PayPay

PayPay is the most mainstream and popular wallet payment method in Japan. As of August 2022, PayPay serves 50 million users, accounting for 41% of Japan's total population. In addition, PayPay's payment ratio exceeds 45%, ahead of other Japan's major electronic wallets.

Properties

The properties of the PayPay payment method are shown in the following table:

Payment type | Wallet | ||

| Acquirer | Hundsun | Acquiring region | JP |

Payment flow | Redirect | Checkout Payment | ✔️ |

Buyer country/region | Japan | Auto Debit | ❌ |

Funds deduction | Real-time | Refund | ✔️ |

Processing currency | JPY | Partial refund | ❌ |

Minimum payment amount | 1 JPY | Chargeback | ❌ |

Maximum payment amount | Non-KYC compliant:

KYC compliant:

| Refund period | 90 days |

Notes:

- The settlement currency supports only JPY and only settlement to the merchant's Japanese entity is allowed.

- Settlement period: half month (For transactions from the 1st to the 15th of each month, the reconciliation reports are issued on the 19th, and the merchant gets the pay-out by the end of the month. For transactions from the 16th to the end of the month, the reconciliation reports are issued on the 4th of the next month, and the merchant gets the pay-out by the 15th of the next month.

- The dispute process not supported

User experience

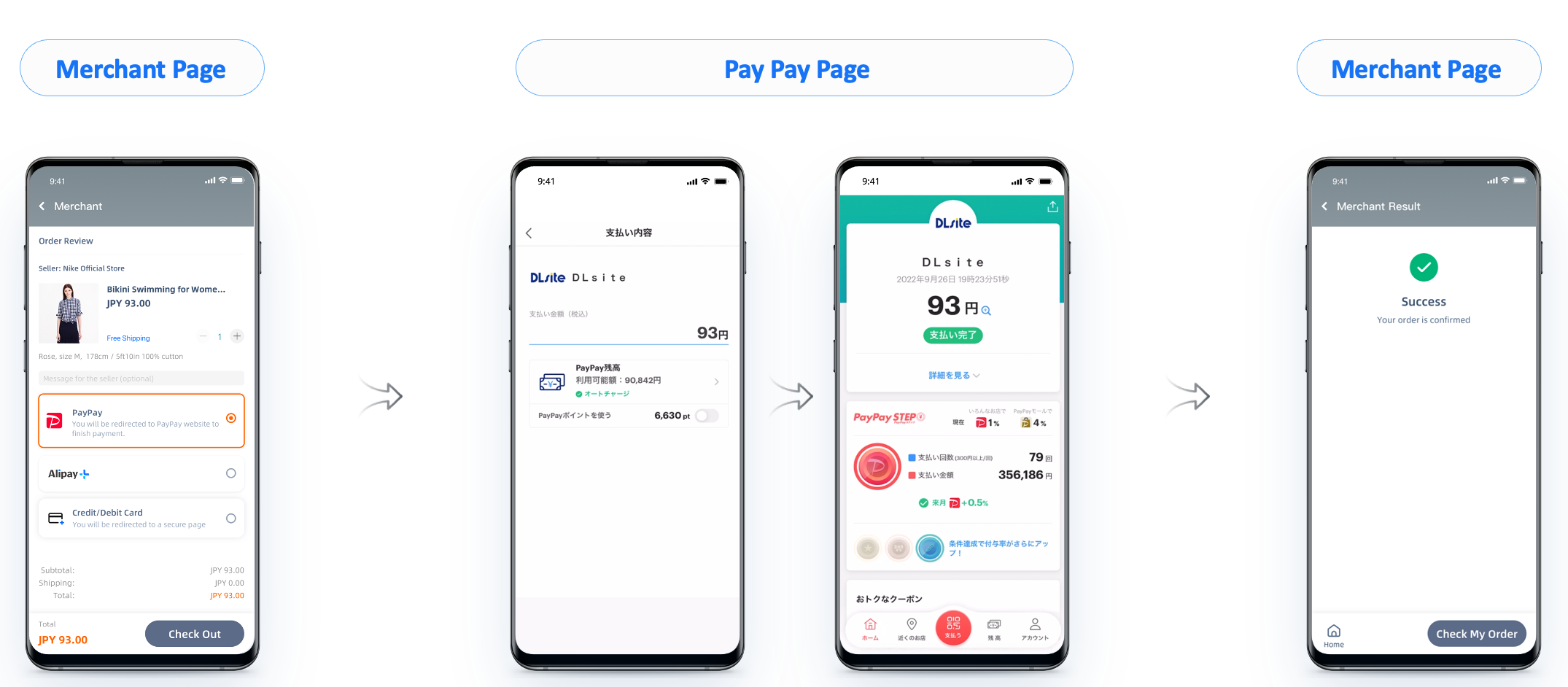

Scenario 1: The user installs the PayPay app. Redirect the user to the app to make a payment.

Figure 1. Payment process with PayPay (App)

Scenario 2: The user registers the PayPay account, but doesn't have the PayPay app. Redirect the user to the PayPay wap page to make a payment.

Figure 2. Payment process with PayPay (Wap)

Scenario 3: The user uses the PayPay app to scan the QR code on the merchant's website to make a payment.

Figure 3. Scan to pay with PayPay (Web)

Scenario 4: The user logs with the account on the PayPay website to make a payment.

Figure 4. Log in to pay with PayPay (Web)