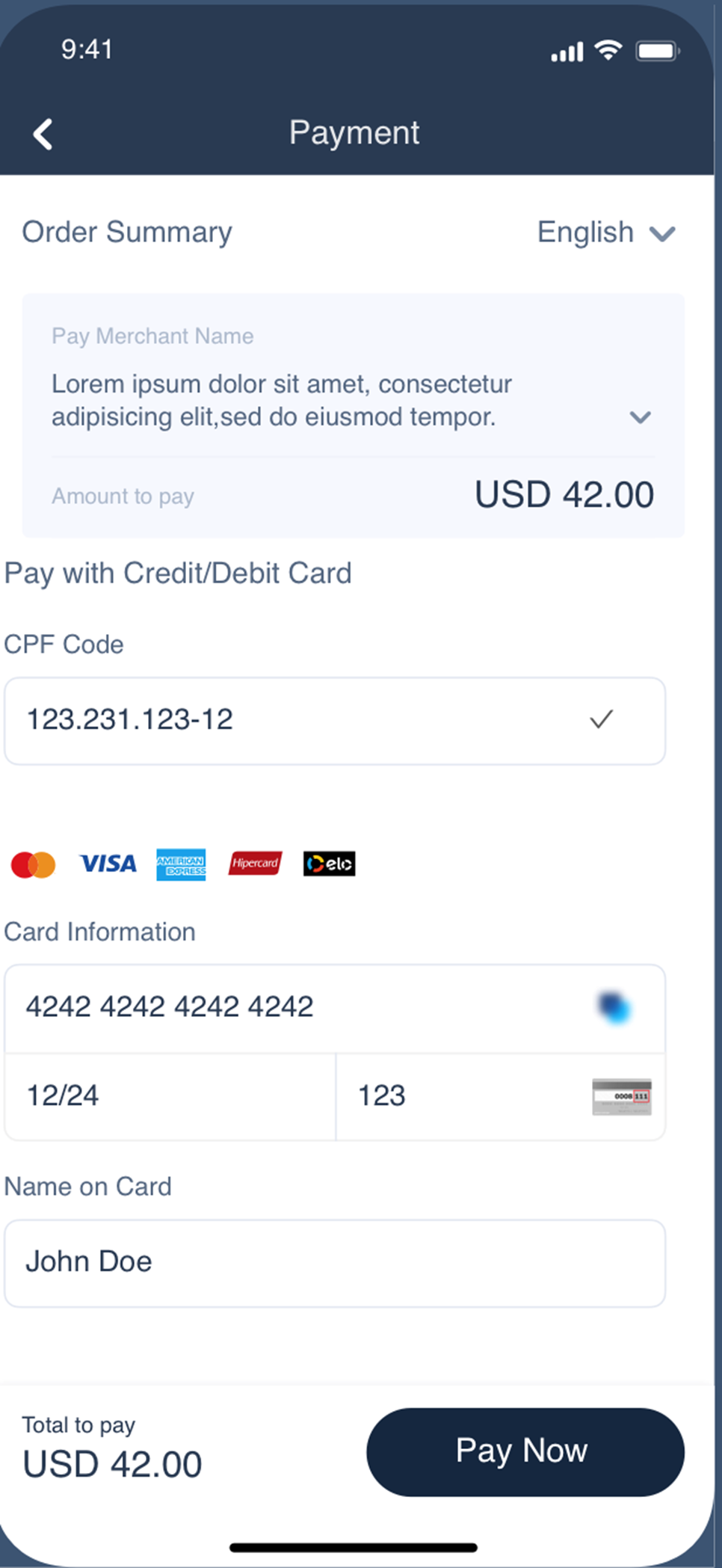

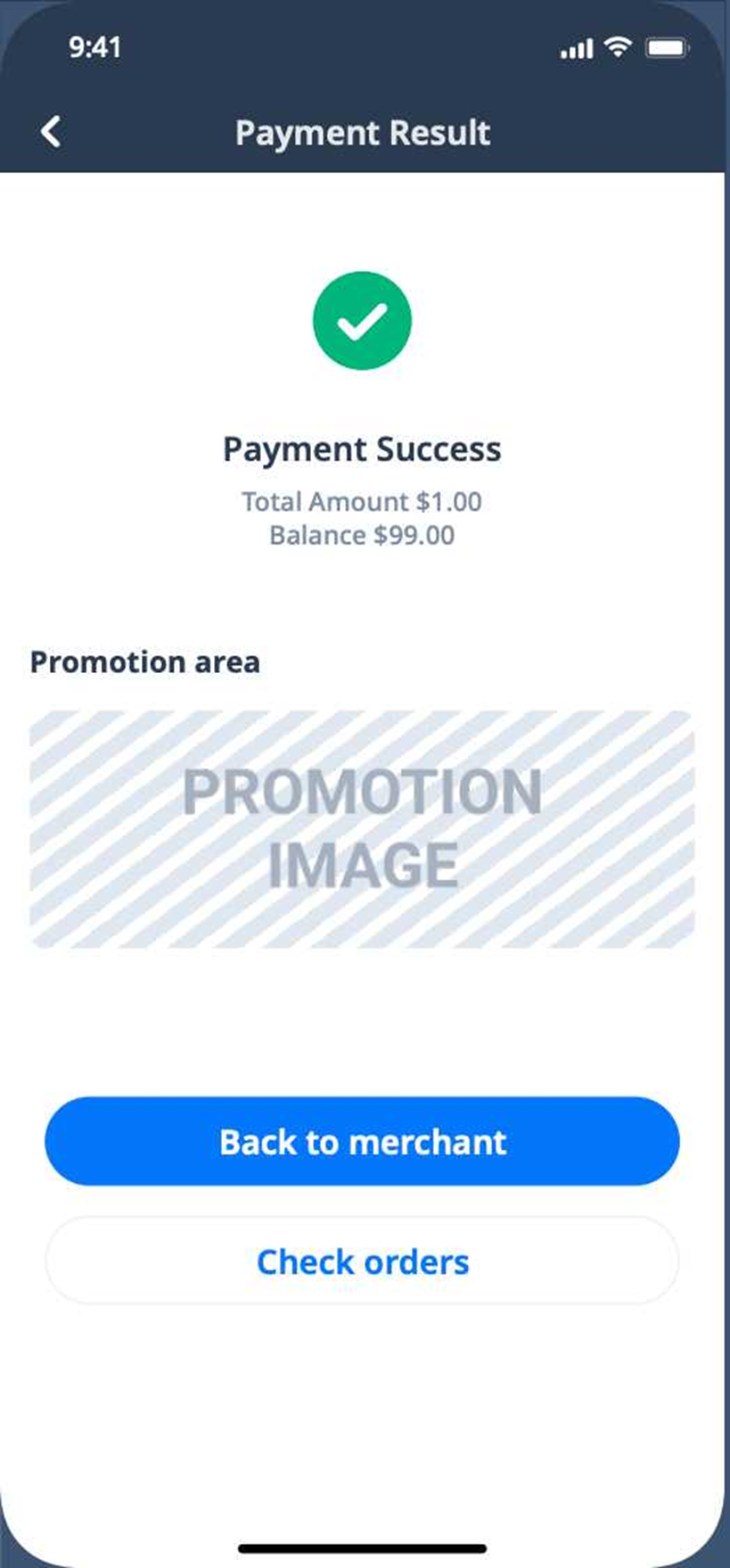

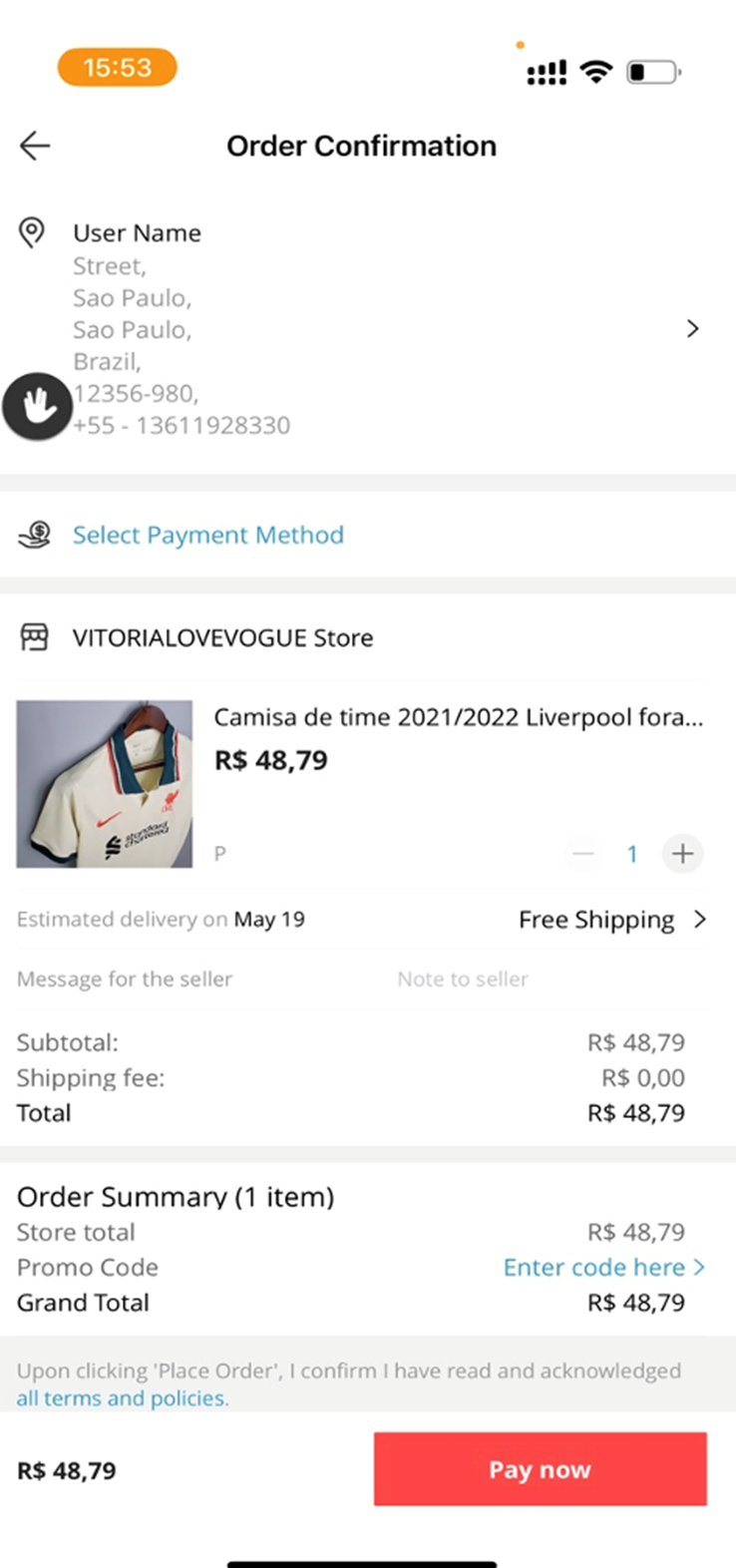

Scenario | Your order confirmation page | Payment method page | Merchants collect the information about a card and an installment plan | Alipay's intermediate page | A payment method provider's verification page | Your payment result page |

Merchants collect the card information and 2D secure verification is used. |

|

|

|

| None |

|

Merchants collect the card information and 3D secure verification is used. |

|

|

For payment methods that support installment, you can allow a user to choose an installment plan. |

|

|

|

An acquirer collects the card information and 2D secure verification is used. |

|

| None |

| None |

|

An acquirer collects the card information and 3D secure verification is used. |

|

| None |

|

|

|

Table 1. User experience of card payment methods

Notes:

The collection mode of the card information falls into the following two types:

- Merchants collect the card information: You provide a page to collect the card information.

- Tokenization: An acquirer provides an intermediate page to collect the card information.

The identity verification falls into two types: 2D secure verification and 3D secure verification.

