Visa

VISA credit card is a credit card jointly issued by the issuing bank and VISA International Organization. This credit card can be used at VISA merchants around the world. The credit card has the VISA International logo on it. Visa is the world's largest card network by transaction value, offering worldwide services. Visa positions itself as "the best way for everyone to pay and receive money."

Properties

The properties of VISA are shown in the following table:

Availability | Acquirer | 2C2P HK | 2C2P SG |

Acquiring region | Hong Kong | Singapore | |

Buyer country/region | Global | Global | |

Product features | Payment type | CARD | CARD |

Card brand | Visa | Visa | |

Payment flow | Redirect | Redirect | |

Payment completion | Real-time | Real-time | |

Currency | Processing currency | See the tables below | |

Settlement currency | |||

Other | Settlement region | Hong Kong | Singapore |

Settlement cycle | T+4 | T+3 | |

3D | ✔️ | ✔️ | |

Authorization validity period | 7 days To reduce costs, we recommend that you request to capture or cancel a payment within 3 days. | 7 days To reduce costs, we recommend that you request to capture or cancel a payment within 3 days. | |

Minimum transaction amount | The smallest unit of the acquirer currency | The smallest unit of the acquirer currency | |

Max transaction amount | 499,999 USD or equal amounts | 499,999 USD or equal amounts | |

Checkout Payment | ✔️ | ✔️ | |

Auto Debit | ❌ | ❌ | |

Multiple partial captures | ❌ | ❌ | |

Partial capture | ✔️ | ✔️ | |

Overdraft capture | ❌ | ❌ | |

Refunds | ✔️ | ✔️ | |

Partial refunds | ✔️ | ✔️ | |

Chargeback | ✔️ | ✔️ | |

Refund period | 365 days | 365 days | |

Installment | ❌ | ❌ | |

Currencies for 2C2P HK

Acquiring currency | Settlement currency | Settlement entity | Acquiring bank of the card |

HKD, USD, GBP, EUR, JPY, SGD, MOP | HKD | 2C2P HK | AEON |

AED, AFN, ALL, AMD, ANG, AOA, ARS, AUD, AWG, AZN, BAM, BBD, BDT, BGN, BHD, BIF, BMD, BND, BOB, BRL, BSD, BTN, BWP, BYN, BZD, CAD, CDF, CHF, CLF, CLP, CNY, COP, CRC, CUP, CVE, CZK, DJF, DKK, DOP, DZD, EEK, EGP, ERN, ETB, EUR, FJD, FKP, GBP, GEL, GHS, GIP, GMD, GNF, GTQ, GYD, HKD, HNL, HTG, HUF, IDR, ILS, INR, IQD, IRR, ISK, JMD, JOD, JPY, KES, KGS, KHR, KMF, KRW, KWD, KYD, KZT, LAK, LKR, LRD, LSL, LTL, LVL, LYD, MAD, MDL, MGA, MKD, MMK, MNT, MOP, MRO, MUR, MVR, MWK, MXN, MYR, MZN, NAD, NGNvNIO, NOK, NPR, NZD, OMR, PAB, PEN, PGK, PHP, PKR, PLN, PYG, QAR, RON, RSD, RWF, SAR, SBD, SCR, SDG, SEK, SGD, SHP, SLE, SOS, SRD, STD, SVC, SYP, SZL, THB, TJS, TMT, TND,TOP, TRY, TTD, TWD, TZS, UAH, UGX, USD, UYU, UZS, VEF, VND, VUV, WST, XAF, XCD, XOF, XPF, YER, ZAR, ZMW | HKD/USD | 2C2P HK | Checkout |

Note: If the merchant's TPV exceeds 1 million USD or that of the card association / acquiring bank of the card, the merchant must sign a tri-party agreement with 2C2P HK and the acquiring bank of the card.

Currencies for 2C2P SG

Acquiring currency | Settlement currency | Settlement entity | Acquiring bank of the card |

AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, VND | SGD | 2C2P SG | UOB |

AUD, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MOP, MYR, NZD, PHP, SGD, THB, TWD, USD, VND | USD | 2C2P SG | UOB |

HKD | HKD | 2C2P SG | UOB |

AUD | AUD | 2C2P SG | MayBank |

CAD | CAD | 2C2P SG | MayBank |

EUR | EUR | 2C2P SG | MayBank |

GBP | GBP | 2C2P SG | MayBank |

HKD | HKD | 2C2P SG | MayBank |

NZD | NZD | 2C2P SG | MayBank |

SGD | SGD | 2C2P SG | MayBank |

USD | USD | 2C2P SG | MayBank |

Note: Acquiring banks support different currencies. 2C2P recommends acquiring banks to the merchant according to the merchant's needs. Each merchant in Singapore must sign the tri-party agreement with 2C2P SG and the acquiring bank.