- 2D secure verification: When a cardholder pays online, the cardholder needs to enter the card information and then undergo a verification process on the mobile phone. Some payment methods even omit the verification process on the mobile phone. 2D secure verification can hardly identify fraudulent charges and thus put the cardholder's account at risk.

- 3D secure verification: When a cardholder pays online, the cardholder needs to enter the card information and then undergo the verification process on a 3D secure verification page. Information required for the verification varies by country. 3D secure verification features complicated verification steps but has higher security.

Payment methods

For details about the card payment methods, see the following table:

Payment method | Acquirer | Acquiring region | Card brand | Payment flow | Supported country | Fund deducted | Supported currency | Refund | Partial refund | Chargeback | 3D | Installment | Minimum payment amount | Maximum payment amount | Refund period |

Brazilian cards | AlipaySG | SG, AU, HK | Visa Mastercard Amex Elo Hipercard Diners | Redirect | Brazil | Real-time | BRL | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | 0.01 BRL | 40000 BRL | 180 days |

Chilean cards | AlipaySG | SG, AU, HK | Visa Mastercard Amex Diners CMR Magna | Redirect | Chile | Real-time | CLP | ✔️ | ✔️ | ✔️ | ❌ | ❌ | 1000 CLP | 7,000,000 CLP | 180 days |

Mastercard | 2C2P HK | HK | Mastercard | Redirect | Global | Real-time | HKD, USD, GBP, EUR, JPY, SGD, MOP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | The smallest payment amount of the acquiring currency | 499,999 USD or equal amounts | 365 days |