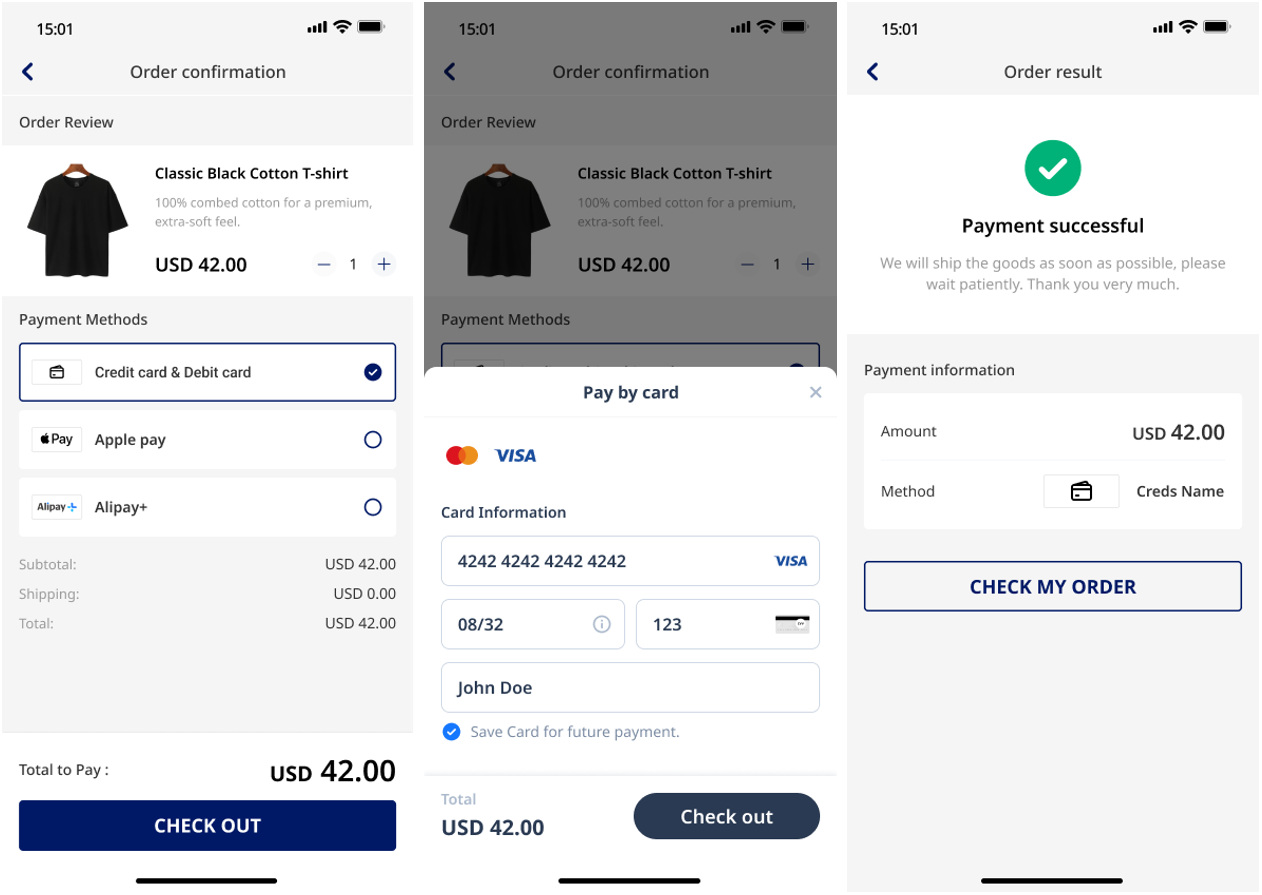

User experience for 2C2P HK/SG

This section shows the user experience of 2C2P HK/SG in different scenarios:

A PCI-qualified merchant uses 3D verification

First-time payment

Payment with a saved card

A PCI-qualified merchant uses non-3D verification

First-time payment

Payment with a saved card

A PCI-not-qualified merchant uses 3D verification

First-time payment

Payment with a saved card

A PCI-not-qualified merchant uses non-3D verification

First-time payment

Payment with a saved card