2C2P SG | SG | Mastercard | Redirect | Global | Real-time | AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, USD, VND | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | The smallest payment amount of the acquiring currency | 499,999 USD or equal amounts | 365 days | |

Mexican cards | AlipaySG | SG, AU, HK | Visa Mastercard Amex | Redirect | Mexico | Real-time | MXN | ✔️ | ✔️ | ✔️ | ❌ | ❌ | 5 MXN | 200,000 MXN | 180 days |

Peruvian cards | AlipaySG | SG, AU, HK | Visa Mastercard Amex | Redirect | Peru | Real-time | PEN | ✔️ | ✔️ | ✔️ | ❌ | ❌ | 1 PEN | 30,000 PEN | 180 days |

South Korean cards | AlipaySG | SG, AU, HK | Kookmin BC Nonghyup Shinhan Samsung Lotte Hyundai Hana | Redirect | South Korea | Real-time | KRW | ✔️ | ✔️ | ✔️ | ❌ | ❌ | 100 KRW | Unlimited | 365 days |

Visa | 2C2P HK | HK | Visa | Redirect | Global | Real-time | HKD, USD, GBP, EUR, JPY, SGD, MOP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | The smallest payment amount of the acquiring currency | 499,999 USD or equal amounts | 365 days |

2C2P SG | SG | Visa | Redirect | Global | Real-time | AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, USD, VND | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | The smallest payment amount of the acquiring currency | 499,999 USD or equal amounts | 365 days |

Table 2. Capabilities of card payment methods